CyberArk Software And Two Additional Stocks That May Be Trading Below Their Estimated Value On US Exchanges

Amidst a landscape of mixed market performances, with tech giants like Nvidia driving the Nasdaq higher and sectors like housing experiencing downturns, investors are continually on the lookout for opportunities. In this context, identifying stocks that may be trading below their estimated value could present potential investment avenues worth considering.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Noble (NYSE:NE) | $44.74 | $88.07 | 49.2% |

Atlantic Union Bankshares (NYSE:AUB) | $31.03 | $60.73 | 48.9% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.4664 | $32.31 | 49% |

First Internet Bancorp (NasdaqGS:INBK) | $25.02 | $49.48 | 49.4% |

Associated Banc-Corp (NYSE:ASB) | $20.13 | $39.53 | 49.1% |

USCB Financial Holdings (NasdaqGM:USCB) | $11.99 | $23.66 | 49.3% |

AppLovin (NasdaqGS:APP) | $81.21 | $158.73 | 48.8% |

HeartCore Enterprises (NasdaqCM:HTCR) | $0.7081 | $1.41 | 49.7% |

Hesai Group (NasdaqGS:HSAI) | $4.19 | $8.32 | 49.7% |

Transocean (NYSE:RIG) | $5.03 | $9.85 | 48.9% |

We'll examine a selection from our screener results

CyberArk Software

Overview: CyberArk Software Ltd. develops and markets software-based identity security solutions globally, with a market capitalization of approximately $11.28 billion.

Operations: The company generates its revenue primarily from the security software and services segment, which brought in $811.73 million.

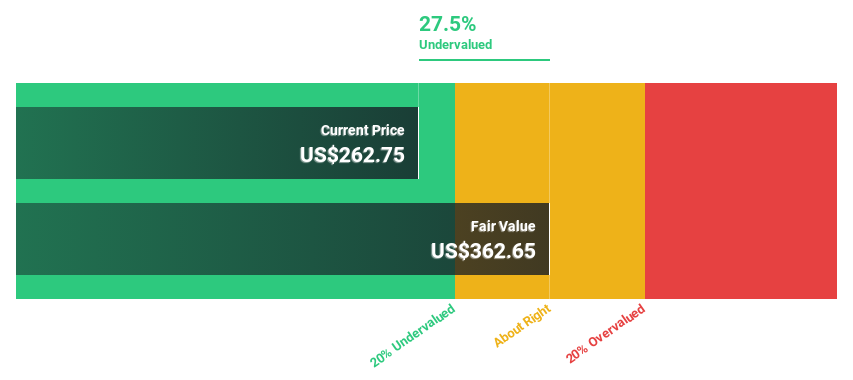

Estimated Discount To Fair Value: 27.5%

CyberArk Software, despite recent shareholder dilution, shows promise based on its cash flows and market position. The company is trading at US$262.75, significantly below the estimated fair value of US$362.65, indicating potential undervaluation. With expected revenue growth at 16.2% annually—outpacing the US market's 8.6%—and a forecasted profit surge of 42.51% per year over the next three years, CyberArk appears strategically positioned for growth. Recent client acquisitions and product enhancements further bolster its competitive edge in identity security solutions.

Zscaler

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $27.37 billion.

Operations: The company generates approximately $2.03 billion from subscription services to its cloud platform and related support services.

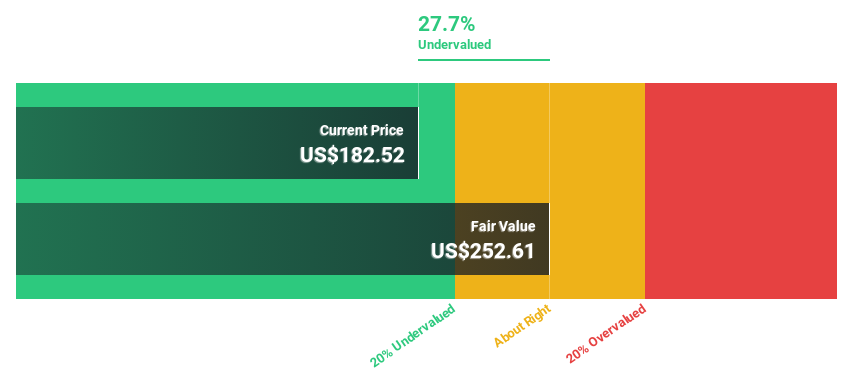

Estimated Discount To Fair Value: 27.7%

Zscaler, recently buoyed by strategic partnerships and product innovations, is trading at US$182.52—27.7% below its estimated fair value of US$252.61. The company's recent earnings turnaround and robust revenue forecasts suggest potential underpricing relative to its cash flows. Analysts project a significant profit increase, with Zscaler expected to become profitable within three years, aligning with an above-market growth forecast in revenue and profits, despite some shareholder dilution over the past year.

Estée Lauder Companies

Overview: Estée Lauder Companies Inc. operates globally, specializing in the manufacturing, marketing, and selling of skin care, makeup, fragrance, and hair care products with a market capitalization of approximately $41.28 billion.

Operations: The company's revenue is segmented into skin care at $7.62 billion, makeup at $4.46 billion, fragrance at $2.55 billion, and hair care at $0.63 billion.

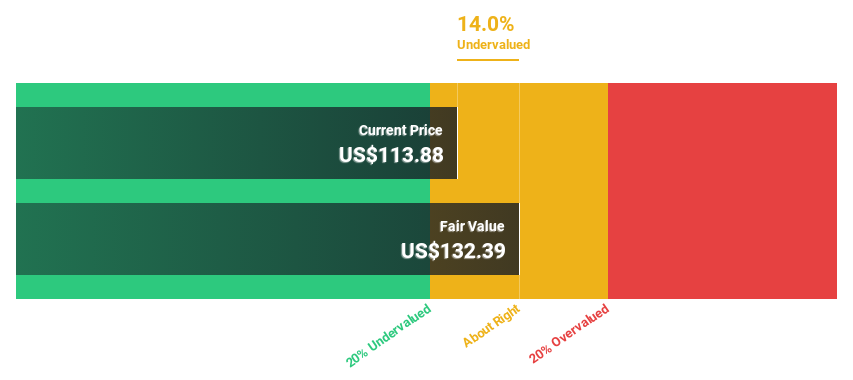

Estimated Discount To Fair Value: 14.0%

Estée Lauder, with a current price of US$113.88, is considered undervalued based on discounted cash flow analysis, showing a gap below the estimated fair value of US$132.39. Despite this, the company faces challenges such as high debt levels and significant insider selling recently. However, Estée Lauder is expected to see substantial earnings growth at 32.93% annually over the next three years, outpacing its revenue growth projections and market averages significantly. Additionally, recent corporate activities include securing a new $2.5 billion credit facility to bolster financial flexibility without immediate borrowing needs.

Where To Now?

Unlock our comprehensive list of 181 Undervalued US Stocks Based On Cash Flows by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CYBR NasdaqGS:ZS and NYSE:EL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance