Dell (DELL) Q1 Earnings Top Estimates, Revenues Up Y/Y

Dell Technologies DELL reported non-GAAP earnings of $1.27 per share in first-quarter fiscal 2025, beating the Zacks Consensus Estimate by 1.6%. The bottom line declined 3% year over year.

Revenues, on a non-GAAP basis, increased 6% year over year to $22.2 billion and beat the consensus mark by 2.5%. The upside was driven by exceptional performance in AI servers and a return to growth in the commercial PC business.

Product revenues rose 7% year over year to $16.12 billion, beating the Zacks Consensus Estimate by 1.63%.

Services revenues moved up 4% year over year to $6.11 billion, beating the Zacks Consensus Estimate by 9.70%.

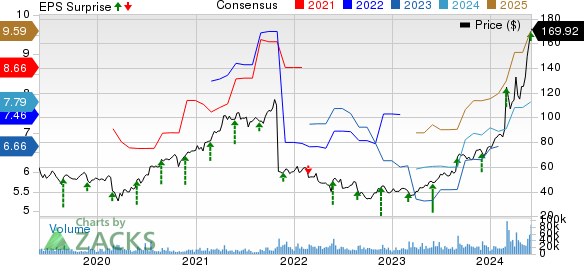

Dell Technologies Inc. Price, Consensus and EPS Surprise

Dell Technologies Inc. price-consensus-eps-surprise-chart | Dell Technologies Inc. Quote

Top-Line Detail

Infrastructure Solutions Group (ISG) revenues increased 22% year over year to $9.2 billion.

The upside can be attributed to record servers and networking revenues of $5.5 billion, up 42% year over year, with demand strength across AI and traditional servers. Storage revenues were flat year over year to $3.8 billion.

In the reported quarter, Dell's AI-optimized server momentum saw an increase of $2.6 billion in orders. The flagship PowerEdge XE9680 experienced strong demand, contributing to the momentum in the AI space.

Over the last three quarters, Dell shipped more than $3 billion worth of AI servers.

In first-quarter fiscal 2025, shipments grew more than 100% sequentially to $1.7 billion.

The backlog for AI-optimized servers grew approximately $900 million, reaching $3.8 billion in the reported quarter.

Client Solutions Group (CSG) revenues were $12 billion, flat year over year. Commercial Client revenues increased 3% year over year to $10.2 billion. Consumer revenues fell 15% to $1.81 billion.

Operating Details

Dell’s fiscal first-quarter non-GAAP gross profit dropped 4% year over year to $4.94 billion. The gross margin contracted 250 basis points (bps) year over year to 22.2%.

SG&A expenses fell 5% year over year to $2.81 billion. Research and development expenses increased 8% year over year to $663 million in the reported quarter.

Non-GAAP operating expenses declined 3% year over year to $3.47 billion. Operating expenses, as a percentage of revenues, contracted 150 bps on a year-over-year basis to 15.6%.

The non-GAAP operating income was $1.47 billion, down 8% year over year. The operating margin contracted 100 bps year over year to 6.6%.

The ISG segment’s operating income dropped 1% year over year to $736 million. The CSG segment’s operating income was $732 million, down 18% year over year.

Balance Sheet

As of May 3, 2024, DELL had $5.83 billion in cash and cash equivalents compared with $7.36 billion as of Feb 2, 2024.

Total Debt was $25.4 billion as of May 3, 2024, compared with $25.9 billion as of Feb 2, 2024.

The company generated a cash flow from the operation of $1.04 billion and the adjusted free cash flow was $623 million in first-quarter fiscal 2025.

Dell returned $722 million to its shareholders through share repurchases and paid $336 million in dividends, resulting in a total capital return of $1.1 billion.

Guidance

For the second quarter of fiscal 2025, revenues are expected to be between $23.5 billion and $24.5 billion, with a midpoint of $24 billion reflecting 5% growth.

Dell anticipates an 8% growth at the midpoint for the combined ISG and CSG, with ISG expected to increase in the mid-twenties.

Diluted share count is expected to be between $723 million to $727 million shares.

Earnings are expected to be $1.65 per share (+/- 10 cents).

Zacks Rank & Other Stocks to Consider

Dell Technologies has a Zacks Rank #2 (Buy).

DELL’s shares have surged 95.6% year to date compared with the Zacks Computer & Technology sector’s increase of 17.8%.

Micron Technology MU, Planet Labs PBC PL and SecureWorks SCWX are some other top-ranked stocks that investors can consider in the broader sector.

Micron Technology, Planet Labs PBC and SecureWorks each carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Micron Technology’s shares have increased 48% year to date. MU is set to report third-quarter fiscal 2024 results on Jun 26.

SecureWorks has declined 19.7% year to date. SCWX is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Planet Labs PBC has declined 21.9% year to date. PL is scheduled to release first-quarter fiscal 2025 results on Jun 6.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Planet Labs PBC (PL) : Free Stock Analysis Report

SecureWorks Corp. (SCWX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance