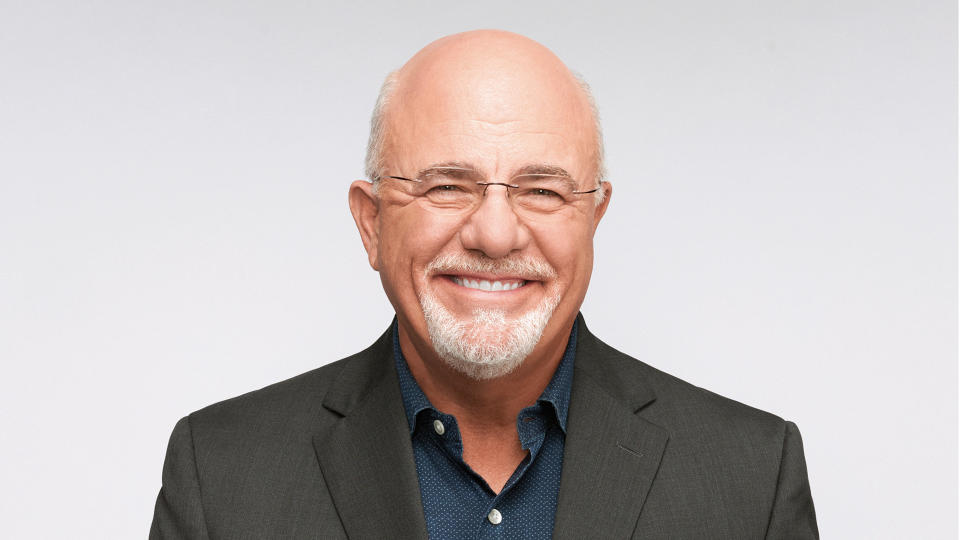

Dave Ramsey’s Frugal Habits: Expert Reveals 3 You Do Not Need To Follow

GOBankingRates recently published an article on the “9 Frugal Habits Dave Ramsey Swears By.” These habits included everything from buying generic products to bringing your lunch from home. While most money experts agree that some of these tips can help save you money, not all of them may be realistic for the average person. In some cases, Ramsey’s advice may be challenging to follow or is too restrictive in real life.

Explore More: I’m a Self-Made Millionaire, but I Still Opt For the Budget Versions of These 6 Items

Find Out: 4 Genius Things All Wealthy People Do With Their Money

We asked Christopher Stroup, a certified financial planner for Abacus Wealth Partners, to provide insight on which of Dave Ramsey’s frugal habits may not be wise to follow. Here are his suggestions of the Dave Ramsey advice you don’t necessarily need to listen to.

Wealthy people know the best money secrets. Learn how to copy them.

Switching Your Cellphone Carrier

When trying to save money, Ramsey frequently tells people to try switching their cellphone carriers. He says you will generally find better deals going through a smaller company but cautions that you should do your research before committing. Most lesser-known companies utilize the cellphone towers of larger companies, meaning you won’t have to settle for less coverage. Switching cellphone companies, however, can be tricky and may not be an option for every person.

Stroup, who is an MBA, EA, CFP®, said that this may not be a realistic option for everyone.

He explained, “The ability to switch cellphone plans and carriers is a luxury that not everyone has access to. For example, rural areas of America often only have one main carrier, which means that there is no competitive market to drive down prices. What you see is what you get if you wish to have cellphone access. If you find yourself in one of those locations, you might be out of luck when it comes to saving money by changing cellphone plans.”

Read Next: 5 Frugal Habits of Mark Cuban

Trying a No-Spend Month

Another money-saving trend that Dave Ramsey regularly recommends to his followers is trying a no-spend month. A no-spend month requires you to not spend any money outside of your necessities, which include your food, utilities, shelter and transportation. No-spend months can be challenging for people to follow because of their restrictions, making it unlikely that they will maintain the budgeting long term.

Stroup noted, “A no-spend month would require an incredible amount of self-discipline that even the most disciplined individuals may struggle to follow. Furthermore, it affords no room for life to throw you a curveball: an unexpected emergency room visit, a flat tire on your car, or some other life event.”

He continued, “Part of your spending plan should focus on accommodating for expenses rather than simply focusing on spending restriction. Too many view budgeting as a restriction exercise when in reality it’s truly our permission slip to spend on what we value most without having to ask for permission.”

Do-It-Yourself

Finally, Ramsey is a firm believer in DIYing or doing it yourself. He frequently advocates not spending money on something or someone if you can do it yourself. Unfortunately, not everyone has the skill set necessary to tackle all projects, and a bad DIY can cost you thousands of dollars. Hiring a professional may actually save you time and money if you are not sure what you are doing and end up getting in over your head on your project.

“Do-It-Yourself is useful if you have the skills and time; however, these are luxuries that not everyone has,” Stroup said. “Sometimes, it can be most cost-effective in the long run to hire an expert to get it done right rather than attempting it yourself to only find that you did it wrong.”

He added, “This is where the concept of value comes into play as it’s not just about the dollars and cents involved. There are times when paying for the expert is often the best move, especially for those tasks that could have a high cost associated with them should you do it wrong like electrical work or maintenance on your car.”

More From GOBankingRates

I'm a Bank Teller: 4 Reasons You Should Withdraw Your Savings Right Now

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Frugal Habits: Expert Reveals 3 You Do Not Need To Follow

Yahoo Finance

Yahoo Finance