DBS’ Piyush Gupta Opens Up on China’s Problems: Can the Bank Continue to Grow?

DBS Group (SGX: D05) has been riding the wave of interest rate increases to post strong results.

The lender saw its 2023 first half (1H 2023) net profit surge to a new record high of S$5.2 billion as its net interest margin (NIM) came in at 2.14%.

Back then, CEO Piyush Gupta anticipated that there would be an upside bias to NIM with possible further increases in interest rates by the US Federal Reserve.

He also expected specific provisions to remain at the low end of around 0.1% to 0.15% of the bank’s loan book.

However, of late, China’s property sector has come under stress.

Will China’s troubles put a spanner in DBS’s growth plans?

Chinese developers under pressure

Chinese developers’ woes have made the headlines in recent months.

China Evergrande Group (HKSE: 3333), one of the world’s most heavily indebted property developers, filed for bankruptcy in a US court a month ago.

The company had been working for months on a debt restructuring deal that ultimately failed to gain traction.

Since this debt crisis erupted in mid-2021, companies accounting for 40% of China’s home sales have defaulted.

Country Garden (HKSE: 2007), China’s largest private property developer, had failed to make payment on a bond coupon back in August, triggering fears that it would be next to go insolvent.

It is not out of the woods yet, though, as the embattled developer faces another liquidity test to pay US$15 million in interest linked to an offshore bond.

To make matters worse, Chinese state-linked developer Sino-Ocean Group (HKSE: 3377) has suspended payment on all its offshore debt.

The country’s 25th-largest builder is responsible for more than 290 property projects across China and is in active discussion with its creditors to manage its liabilities.

With the turmoil roiling China’s property sector, could DBS be negatively impacted?

China is still investible

Gupta sees China as being an important cog for the bank even as the country grapples with these headwinds.

DBS is positive on the electronic vehicles and technology sectors within the Middle Kingdom and he believes that these sectors provide continued opportunities for growth.

The country remains “investible” although Gupta admitted that the property crisis has no quick fix.

Recall that back in April 2021, DBS acquired a 13% stake in Shenzhen Rural Commercial Bank for S$1.08 billion.

Gupta has reiterated that the bank remains interested in increasing this stake, although no timeline was provided and the CEO did not elaborate on the bank’s target shareholding.

He also revealed that DBS halted property financing in China around three to four years ago and limited its credit exposure and loan book in the country as the lender anticipated these problems.

Upbeat about India

While DBS has limited its exposure to China’s property sector, its CEO remains upbeat about India’s prospects.

Nearly three years ago in November 2020, the bank took over Lakshmi Vilas Bank in a move to grow its presence in the country.

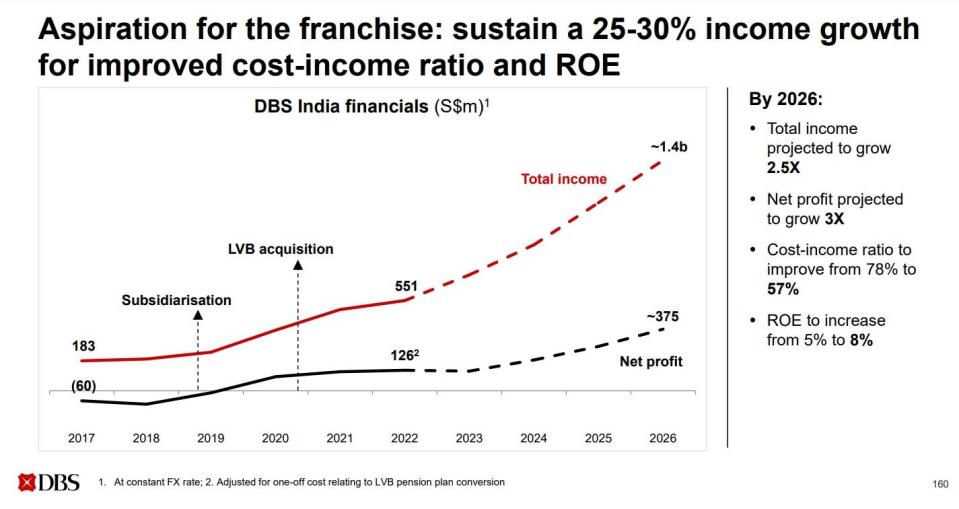

DBS’s recent Investor Day also saw the lender disclosing interesting statistics about its India franchise.

From 2017 to 2022, income from this segment has tripled from S$183 million to S$551 million.

The return on equity has gone from negative 3% to positive 5% over the same period.

DBS has also expanded its network in India to more than 500 branches, and Gupta has ambitious plans to triple its business in the next five years.

Tapping on a phygitial (i.e. physical plus digital) strategy, the bank hopes to leverage this to tap growth opportunities in a market with annual revenues of S$200 to S$250 billion per annum that is growing at 10% every year.

DBS has a clear two-pronged strategy to grow its business in India.

For Consumer and Small & Medium Enterprises (SMEs), the group will roll out retail deposits, grow its secured loans base, and expand analytics-based lending across the network.

For these two groups, income is projected to grow by between 40% to 60% per annum from 2022 to 2026.

Turning to the mid-cap and large-cap companies, DBS intends to deepen relationships with large conglomerates while expanding mid-cap coverage across India’s top 30 cities.

Income from these two segments is expected to grow between 10% to 15% per annum over the same period.

Source: DBS Group Investor Day Presentation

DBS has grand plans to grow its total income by two and a half times with net profit projected to triple by 2026.

The above slide also shows the bank’s India ambitions concerning cost-to-income ratio and return on equity.

Get Smart: Still room for growth

It seems clear that DBS has laid a clear path for continued growth despite China’s ongoing challenges.

The bank recently lifted its quarterly dividend to S$0.48 from S$0.42 in the first quarter of 2023.

The Investor Day slides revealed that the bank’s baseline for sustainable dividend growth is S$0.06 per quarter.

If its growth plans pan out as planned, investors could see the annual dividend steadily rising in the years to come.

By the time your child grows up, inflation will have gobbled up their savings. If you not only want to protect their money but also grow it, there are 3 SGX stocks you can consider buying. One has already proven to give a 55.8% dividend pay rise. Get all the details in our latest special FREE report. Just click here.

Disclosure: Royston Yang owns shares of DBS Group.

The post DBS’ Piyush Gupta Opens Up on China’s Problems: Can the Bank Continue to Grow? appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance