Decoding Duolingo Inc (DUOL): A Strategic SWOT Insight

Robust user engagement with significant growth in monthly active users (MAUs) and daily active users (DAUs).

Expansion into new markets and consistent investment in AI and machine learning for product enhancement.

Challenges include intense competition in the online language learning industry and dependency on third-party platforms.

Strategic focus on brand campaigns and organic growth through word-of-mouth virality.

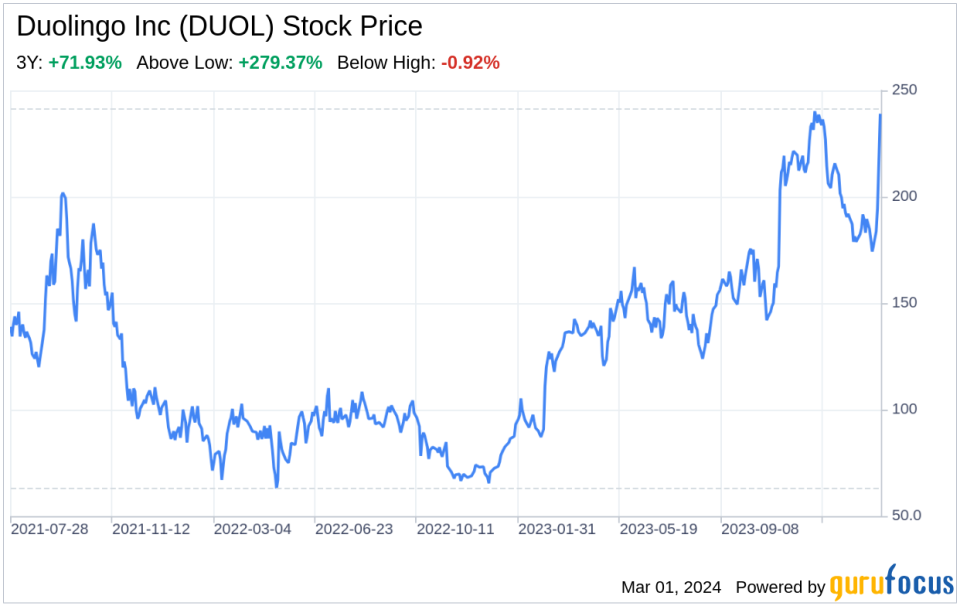

On February 29, 2024, Duolingo Inc (NASDAQ:DUOL) filed its annual 10-K report, revealing a year of strategic growth and technological advancement in the competitive field of online language learning. As the top-grossing Education app, Duolingo has leveraged its sophisticated data analytics and AI to deliver a compelling learning experience, resulting in a substantial user base growth. The company's financial health is reflected in its market valuation of approximately $3.89 billion as of June 30, 2023, showcasing its strong position in the market. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as presented in the 10-K filing, providing investors with a comprehensive understanding of Duolingo's current standing and future prospects.

Strengths

Brand Awareness and Market Position: Duolingo Inc (NASDAQ:DUOL) has established itself as a leader in the online language learning space, with its app becoming synonymous with language learning globally. The company's brand awareness is bolstered by its strategic marketing efforts, including engaging social media campaigns and influencer partnerships. This has translated into a significant user base, with the company reporting robust monthly and daily active users. The brand's strength is further evidenced by the high search volume for "Duolingo" compared to generic language learning terms, indicating a strong mindshare among consumers.

Technological Innovation: Duolingo's commitment to technological innovation is a key strength. The company's use of AI and machine learning has not only improved the efficacy of its language learning app but also allowed for the development of new products like the Duolingo English Test. This focus on innovation has enabled Duolingo to offer a differentiated and effective product suite that caters to a diverse range of learning needs and preferences.

Weaknesses

Dependence on Third-Party Platforms: A significant weakness for Duolingo Inc (NASDAQ:DUOL) is its reliance on third-party platforms for product distribution and revenue collection. This dependence poses a risk as changes in platform policies or fee structures could adversely affect Duolingo's business operations and profitability. Additionally, the company's reliance on third-party hosting and cloud computing providers could lead to vulnerabilities in service delivery and data security.

Limited Operating History: Despite its success, Duolingo's limited operating history presents a weakness. As the company scales, it faces challenges in maintaining the quality of its products and services and preserving its company culture. This rapid growth could lead to operational inefficiencies and affect the company's ability to forecast future performance accurately.

Opportunities

Market Expansion: Duolingo Inc (NASDAQ:DUOL) has significant opportunities for growth in new geographic markets. The company's efforts to hire local marketing managers and engage in localized campaigns can drive user acquisition and increase market penetration. With the global demand for language learning projected to rise, Duolingo is well-positioned to capitalize on this trend and expand its user base internationally.

Advancements in AI and Machine Learning: The ongoing advancements in AI and machine learning present an opportunity for Duolingo to further enhance its learning platform. By staying at the forefront of technological innovation, Duolingo can continue to improve the learning experience for users, develop new products, and maintain a competitive edge in the rapidly evolving online education sector.

Threats

Competitive Landscape: The online language learning industry is highly competitive, with low barriers to entry and a constant influx of new products and entrants. Duolingo Inc (NASDAQ:DUOL) faces the threat of competitors harnessing new technologies or distribution channels that could potentially disrupt its market position. Additionally, the availability of free language learning resources poses a threat to Duolingo's paid subscription model.

Regulatory and Legislative Developments: Duolingo's use of AI and machine learning could be impacted by regulatory and legislative developments. Changes in data protection, privacy laws, and intellectual property rights could impose new constraints on the company's operations and necessitate adjustments to its technology and business practices, potentially leading to increased costs and operational challenges.

In conclusion, Duolingo Inc (NASDAQ:DUOL) exhibits a strong market position and brand awareness, bolstered by its technological innovation and data-driven approach to language learning. However, the company must navigate challenges such as its dependence on third-party platforms and a competitive landscape that includes both established players and emerging technologies. Opportunities for growth through market expansion and advancements in AI are promising, but regulatory changes and the threat of new entrants remain significant considerations. Duolingo's strategic focus on organic growth and brand campaigns positions it well to leverage its strengths and address potential weaknesses and threats.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance