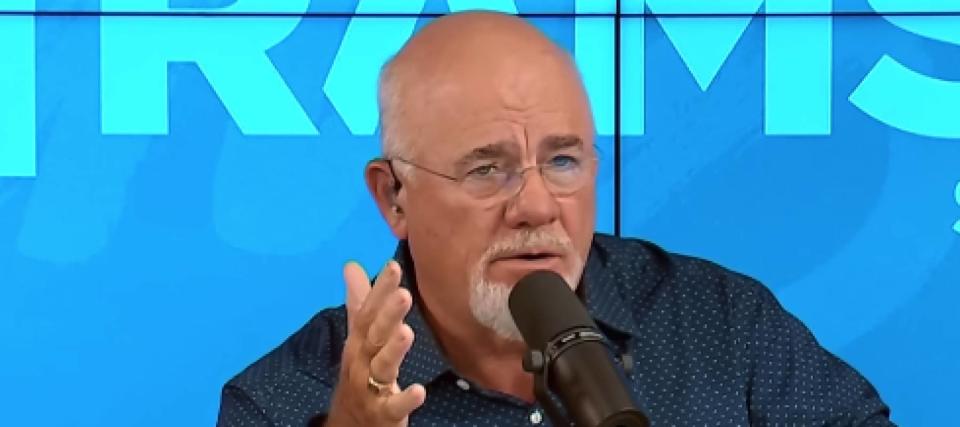

Dave Ramsey crushes 27-year-old Atlanta man's ice business dream — why some opportunities may really be a ‘trap’

Most Americans would agree that your 20s should be a time of new experiences, growth and discovering your career path.

And while it can be the perfect time to take risks and big swings, leaping without a safety net goes beyond just risky — that’s reckless territory. At least, that’s what personal finance celebrity Dave Ramsey recently cautioned 27-year-old Michael.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Michael, from Atlanta, Georgia, finds himself at a crossroads and he called into Ramsey’s show to get some advice. He can either continue working for someone else or dive into small business ownership by purchasing an ice business.

But as Ramsey tells him, he needs to make sure his financial foundation is solid before he can think about building a business — here’s what Michael (and other young Americans in his position) needs to do before he can even think about taking that big step.

Small businesses are work

Michael told Ramsey he was looking for advice on how best to secure the funds to buy out the owner of an ice business he currently works for. But as he explained, the owner has indicated his desire to sell the company within the next two years, which includes a building with existing tenants, for an asking price of $1 million. that he’s looking to take out a $1 million loan to buy a small business.

Michael’s interested in taking over the business but needs the capital to buy it himself.

The hosts were skeptical about Michael’s devotion to the ice business, but he told them he’s happy he was exposed to it so young because he sees great opportunity in the field.

He’s also not technically in a bad place financially — Michael and his wife have worked diligently toward clearing their debts and improving their overall financial standing. But he’s also a 27-year-old still living in his parent's house with no meaningful assets, and so Ramsey doesn’t think he’s prepared to make this step. He went on to talk some sense into Michael, with co-host John Delony backing him up, cautioning Michael this wasn’t an opportunity, rather a “trap.”

“No bank's going to loan you this,” Ramsey bluntly stated. “You don’t have the assets, you don’t have the income — you’re not bankable. Buying and running a small business will take the bone marrow out of you. It'll drain you, it'll squeeze you like yesterday's dish rag, man."

Ramsey’s overall take is that being financially stable and debt-free before deciding to buy and own a small business is absolutely crucial. This is the same advice he’d give to his own son.

“I would say you need a better, stronger personal financial foundation before you start talking about buying and running a small business,” remarked Ramsey. “You got a car payment and you live with your momma. You’re not ready to do it.”

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these assets instead. Get in now for strong long-term tailwinds

Prioritize financial stability

The U.S. Chamber of Commerce reported that there are 33.2 million small businesses in the U.S. Combined, these small businesses account for 99.9% of all U.S. businesses as of 2023 (this is a pretty impressive metric!)

At the same time, roughly half (an astonishing 49%) of U.S. adults admit they wouldn’t be able to cover a $1,000 emergency in cash as of 2023.

One way to fund the purchase of a small business is through an SBA (Small Business Association) loan. They usually range from $500 to $5.5 million. However, they do come with some downsides and risks:

Borrowers are usually required to make a down payment

Borrowers with low credit scores usually won’t qualify

Putting up collateral could be required

There’s typically a slow approval process

You may be personally liable if the business defaults

If you’re looking to join the tens of millions of Americans who’ve made the jump into entrepreneurship, be sure that you’re not among the 49% who can’t afford an emergency expense. Personal financial stability should be of paramount importance before taking on any business venture.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

‘Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

The 5 most expensive mistakes in options trading and how to avoid them

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance