Decoding Walgreens Boots Alliance Inc (WBA): A Strategic SWOT Insight

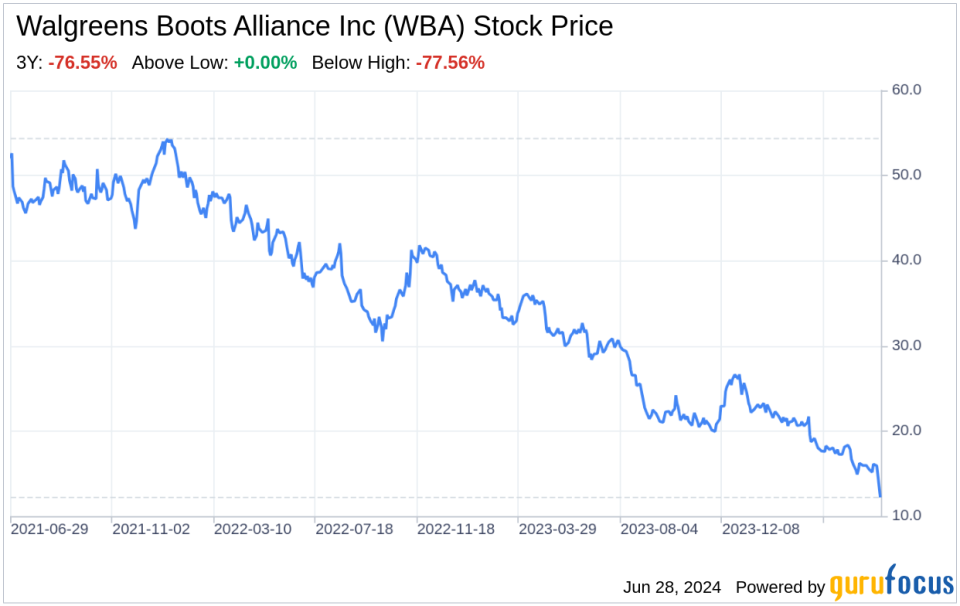

Walgreens Boots Alliance Inc faces a challenging retail environment but leverages a strong pharmacy presence.

Recent goodwill impairment charges highlight risks but also opportunities for strategic repositioning.

The company's U.S. Healthcare segment shows promise with a consumer-centric, technology-enabled approach.

Walgreens Boots Alliance Inc's strategic initiatives aim to optimize U.S. operations and enhance customer experience.

On June 27, 2024, Walgreens Boots Alliance Inc (NASDAQ:WBA), a leading retail pharmacy chain, released its 10-Q filing, revealing a complex financial landscape shaped by both internal strategic decisions and external market forces. The company, with its vast network of over 8,500 locations, serves as a critical healthcare provider to a significant portion of the U.S. population. Despite a challenging retail environment, WBA continues to generate a substantial portion of its revenue from prescription drug sales, which account for two-thirds of its total revenue, cementing its position as a key player in the pharmaceutical industry. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as disclosed in the recent SEC filing, providing investors with a comprehensive understanding of WBA's current position and future prospects.

Strengths

Robust Pharmacy Network and Brand Presence: Walgreens Boots Alliance Inc's extensive pharmacy network remains its most formidable strength. With a market share of 20% in U.S. prescription revenue and nearly three-quarters of Americans living within five miles of a Walgreens, the brand's accessibility is unparalleled. This network is not only a conduit for prescription drug sales but also serves as a platform for health and wellness services, specialty pharmacy, and home delivery services. The company's brand is synonymous with pharmacy retail, providing a solid foundation for customer loyalty and trust.

U.S. Healthcare Segment Growth: The U.S. Healthcare segment of WBA is a testament to the company's forward-looking approach. Embracing a consumer-centric, technology-enabled business model, WBA is poised to deliver improved health outcomes at lower costs. The segment includes a majority stake in VillageMD, a provider of value-based care, and other assets like Shields Health Solutions and CareCentrix. Despite a recent goodwill impairment charge, this segment represents a strategic pivot towards a more integrated healthcare offering, which could drive future growth.

Strategic Cost Management and Operational Review: WBA's Transformational Cost Management Program and the recent strategic and operational review underscore its proactive stance in optimizing operations. The company is exploring opportunities to close underperforming stores, invest in customer experience, and streamline its U.S. Healthcare portfolio. These initiatives are crucial for maintaining competitiveness and adapting to the evolving retail landscape.

Weaknesses

Goodwill Impairment and Financial Volatility: The $12.4 billion goodwill impairment charge related to VillageMD is a significant weakness, reflecting challenges in the U.S. Healthcare segment's valuation. This non-cash charge has heavily impacted WBA's financial performance, indicating potential overestimation of the segment's future profitability and the need for strategic reassessment.

Challenging Retail Environment: WBA's retail segment has faced a decline, with a 4.0% decrease in retail sales for the three months ended May 31, 2024. This is indicative of a broader trend in the retail industry, where consumer behavior is shifting, and traditional brick-and-mortar stores are under pressure. The company must navigate these challenges while enhancing its e-commerce capabilities and in-store experience to remain competitive.

Legal and Regulatory Pressures: The company has been embroiled in significant legal proceedings, including opioid litigation, resulting in substantial financial accruals. These unpredictable expenses, while non-recurring, can affect investor confidence and divert resources from core operations.

Opportunities

Healthcare Services Expansion: WBA has the opportunity to further expand its healthcare services, leveraging its retail footprint to offer an omnichannel experience. The integration of Health Corner and Village Medical services within its locations can transform the company into a holistic healthcare destination, meeting the growing demand for convenient care.

Technology and Digital Innovation: Investment in digital health solutions and e-commerce can drive growth for WBA. Enhancing online platforms, mobile applications, and leveraging data analytics can improve customer engagement, streamline operations, and create new revenue streams.

Global Market Penetration: WBA's international presence, particularly in the UK with Boots, provides a platform for global expansion. Exploring emerging markets and capitalizing on international retail and pharmaceutical opportunities can diversify revenue and mitigate risks associated with the U.S. market.

Threats

Competitive Pressure: The pharmacy retail and healthcare markets are highly competitive, with players like CVS Health and Amazon entering the space. WBA must continuously innovate and differentiate its offerings to retain market share and customer loyalty.

Regulatory Changes: Changes in healthcare laws, regulations, and reimbursement models can significantly impact WBA's operations. The company must stay ahead of policy shifts to ensure compliance and adapt its business strategies accordingly.

Economic and Market Fluctuations: Economic downturns, shifts in consumer spending, and market volatility can adversely affect WBA's financial performance. The company must maintain financial flexibility and operational efficiency to withstand these external shocks.

In conclusion, Walgreens Boots Alliance Inc (NASDAQ:WBA) operates in a complex and dynamic environment, with significant strengths in its extensive pharmacy network and emerging U.S. Healthcare segment. However, it faces challenges from financial volatility, a tough retail landscape, and ongoing legal issues. Opportunities for growth lie

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance