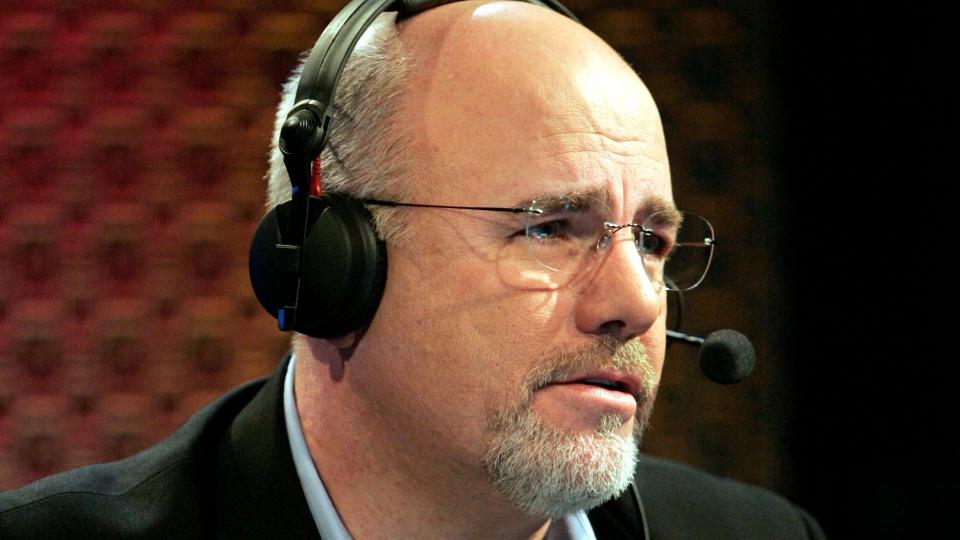

Dave Ramsey: 3 Toxic Financial Habits You Need To Drop Today

Dave Ramsey is a popular financial personality known for not holding back when it comes to describing financial mistakes.

His mission is driven in large part by his own experiences, in which had admittedly made bad choices and ended up having to file for bankruptcy. While Ramsey has numerous videos, web posts and books describing his financial philosophy in detail, he took to X on Nov. 30 to offer a simple three-point overview.

I’m a Self-Made Millionaire: 4 Things To Stop Buying That Are a Waste of Money

More: 3 Things You Must Do When Your Savings Reach $50,000

According to Ramsey, greed, fear and pride are behind all of the toxic financial habits that you need to drop today. Here’s what Ramsey told his followers, along with a look at how these three bad habits leak into specific, real-life examples.

Sponsored: The Results Are In: Is your bank one of the best of the year?

Greed

Ramsey defines the “greed” element as pursuing money above all else to the exclusion of other things that are healthy.

This is different from focusing on your financial life and trying to make it better. In fact, in Ramsey’s own philosophy, it’s important to be obsessive about getting your finances in order, particularly if you are in debt, don’t have an emergency fund and/or have no savings or investments.

But this is not the same as focusing on money as an end in and of itself. Greed for money can lead to making bad choices in other areas of your life, such as neglecting friends and family or even your own health.

I’m a Financial Advisor: Here’s the No. 1 Piece of Advice I Would Give My Younger Self

Pride

As Ramsey uses a Biblically based philosophy to inform his financial advice, it’s perhaps not surprising that “pride” is one of the toxic financial habits he rails against. Ramsey defines financial pride as “…I buy a car to impress someone at a stoplight that I will never meet. Would I buy this if no one ever saw it? That’s your test on the pride button, right?”

In other words, pride is spending your money on things used to impress other people, rather than for their actual value to you.

Fear

For Ramsey, fear is the worst of these three cardinal financial sins. In fact, Ramsey refers to the “fear” portion of his trifecta as “desperation.” As he explains it, “When you get desperate, just about twenty seconds later after I get desperate, I get stupid. And right after I get stupid, I get broke, right? It’s a progressive, causal thing. Desperate leads to stupid leads to broke.”

From a behavioral standpoint, most people can probably relate to Ramsey’s advice. If you’re desperate for money, for example, it’s almost inevitable that you’ll be emotional about your situation. And when people are emotional, they rarely make sound financial decisions.

Common Examples of Toxic Financial Habits

The most obvious place where fear and greed lead to bad financial decisions is the stock market. When the stock market falls dramatically, many people immediately sell their shares out of fear. But then they inevitably miss the recovery that follows, only buying in again when shares go much higher and they are fueled by the greed of rising prices (along with fear of missing out). These types of emotion-based financial decisions can be absolutely toxic.

When it comes to pride, that’s often exhibited in flashier items like cars and homes. Many people overextend themselves when buying these types of items, and that’s simply a bad financial decision. Ramsey urges his followers to think of a car as a transportation device, not something to show off in, and he stresses you must only buy a home that you can truly afford. If possible, Ramsey would like his followers to pay cash for these purchases, especially when it comes to a car.

How To Adopt a New Mindset

If you’re really looking to build long-term wealth, you may have to rewire your thinking. Rather than viewing flashy material objects as ends in and of themselves, think instead of your savings and investments as your golden goose. Ramsey would have you eschew most material goods unless absolutely necessary until you achieve a level of financial freedom, but even if you’re not committed enough to dedicate that type of energy, there are choices you can make in your daily life to strike a balance.

For example, if you’re thinking about buying a piece of jewelry, you don’t have to put a $40,000 diamond-and-gold bracelet on your credit card. Rather, consider a low-cost alternative. This way you can indulge yourself a bit without ruining your financial plan, or falling victim to the “financial pride” that Ramsey warns of. If you think a cheaper item wouldn’t bring you any joy, the answer is to not buy one at all, not to keep spending more and more.

When it comes to investments, always refer back to your long-term plan and what you’re trying to achieve so that you can avoid the paralyzing fear that can cost you opportunities. On the greed side of the spectrum, avoid falling for “get-rich-quick” schemes that promise an easy path to riches. Instead, draft a winning financial plan with long-term, consistent investments and be patient with your results.

In short, follow Ramsey’s advice and stop running your financial life based on greed, pride or fear.

More From GOBankingRates

Grant Cardone Says Passive Income Is the Key To Building Wealth: Here's His No. 1 Way To Get It

Don't Make These Common Mistakes If You Want to Retire Wealthy

This article originally appeared on GOBankingRates.com: Dave Ramsey: 3 Toxic Financial Habits You Need To Drop Today

Yahoo Finance

Yahoo Finance