Discover JUSUNG ENGINEERINGLtd And Two More KRX Growth Leaders With High Insider Stakes

The South Korean market has shown resilience, remaining flat over the last week and achieving a 7.2% rise over the past year, with earnings expected to grow by 29% annually in the coming years. In such an environment, stocks like JUSUNG ENGINEERING Ltd that combine growth potential with high insider ownership may offer appealing opportunities for informed investors.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 118.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's review some notable picks from our screened stocks.

JUSUNG ENGINEERINGLtd

Simply Wall St Growth Rating: ★★★★★☆

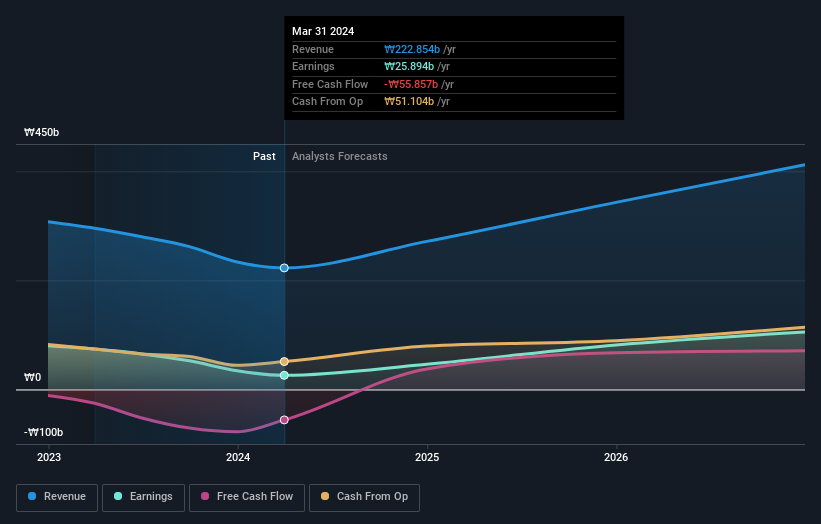

Overview: JUSUNG ENGINEERING Ltd, a company based in South Korea, specializes in manufacturing and selling semiconductor, display, solar, and lighting equipment globally with a market capitalization of approximately ₩1.82 billion.

Operations: The primary revenue segment for the company is derived from semiconductor equipment and services, generating approximately ₩272.61 billion.

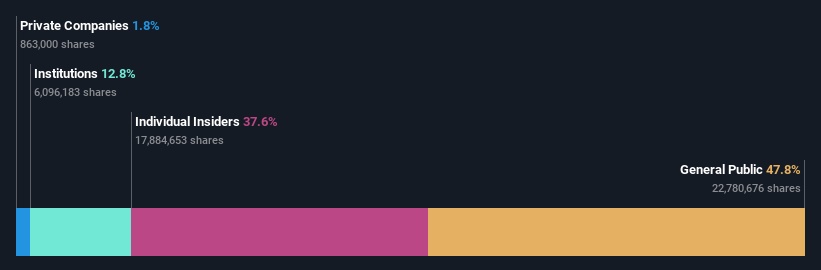

Insider Ownership: 36.8%

Revenue Growth Forecast: 24.7% p.a.

JUSUNG ENGINEERING Co., Ltd. is positioned for robust growth with expected revenue and earnings increases outpacing the South Korean market, projected at 24.7% and 37.9% per year respectively. However, its return on equity is anticipated to remain low at 17.2%. Analysts predict a potential stock price increase of 22%. Recent shareholder discussions reflect active engagement, though profit margins have dipped to 14.6%, influenced by significant one-off items impacting financial results.

Techwing

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. specializes in the development, manufacturing, sale, and servicing of semiconductor inspection equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.06 trillion.

Operations: The company generates revenue primarily through the development, manufacturing, sale, and servicing of semiconductor inspection equipment across domestic and international markets.

Insider Ownership: 18.7%

Revenue Growth Forecast: 41.3% p.a.

Techwing is poised for significant growth, with revenue expected to surge by 41.3% annually, outstripping the South Korean market's 10.7%. The company is forecasted to turn profitable within three years, showcasing a robust upward trajectory in earnings. However, its financial stability is questioned as interest payments are not well covered by earnings. Additionally, despite high insider ownership, there has been no substantial insider buying or selling in the past three months. The share price remains highly volatile.

Hana Materials

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Materials Inc., based in South Korea, specializes in the manufacturing and selling of silicon electrodes and rings, with a market capitalization of approximately ₩1.30 billion.

Operations: The company primarily generates revenue through the production and sale of silicon electrodes and rings.

Insider Ownership: 12.5%

Revenue Growth Forecast: 20.5% p.a.

Hana Materials is set to outperform with its earnings growth projected at 40.7% annually, surpassing the South Korean market's average of 29.2%. Revenue growth is also robust at 20.5% yearly, again exceeding the local market forecast of 10.7%. Despite these strengths, the company faces challenges with a high debt level and declining profit margins, down from last year's 25.1% to 11.6%. Additionally, there has been no significant insider trading activity recently.

Take a closer look at Hana Materials' potential here in our earnings growth report.

Upon reviewing our latest valuation report, Hana Materials' share price might be too optimistic.

Key Takeaways

Click here to access our complete index of 87 Fast Growing KRX Companies With High Insider Ownership.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A036930KOSDAQ:A089030 and KOSDAQ:A166090.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance