The cult of Costco: How one of America’s biggest retailers methodically turns casual shoppers into fanatics

On your first visit to a Costco Wholesale warehouse, it’s easy to feel as if the whole experience is designed to haze the newbie.

Sensory overload starts the second you enter the airplane-hangar-size store. The place is packed with people. And do I smell … hot-dog water? (Yes, you do.) The shopping floor is a bewildering jumble of merchandise, much of it stacked high above your head, still in its cardboard boxes. There are virtually no signs to tell you what’s where; you eventually realize that the stuff you came to buy is, of course, all the way in the back.

Once you find the toilet paper and ketchup, you realize it’s mostly packaged in inelegant bulk formats and mega-tubs. Will this even fit in my car? For such a huge place, it doesn’t carry that wide a selection. Really, no sweatshirts in my size? And once you’ve finally fought your way through the throngs to the cash registers? Good Lord, the LINES. It’s like the merch tables at the Eras Tour. With all due respect to your friends who for eons told you you were missing out, you’re second-guessing your decision to become a Costco member.

And yet. You did score those nifty flip-flops you didn’t realize you needed. It’s probably going to be three years before you need to buy ketchup again. The line moved a lot faster than you expected. And considering how full your cart got, your tab was surprisingly low. Hmm. I’m hosting that barbecue next week. Maybe I’ll come back for some garden chairs and pork roast.

Congratulations on your first Costco run—and welcome to the cult.

There is method to the madness here. Warehouses (a.k.a. stores) that seem haphazard and chaotic are in fact run with military precision, and virtually every detail of merchandise selection, store layout, and pricing is designed to turn wary first-timers into loyalists. Charlie Munger, Warren Buffett’s late lieutenant and a longtime Costco board member, famously said that he wished everything in the U.S. ran as well as Costco. Indeed, the company has nailed the science, and art, of retail like virtually no competitor.

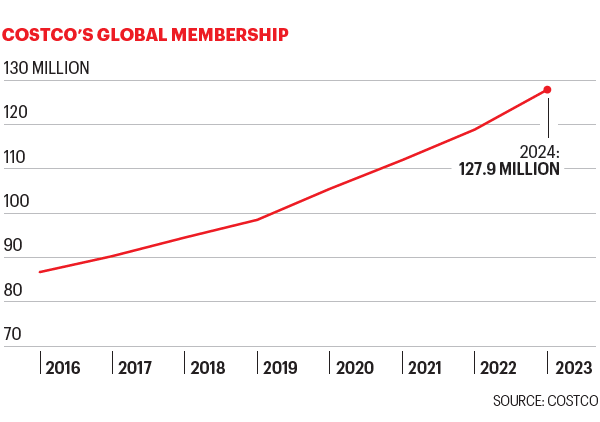

At a time when brick-and-mortar retailers are desperate to lure shoppers, Costco boasts 128 million members worldwide—each paying at least $60 a year for the privilege of visiting the palace of pallets. (Sorry, outsiders: Only members can shop here.) Costco’s eclectic sales assortment—Shrimp cocktail! Khakis! Coffins!—has helped embed it firmly in pop culture. Costco obsessives throng dedicated groups on Instagram, Facebook, Reddit, and X to trade information on a great find, or discuss which celebrity was spotted in which of its 600 U.S. stores, or just to bemoan leaving a store after spending $300 more than they’d intended.

Its distinctive place in the public’s imagination has propelled Costco to tremendous growth. Net sales have risen around 10% annually for the past 35 years, almost three times as fast as overall retail spending over that span. Membership, meanwhile, has risen 50% since 2016—a vital detail, because membership fees drive most of Costco’s profits. Last year the fees amounted to roughly two-thirds of profits, and on several occasions in the past few years, Costco would have reported a net loss without them. Without membership growth, Costco’s bargain, sometimes loss-leading prices—and the clout with suppliers that makes them possible—would be hard to sustain.

“The most important item we sell is the membership card,” says Ron Vachris, Costco’s new CEO as of Jan. 1. “Everything we do supports that transaction.”

That means constantly proving to shoppers that the membership, which costs $120 a year at the higher-rewards Executive level, is worth it. Despite the cult’s devotion, the CEO job isn’t a slam dunk: Vachris’s challenges include figuring out how to better expand the adrenaline rush of a Costco run to e-commerce and to markets outside North America.

But he’s got a winning formula to build on. This spring, Fortune talked with Costco’s management team and dropped in on warehouses across the continent—learning the secrets that keep customers satisfied and make those bewildering warehouses work.

Merchandise magic

At a warehouse near Costco headquarters in Issaquah, Wash., among the first products a shopper encounters are plastic “slide” sandals from sportswear brand 32 Degrees—hundreds upon hundreds of pairs, boxed and stacked in tall rows.

Countless warehouses are selling the same sandals, in the same spot—the area reserved for seasonal and promotional items, which change weekly. As Vachris is pleased to point out, they’re selling like colorful plastic hotcakes. It helps that they were priced at $9.99, well below the $22 or so other retailers charge. That’s no accident, as Vachris animatedly explains. “We ordered 4 million of them in four colors, right?” he says. “Department stores ordered them in 12 colors. But we wanted only four colors and got them to start their machines to make them just for us.”

That’s a typical Costco strategy: Place a huge order with a narrower assortment, so the supplier can make it faster and cheaper. Such orders encourage suppliers to give Costco priority, which comes in handy with seasonal goods, where Costco aims to be “early in, early out”—in this case, selling warm-weather kicks when many markets are still chilly. The upshot: Costco has an eye-catching bargain to put near the door, weeks before other retailers have it.

At the same time, Costco is choosy about what it sells. A typical warehouse offers some 3,800 unique items, called stock-keeping units (SKUs), compared with some 120,000 at a Walmart store. Rather than carry eight different brands of an item in a bunch of sizes, Costco will offer, say, two brands (one of which is often its in-house Kirkland Signature) in two sizes. The idea is to help shoppers escape what psychologists call the tyranny of choice, which can paralyze consumers and lead them to leave a store having bought nothing.

That also means Costco’s buyers—the execs who choose which products get to the store floor—must nail those selection choices. Vachris, 59, knows this from experience. He’s a company lifer, having started as a forklift driver at age 17 in 1982 at a Price Club in Arizona. (Price Club merged with Costco in 1993.) More important, he served for several years as Costco’s head of merchandising—the boss of the buyers.

These merchants know their customers well, relying on in-depth sales data that lets them course-correct quickly. The company also does pilot tests at a handful of stores before a broader rollout. You won’t see a 1.5-pound brick of Parmigiano-Reggiano go national until it’s gone over well in, say, Pittsburgh.

This careful curation builds enormous trust, says Kathy Gersch, a retail specialist and cofounder of consulting firm Kotter International. “People tell themselves, ‘Costco has done the research for me, and they know this is the best one,’ ” she notes.

Sure, the occasional mistake slips through. Kirkland Signature Light Beer, introduced in 2017 and quickly discontinued, was a dud (“the only beer I’ve thrown away,” wrote one Redditor). And about the five-pocket men’s jeans, the less said the better. Still, Claudine Adamo, chief operating officer for merchandising, argues that the occasional flop can be a good thing: “We always say that if you don’t have a bad buy, you’re not trying hard enough.”

The Kirkland line is key to Costco’s merchandising strategy. Launched in 1995 and now including products from dog beds and pork chops to coffee and diapers, it’s Costco’s secret weapon for staying on trend while keeping prices down. With about 550 SKUs, Kirkland merchandise generates roughly 23% of Costco revenue, about $56 billion a year. (Based on those numbers, if Kirkland were its own company, it would be bigger than Nike or Coca-Cola.)

Kirkland allows the retailer to fill “white spaces” in its lineup with a low-priced product, without having to persuade a national brand to sell it under its own name. That said, many big companies do make goods for Kirkland; Costco members are too big a revenue stream to ignore. Costco treats the identities of most suppliers like a state secret. But it’s known that Starbucks makes some Kirkland coffee, while Duracell, Huggies’ parent Kimberly-Clark, and Ocean Spray also reportedly produce Kirkland items incognito.

Analysts believe Kirkland could grow bigger still. But management is vigilant about keeping quality ahead of quantity: Any item added to the Kirkland roster needs signoff from top leadership. “We’re not looking to win a trophy for the highest amount of Kirkland Signature SKUs,” says Adamo. “You build loyalty with that brand.”

Treasure hunting

It was enough to make a skin-care fanatic crash her shopping cart. At a Costco in Astoria, Queens, perched in a personal-care aisle among bulk packs of Irish Spring soap and tubs of Aveeno lotion, was a single jar of Estée Lauder’s La Mer moisturizer.

It’s the kind of luxury item more typically found at Neiman Marcus, where it sells for $600 and up. Costco had it for less, but the savings weren’t really the point. The jar was an effective gambit that Costco has perfected. It had deliberately bought a limited supply, stocking it in just a few warehouses. The idea was to give a handful of members the triumphant sense of finding something truly special. As Adamo explains, “It comes down to the treasure hunt.”

Bulk staples like 48-count packs of batteries may be central to the Costco experience, but company brass understand that staples don’t inspire cultish devotion. They’ve learned that it’s the unexpected finds—that La Mer jar, or dill-pickle-flavored cashew nuts, or trendy new Birkenstocks—that stoke obsession. The “treasure hunt” ethos also explains why Costco has no signs in its aisles flagging product categories; that absence forces shoppers to wander, increasing the chance of shopping serendipity. It pays off: Treasure-hunt buys represent about 15% of what Costco sells, but contribute disproportionately to customer loyalty.

“You never quite know what else you’ll find when you’re there,” says Neil Saunders, a managing director at GlobalData. “And there’s always something where you think, ‘I didn’t even know I needed that.’ ”

One day this spring, the Facebook group Costco Fans Midwest was abuzz after one member, Sophie, found granulated onion—an item missing from the company’s arsenal—in the spice aisle in the Niles, Ill., Costco. “I literally jumped for joy!” she posted. The comments blew up with people asking if anyone had seen granulated onion at their Costco.

The treasure-hunt strategy often goes to the very high-end. Visitors to the Costco in Newark, Calif., last year could stumble across a rare bottle of Screaming Eagle Napa Valley Cabernet Sauvignon for $3,699. Elsewhere, the company has sold a four-bottle set of the rare Burgundian wine Domaine de la Romanée-Conti for $55,000. (Costco is the world’s largest buyer of wine in the $20-a-bottle-and-up range.) On the jewelry side, where Costco’s sales are roughly on par with LVMH’s Tiffany & Co., the in-store assortment can run from $99.99 earrings to $9,000 diamond rings.

While the most expensive items are very much the exception, they help to serve an important purpose: They signal to upper-middle-class shoppers that Costco is for them too. Among the converts to the church are celebrities with the means to shop anywhere: Singer Billie Eilish, for example, has said she uses Kirkland organic peanut butter for her cookies, while Lana Del Rey has called Costco her “happy place.”

Indeed, despite the chain’s reputation for bargains, Costco’s shopper is affluent. The average U.S. Costco member has a household income of $100,000, well above shoppers at Target ($89,400), Sam’s Club ($86,900), and Walmart ($76,300), according to consultancy Kantar Retail. Buying in bulk makes things cheaper on a unit basis but still requires a big cash layout—and it’s hard to do if your abode isn’t big.

That said, well-off members who splurge can still congratulate themselves on their savvy. After all, those thousand-dollar wines are going for hundreds more elsewhere. “That is Costco’s position on everything,” says Saunders. “It’s about offering value for money, whether you’re buying tires [or] a diamond ring.”

Whatever shoppers’ motives, the Costco formula is cultivating loyalty. In the fiscal year that ended last September, membership fees generated $4.6 billion in revenue, and the member renewal rate in the U.S. and Canada was 92.7% (globally it was 90%). Those “stickiness” numbers are encouraging: Costco hasn’t raised membership fees since 2017, but when it does, odds are good that few customers will jump ship.

Back to the warehouse

Once you understand the equation that powers the cult—bargains plus treasure equals fandom—it’s easier to understand how the seeming mayhem turns a Costco warehouse into a cash machine. (The average location generates $270 million in sales annually.)

The strategy begins in the food court, where Costco sells its famous (and fragrant) $1.50 hot-dog-and-beverage combo. That $1.50 price has been in place since 1985, and Costco has vowed to never raise it. Costco’s first CEO, Jim Sinegal, in 2008 jokingly warned his successor, Craig Jelinek, to stick with the price, inflation be damned. “If you raise the effing hot dog, I will kill you,” he said. “Figure it out.” (Jelinek did figure it out, by opening Costco’s own hot-dog-making plant in 2009.)

Costco sells 199 million food-court hot dogs a year, along with an almost equally iconic $4.99 rotisserie chicken. “Both of those items are foundational,” says Richard Galanti, who recently stepped down as chief financial officer: Together they signal that Costco is holding the line on low prices.

Nothing else about a warehouse layout is an accident. Big-ticket items like large TVs and appliances are almost always close to the members’ entrance. The idea is to immediately remind people how quickly a discount can make up for their annual fees, notes Vachris: “You come in and say, ‘Wait, I can recoup my $60 membership with one item?’ ”

You’ll find higher-velocity items like toilet paper, cleaning products, and bottled water near the back, dozens of yards from the entrance. That puts them near the receiving docks, keeping employees from having to continually run back and forth to restock shelves. It also makes it more likely that shoppers will traverse the whole store—increasing the odds of a treasure-hunt moment.

If a Costco store is a touch chaotic, it is almost always tidy. Employees typically start showing up at 4 a.m., six hours ahead of opening, to make sure a warehouse is “showtime ready.” Gersch, the consultant, challenged Fortune to clock how long a piece of clothing would remain unfolded after a shopper tossed it back onto a pile. Sure enough, in Fortune’s multiple observations, it rarely took more than two minutes before a store worker swooped in to neaten up.

Even Costco fans complain about the long checkout lines. But here, too, there’s a system in place. Scanning membership cards at the entrance dissuades shoplifters, but also enables staff to track exactly how many shoppers are present (the typical store gets 350 visitors per hour). That allows warehouse managers to deploy staff from elsewhere to speed up the lines. If shoppers feel like they got through faster than they’d expected, they’re more likely to drive home gratified—building more goodwill for the cult.

"The most important item we sell is the membership card. Everything we do supports that transaction."

Ron Vachris, CEO, Costco

This attention to shopper experience is easier to pull off because Costco’s workforce is unusually stable. Costco pays among the highest wages and benefits in retail. Its hourly average wage is about $26, compared with $18 at Walmart. That keeps turnover low: Costco’s retention rate last year was 90% for staff who’d been there for at least a year. There’s low turnover in the C-suite too. Vachris is only the third CEO in Costco’s 41-year history, and Galanti was CFO for nearly 40 years. (In a rare C-suite hiring of an outsider, Galanti’s successor is Gary Millerchip, previously Kroger’s CFO.)

Digital, and global

Vachris and his team face a challenge that’s substantial, albeit a nice problem to have: With the North American in-store market approaching saturation, where will growth come from next?

E-commerce is one answer. Last year, according to Insider Intelligence, Costco’s online sales were $17 billion, up 8.4% year over year—sizable, but a fraction of Walmart’s or Amazon’s. Costco.com has some advantages over in-store shopping: The product assortment is more than twice what it is in stores at 9,200 SKUs, for example. Moreover, Costco has injected some of its “Wow, this is insane” treasure-hunt sensibility online. Costco.com currently lists a rare Mickey Mantle rookie baseball card from 1951, for example, for $250,000. (On the page showing that listing recently, Costco also recommended a foot massager.)

Still, Costco.com’s tech has some catching up to do with rivals. There’s limited ability to tell whether an item is in stock at a given warehouse, and the search function is wonky. The vibe is very Internet Explorer. Galanti says that a much-needed re-platforming of the site is still not even half done.

Vachris says e-commerce is a priority, but growing online sales won’t come at the expense of the in-store experience. Indeed, brick-and-mortar execution is central to Costco’s next phase of growth: The company is planning a large expansion internationally. It currently has 164 stores outside the U.S. and Canada; Mexico and Japan are its next-biggest markets. But Galanti says that within a few years, new warehouse openings could be split 50/50 between the U.S. and Canada and the rest of the world. That doesn’t seem far-fetched. Thousands of Chinese consumers turned out for the opening days of new warehouses in Shanghai and Shenzhen over the past few months, and about 75% of households in Iceland already have Costco membership.

For Vachris, the former buyer-in-chief, the biggest risk for Costco as it gets bigger wouldn’t be competition. It would be losing sight of what has made it the rare retailer that does what every retailer claims to do: put its customer at the center of everything. “We have to stay as focused as we were when we had 200 warehouses,” he says. “We can’t become arrogant. We can’t become comfortable.” In reaching for greater treasure, in other words, Costco can’t neglect the treasure hunters.

You can buy that at Costco?

Gold Bars

Costco started selling one-ounce 24-karat gold bars in October, for about $2,000 each. It now sells about $100 million worth of them a month, according to Wells Fargo.

Automobiles

Via a partnership with dealers, the Costco Auto Program, the company sells about 500,000 new cars per year. And cars, of course, need fuel: Costco got 13% of its revenue last year from gasoline sales, or about $30 billion.

Jewelry

While its presentation is hardly flashy, Costco moves a lot of bling. It’s the No. 6–ranked jeweler in the U.S. by sales, with revenue comparable to Tiffany & Co. In 2021, Costco sold a $605,999 diamond ring, the company’s priciest item ever.

Wine

Costco is the world’s biggest seller of fine wines. That category starts at around $20 a bottle but can go way up: The retailer is currently listing a 48-bottle collector’s set of Château Haut-Brion, the famed Bordeaux, for $49,000.

This article appears in the June/July 2024 issue of Fortune with the headline "Inside the Cult of Costco."

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance