Demand still apparent in office market despite global setbacks: Knight Frank

View from Guoco MidTown (Photo: Samuel Isaac Chua/EdgeProp Singapore)

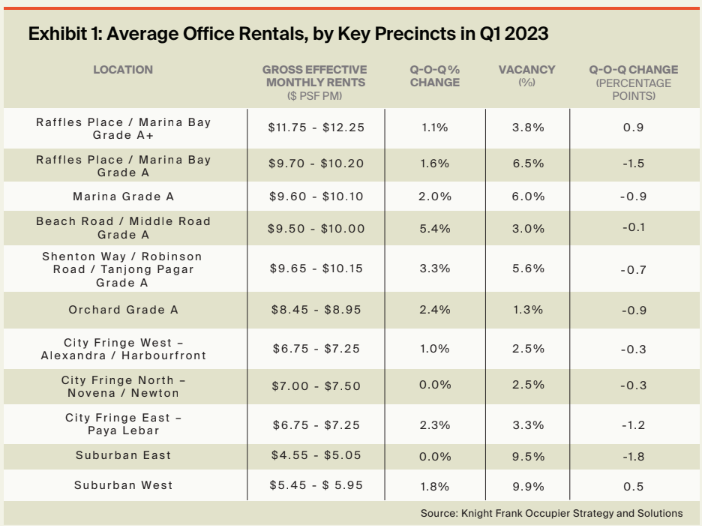

SINGAPORE (EDGEPROP) - Singapore office rents continued their upward trajectory in the last quarter, supported by tight supply, especially in the CBD. A report by Knight Frank found that prime-grade office rentals in the Raffles Place and Marina Bay precincts increased to an average of $10.83 psf per month, recording a 1.3% q-o-q growth in 1Q2023.

Occupancy levels in Raffles Place, Marina Bay and the overall CBD precinct remained steady at 95.4% and 94.1%, respectively, in 1Q2023. These figures were broadly unchanged from 95.5% and 94.2% in the previous quarter.

Calvin Yeo, managing director of occupier strategy and solutions at Knight Frank, attributes the healthy occupancies to selected office buildings commencing asset enhancement initiatives (AEIs) or redevelopment, thus removing stock from the market. Furthermore, quality office spaces remained full as businesses relocated their headquarters to Singapore.

As more employees return to the office, Yeo says that occupiers seek quality office spaces that facilitate vibrant activity-based workplaces. For example, the mixed-use development Guoco Midtown — completed in January — has Grade A offices incorporating a wide array of communal facilities supporting work productivity and lifestyle amenities. The project’s office component was reported to be 80% filled upon completion.

While the tech sector continues to make headlines, Yeo says that smaller users in flight-to-quality moves from ageing office buildings have absorbed office shadow space that has emerged from layoffs impacting major tech firms. “In Singapore, while technology firms are no longer expanding as they were before the pandemic, neither is the pre-termination quantum significantly affecting the market at this point,” he adds. Knight Frank says the supply of pre-termination space stood at around 100,000 sq ft as of 1Q2023.

The recent turmoil in the banking market — including the collapse of Silicon Valley Bank and the bailout of Credit Suisse — has further clouded economic sentiment. Knight Frank believes that Singapore is “poised to stay resilient by offering a destination of stability”. Demand for office space is expected to stay underpinned by flight-to-quality and cautious expansion.

Knight Frank predicts that prime office rents are expected to be stable, with an increment of 3% for this year. “As overall CBD rents rose moderately in 1Q2023, the office sector in Singapore remains on an even keel due to predominantly flight-to-quality demand in a stable ecosystem of cautious expansion amid wider uncertainty,” says Yeo.

Check out the latest listings near Guoco Midtown, Raffles Place, Marina Bay

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Nearly one-third of Singapore property investors keen to venture overseas

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance