DaVita (DVA) Expands Operational Footprint Via New Agreement

DaVita Inc. DVA recently announced that it has agreed to terms on expanding its international operations in Brazil and Colombia, and its entry into Chile and Ecuador. The deal, involving four separate acquisitions from Fresenius Medical Care, is consistent with DaVita's disciplined investment strategy.

It should be noted that the transaction in Chile closed effective today. The transactions in Ecuador, Colombia and Brazil remain subject to each country's respective anti-trust and regulatory approval processes, which are each expected to be completed at various times during 2024.

The latest deal is expected to significantly boost DaVita's Latin American business and solidify its foothold in the niche space.

Rationale Behind the Agreement

Per management, following the completion of the transactions and combination with DaVita's existing Latin American operations in Brazil and Colombia, the company will likely be able to provide clinical care to more than 60,000 patients in over 270 clinics. This, in turn, is expected to make DaVita the largest dialysis services provider in Latin America.

Industry Prospects

Per a report by Precedence Research, the global end-stage renal disease market was estimated to be $105.22 billion in 2022 and is anticipated to reach $372.31 billion by 2032 at a CAGR of approximately 13.5%. Factors like the increase in kidney failure patients and the introduction of technologically advanced products are expected to drive the market.

Given the market potential, the latest agreement is expected to significantly boost DaVita's business.

Notable Development

Last month, DaVita announced its fourth-quarter 2023 results, wherein it registered an uptick in its overall top line and dialysis patient service and Other revenues. The company opened dialysis centers within the United States and acquired centers overseas during the quarter, which was promising. DaVita also recorded per-day increase in total U.S. dialysis treatments for the fourth quarter on a sequential basis.

Price Performance

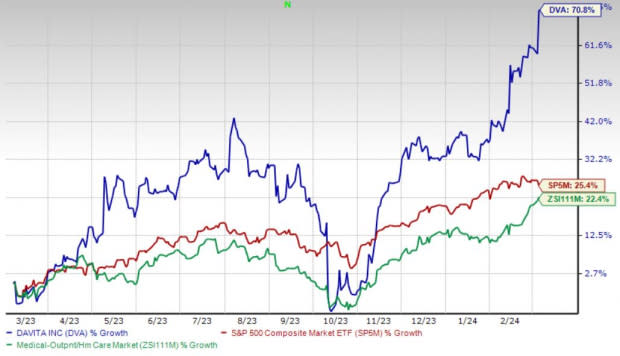

Shares of DaVita have gained 70.8% in the past year compared with the industry’s 22.4% rise and the S&P 500’s 25.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, DaVita flaunts a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks in the broader medical space are DexCom, Inc. DXCM, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DexCom, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 33.1%. DXCM’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 32.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DexCom’s shares have gained 7% compared with the industry’s 10.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 54.8% compared with the industry’s 14% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 53.6% compared with the industry’s 1.1% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance