DBS downgrades SIA to 'hold', urges switch to ST Engineering, SATS instead

DBS analysts believe SIA's earnings may peak in FY2024 as supernormal passenger yields revert to more normalised levels.

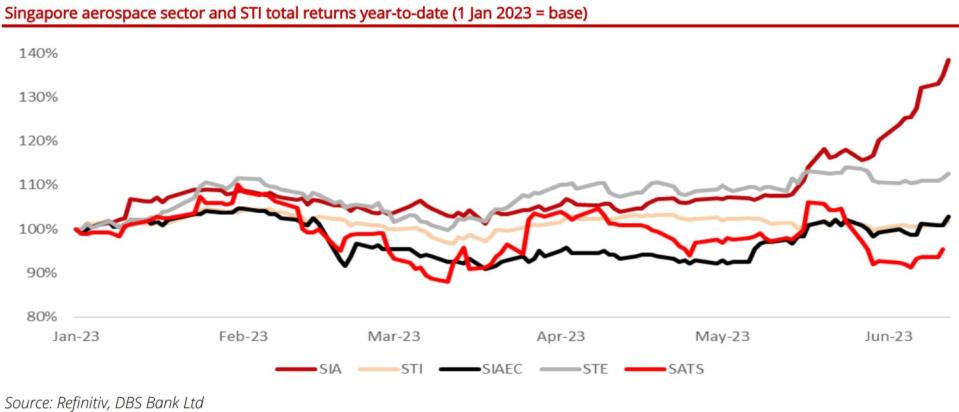

Following a triumphant return to profitability, Singapore Airlines C6l’ (SIA) bright earnings prospects are “largely priced-in”, say DBS Group Research analysts. Now, the DBS analysts recommend investors switch to ST Engineering (STE) or SATS.

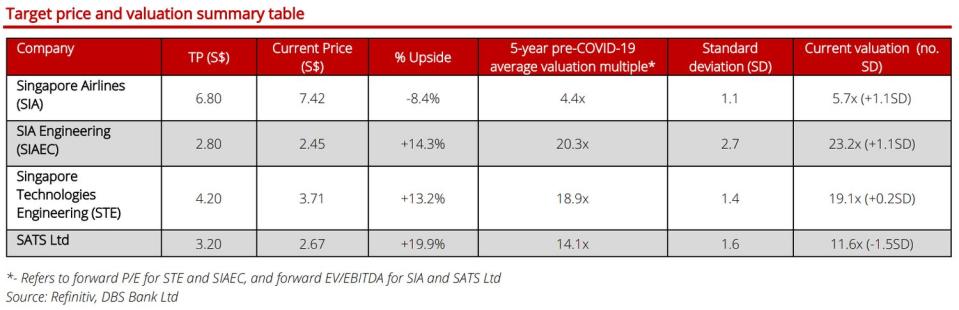

SIA’s valuations are “broadly in-line” with its fundamentals after the “stunning” rally in its share price year-to-date, according to analysts Jason Sum, Tabitha Foo and Paul Yong. “While we continue to be optimistic about the airline’s near-term earnings outlook, we believe its earnings may peak in FY2024 as supernormal passenger yields revert to more normalised levels due to fiercer competition in the region.”

Additionally, SIA will also likely suffer greater losses from associates after Air India becomes an associate, add the analysts. “Hence, we recommend that investors take profit and rotate into other Singapore aviation-related names with more durable growth characteristics and attractive valuations.”

ST Engineering is DBS’s preferred choice. “Its valuation has yet to reflect the multiple growth levers that we foresee fuelling its 16% core earnings CAGR over the next two years. We also like SATS, as its current valuation is not indicative of its longer-term earnings capability, but the absence of near-term catalysts may delay its re-rating.”

In a June 26 note, the DBS analysts downgrade SIA to ‘hold’ with an unchanged target price of $6.80, while STE, SATS and SIA Engineering earn “buy” calls with target prices of $4.20, $3.20 and $2.80 respectively.

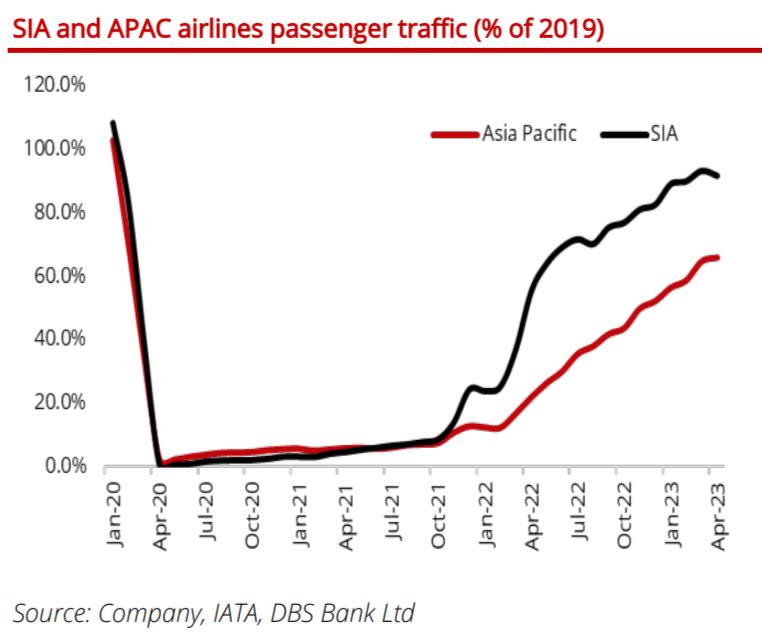

Singapore’s aviation sector is progressing well against expectations, and Asia-Pacific will see accelerated recovery in 2023, say the analysts.

The release of substantial pent-up travel demand post China’s reopening drove a significant upswing in global air passenger activity, propelling global air passenger traffic to 90.5% of 2019 levels in April.

Upbeat consumer sentiment and solid forward-booking activity underpin DBS’s expectation that this momentum would be sustained going forward, particularly in Asia-Pacific, which is expected to see the strongest improvement due to its delayed reopening.

According to the International Air Transport Association (IATA), passenger traffic in the region is projected to surge to 86% of pre-pandemic levels in 2023, up from a mere 54% in 2022.

Singapore has outpaced other countries in this region and is well-positioned to maintain its lead, which bodes well for aviation-related companies in the country, say DBS analysts. “Meanwhile, channel checks indicate that the maintenance, repair and overhaul (MRO) market is becoming increasingly tight, with demand poised to rise sharply on multiple tailwinds. Contrarily, the air cargo market will likely remain under stress due to a culmination of softer demand and stiffer competition from ocean freight.”

Key factors impacting earnings

For SIA, the DBS analysts are watching for an increase in passenger traffic, if passenger capacity hits 90% of January 2020’s level in 2H2023 and 100% by end-1H2024.

They are also watching if passenger load factors will be maintained at above pre-pandemic levels, while passenger yields moderate at a more gradual pace.

However, they think a sharp decline in air cargo rates and load factors could be tempered by rising cargo capacity, along with lower unit costs due to the fall in jet fuel prices and increased efficiency with the restoration of capacity.

There is also uncertainty on investment quantum required to finance Air India’s ambitious growth aspirations, which could contribute to an increase in share of losses from associates from FY2025 with Air India as an associate.

As for STE, there are a few positive factors. For one, the company has divested its loss-making US-based marine subsidiary, which was $80 million in the red for FY2022.

There could also be a full-year positive contribution from subsidiary TransCore, a US-based transportation technology company, including lower transaction and integration costs of around $10 million to $15 million in FY2023, compared to $30 million in FY2022.

The DBS analysts also point to lower energy-inflation costs as compared to FY2022 with the normalisation of commodity and electricity prices, as well as the continued business recovery in the commercial aerospace business.

Meanwhile, ST Engineering’s defence business should remain resilient amid heightened geopolitical tensions, they add, while expecting sustained operating margin expansion, with the passenger-to-freighter (P2F) programme turning ebit positive, increased economies of scale and positive cost-cutting.

On SATS, the DBS analysts point to a healthy growth in non-aviation food businesses as the group expands its product portfolio, distribution channels and production capacity with new central kitchens in Tianjin and Bengaluru coming online.

There is also a new food hub in Jurong Ground handling and aviation food business to benefit from recovery in passenger flights and traffic, particularly in inter-region flights to and from Asia, they add.

That said, the downturn in the air cargo market could weigh on SATS’s cargo handling business in the near term before seeing a recovery in the next year, say the DBS analysts.

There is also the risk of higher interest expenses, given a substantial increase in the debt burden and integration costs in 2023.

As at 11.58am, shares in SIA are trading 8 cents higher, or 1.07% up, at $7.56; while shares in ST Engineering are trading 5 cents higher, or 1.40% up, at $3.63; and shares in SATS are trading 4 cents higher, or 1.56% up, at $2.60.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

DBS keeps StarHub at 'hold' as it waits for more clarity on earnings trajectory

RHB, DBS stay 'buy' as ESR-LOGOS REIT divests seven assets with 'slightly high' discount

DBS downgrades Nanofilm to ‘fully valued’ as outlook remains weak

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance