A Deep Dive Into Coca-Cola's Dividend and Investment Viability

In my series examining Dividend Aristocratscompanies that have consistently increased dividend payments to shareholders for at least 25 yearsI have analyzed several notable corporations, including Dover (NYSE:DOV), Procter & Gamble (NYSE:PG), American States Water (NYSE:AWR), Genuine Parts (NYSE:GPC), Emerson Electric (NYSE:EMR), Parker-Hannifin (NYSE:PH) and 3M (NYSE:MMM). Remarkably, each of these companies has an impressive record, having raised their dividends every year for at least 66 years.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

This analysis now turns to another elite member of this group: Coca-Cola Co. (NYSE:KO), the favorite company of legendary investor Warren Buffett (Trades, Portfolio). Coca-Cola has successfully raised its dividends for 62 consecutive years. However, the company experienced a challenging year in 2023, marked by a 4.8% decline in share price over 12 months. This performance significantly lagged behind the S&P 500's (SPY) return of nearly 24%. Given these circumstances, let's look at the company to determine if it is a good choice for income investors at its current price.

Global dominance with worldwide operations

Coca-Cola, a globally renowned brand, hardly needs an introduction. Established in 1886, it is now the world's largest beverage company, operating in over 200 countries and territories. Its portfolio includes five major non-alcoholic sparkling soft drink brands: Coca-Cola, Sprite, Fanta, Coca-Cola Light/Diet Coke and Coca-Cola Zero Sugar. A key strength of the company is its expansive global distribution network, which includes a mix of independent bottling partners, distributors, wholesalers and retailers. Impressively, Coca-Cola distributes approximately 2.2 billion servings daily.

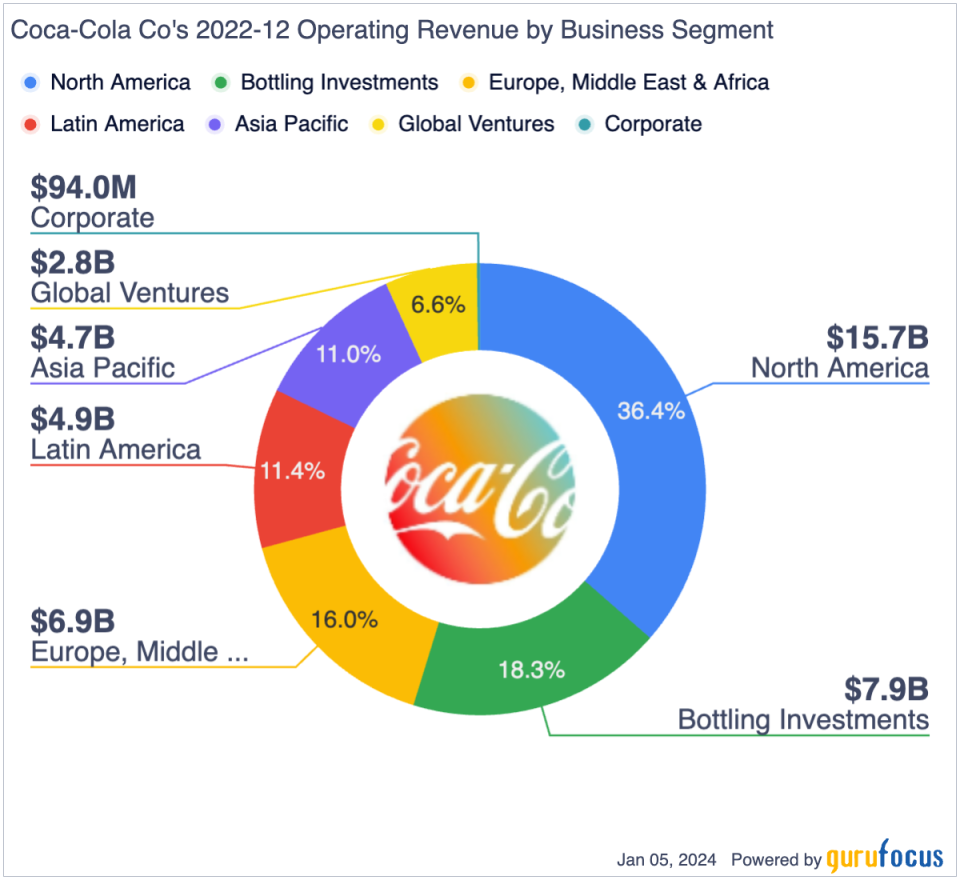

The company's operations are segmented into six main geographical regions: North America, Europe, Middle East and Africa, Latin America, Asia Pacific, Bottling Investment and Global Ventures. In 2022, the North American segment was its largest revenue contributor, generating $15.7 billion, which accounted for 36.4% of total revenue. The Bottling Investments segment followed with $7.9 billion in revenue, representing 18.3%. The Europe, Middle East and Africa region contributed $6.9 billion in sales, making up 16% of the total. The Latin America and Asia Pacific segments were closely matched, with revenue of $4.9 billion and $4.7 billion.

Consistently profitable and strong cash flow generation

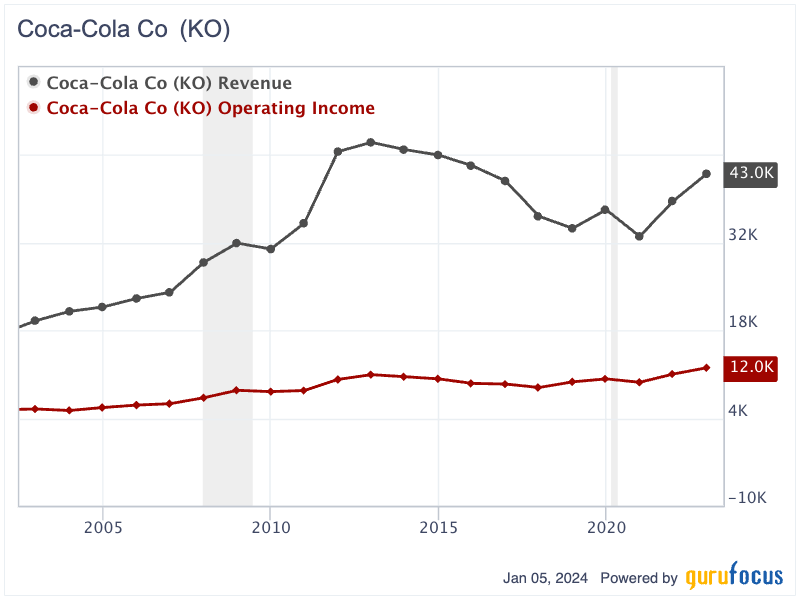

Coca-Cola has firmly established itself as a top choice in consumers' minds. Since 2008, its market share in the U.S. non-alcoholic beverage market has increased from 42.6% to 46.3% in 2022. Over the past two decades, Coca-Cola's revenue growth hasn't been steady, with increases noted in only 12 out of the 20 years. From 2002 to 2022, its revenue grew from $19.56 billion to $43 billion, achieving a compounded annual growth rate of 4%. Similarly, its operating income rose from $5.46 billion in 2002 to $12.25 billion in 2022, with a CAGR of 4.1%.

Though not a high-growth business, Coca-Cola stands out for its high profitability. Over the last 20 years, its gross margin has consistently ranged between 58.14% and 66.12%, while its operating margin has varied between 23.12% and 30.29%. In 2022, the company reported a gross margin of 58.14% and an operating margin of 28.5%.

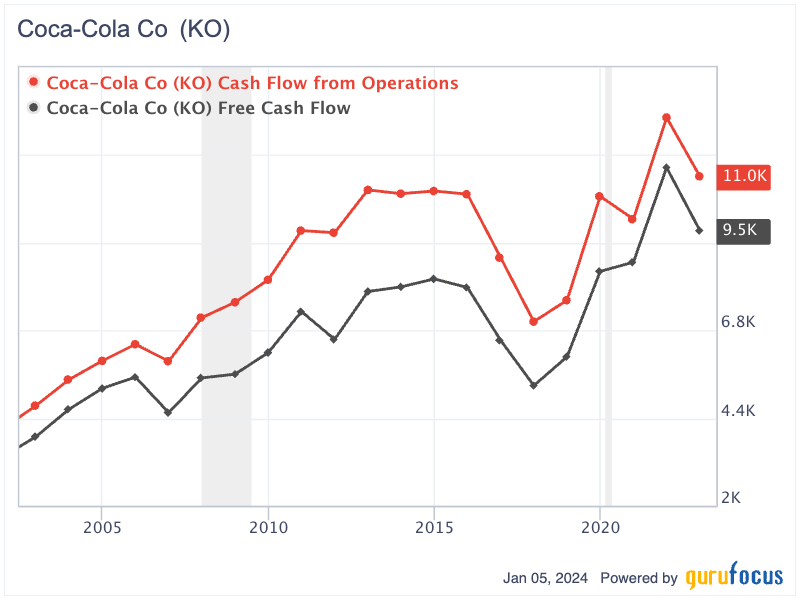

Coca-Cola is also a consistent cash flow generator. Over the years, it has maintained a positive operating and free cash flow trend. From 2002 to 2022, its operating cash flow grew substantially, from $4.74 billion to $11 billion. Simultaneously, the free cash flow also experienced significant growth, rising from $3.89 billion in 2002 to $9.53 billion in 2022. This consistent profitability and positive cash flow generation highlight Coca-Cola's strong business and operational efficiency.

High debt-to-equity ratio is not a concern

At first glance, investors might be concerned about Coca-Cola's high debt-to-equity ratio. As of September, the company had total equity of $27.83 billion, much lower than its interest-bearing debt of $40.17 billion. Thus, the debt-to-equity ratio is considered to be high at 1.44. However, this lower shareholder equity is primarily due to nearly $54 billion in treasury stock, representing the accumulated share repurchases over the years.

Furthermore, while the total debt may seem substantial, it's important to note that long-term debt is structured with maturities spread over many years, extending as far as 2093. From 2023 to 2026, the debt principal due each year ranges from $399 million to nearly $2 billion. In 2027, the principal payment will be close to $4.5 billion. Given Coca-Cola's average operating cash flow of $10 billion over the past five years, the company appears well positioned to effectively manage its interest payments and debt obligations.

Exceptional track record of dividend payment

Because of the company's strong moat, global brand and dividend track record, Buffett initiated Berkshire Hathaway's (NYSE:BRK.A) (NYSE:BRK.B) position in Coca-Cola in 1988 and has become the largest shareholder with 400 million shares. His cost basis was only nearly $3.25 per share, with a total investment of nearly $1.3 billion. As Coca-Cola paid $1.84 per share, his 400 million shares received $736 million in dividend payments alone, representing a yield on cost of a whopping 57%.

Indeed, Coca-Cola has an exceptional track record of consistently increasing its dividend for the past 62 years. Its dividend has increased from 40 cents per share in 2002 to $1.76 per share in 2022, with an annual compounded growth rate of nearly 7.67%.

Potential upside

The Gordon Growth Model, which is particularly suited for evaluating companies with a consistent history of dividend growth, is highly applicable to Coca-Cola due to its remarkable record of increasing dividends for 66 consecutive years. To estimate the intrinsic value of the stock using this model, let's assume the company will continue to grow its dividends at a reduced rate of 6%. By applying a discount rate of 8%, we can estimate the stock's intrinsic value as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $1.84 *(1+6%) / (8%-6%)

= $97.52

Applying the Gorden Growth Model, Coca-Cola's intrinsic value is estimated at around $97.5 per share, indicating a potential 62.5% upside from the current trading price.

Key takeaway

Coca-Cola presents a compelling case for income investors. With a legacy of 62 consecutive years of dividend increases and a global presence unparalleled in the beverage industry, the company stands as a paragon of stability and resilience. Despite the recent share price decline and concerns over its debt-to-equity ratio, Coca-Cola's robust financial health, as evidenced by its strong cash flow generation and operational efficiency, positions it well to manage these challenges.

Buffett's longstanding investment and the remarkable yield on cost from Coca-Cola's dividends further underline its attractiveness. Moreover, applying the Gordon Growth Model suggests a significant potential upside in its stock value. Therefore, for investors seeking a blend of steady income and long-term growth potential, Coca-Cola represents a solid choice, anchored by its iconic brand strength and unwavering commitment to shareholder value.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance