Director Cynthia Egnotovich Acquires 10,000 Shares of Triumph Group Inc (TGI)

On June 6, 2024, Cynthia Egnotovich, a director at Triumph Group Inc (NYSE:TGI), purchased 10,000 shares of the company, as reported in a recent SEC Filing. Following this transaction, the insider now owns a total of 32,561 shares of Triumph Group Inc.

Triumph Group Inc specializes in manufacturing and overhauling aerospace structures, systems, and components. Operating in various sectors of the aerospace industry, Triumph Group Inc plays a crucial role in both commercial and military aviation markets.

The shares were acquired at a price of $15.14 each, valuing the transaction at approximately $151,400. This acquisition has increased the insider's stake significantly, reflecting a strong commitment to the company's future.

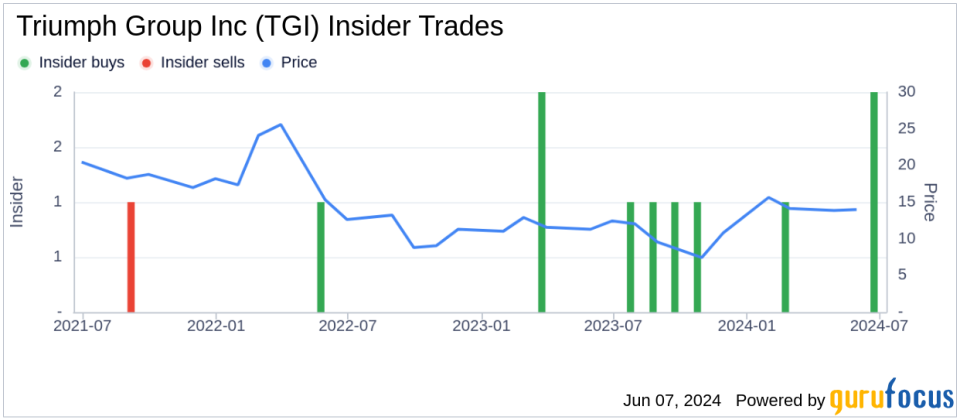

Over the past year, there have been seven insider buys and no insider sells at Triumph Group Inc. This pattern of insider activity often gives investors insight into the sentiments of key executives and directors regarding the company's prospects.

The current market cap of Triumph Group Inc is approximately $1.16 billion. The stock's price-earnings ratio is 2.29, which is significantly lower than the industry median of 34.64, suggesting that the stock is undervalued compared to its peers.

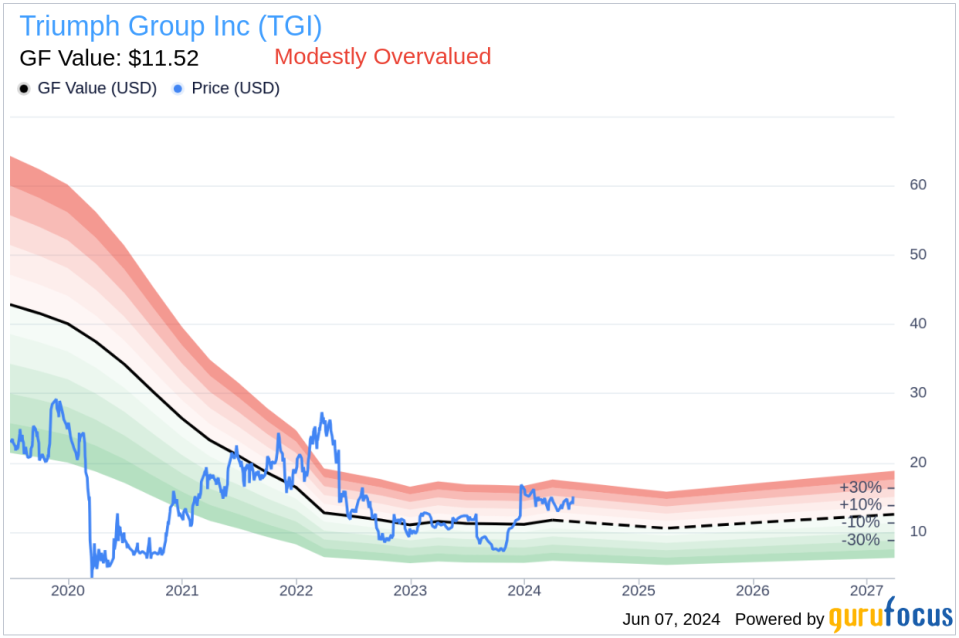

According to the GF Value, the intrinsic value of Triumph Group Inc is estimated at $11.52 per share, making the current price of $15.14 appear modestly overvalued with a price-to-GF-Value ratio of 1.31.

This recent insider purchase could signal a positive outlook from the insider regarding the company's valuation and future performance. Investors often look for such insider buys as they can indicate the executives' confidence in the company's current and future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance