CTT Systems And Two More Swedish Exchange Stocks Estimated To Be Undervalued

Amidst a backdrop of political uncertainty and fluctuating market indices in Europe, Sweden's stock market presents unique opportunities for investors looking for potentially undervalued assets. Understanding the intrinsic value of stocks and their potential in current economic conditions is crucial when considering investment options.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK55.60 | SEK101.91 | 45.4% |

Boule Diagnostics (OM:BOUL) | SEK10.80 | SEK21.03 | 48.6% |

Alleima (OM:ALLEI) | SEK70.60 | SEK138.44 | 49% |

RaySearch Laboratories (OM:RAY B) | SEK140.00 | SEK279.05 | 49.8% |

Net Insight (OM:NETI B) | SEK5.02 | SEK9.83 | 49% |

Nolato (OM:NOLA B) | SEK58.35 | SEK111.93 | 47.9% |

MilDef Group (OM:MILDEF) | SEK68.50 | SEK131.89 | 48.1% |

Humble Group (OM:HUMBLE) | SEK10.11 | SEK19.48 | 48.1% |

Hexatronic Group (OM:HTRO) | SEK49.85 | SEK98.54 | 49.4% |

Gigasun (OM:GIGA) | SEK3.95 | SEK7.56 | 47.7% |

Let's uncover some gems from our specialized screener

CTT Systems

Overview: CTT Systems AB, based in Sweden, specializes in designing, manufacturing, and selling humidity control systems for aircraft globally, with a market capitalization of approximately SEK 4.37 billion.

Operations: The company generates its revenue primarily from the Aerospace & Defense sector, totaling SEK 314.20 million.

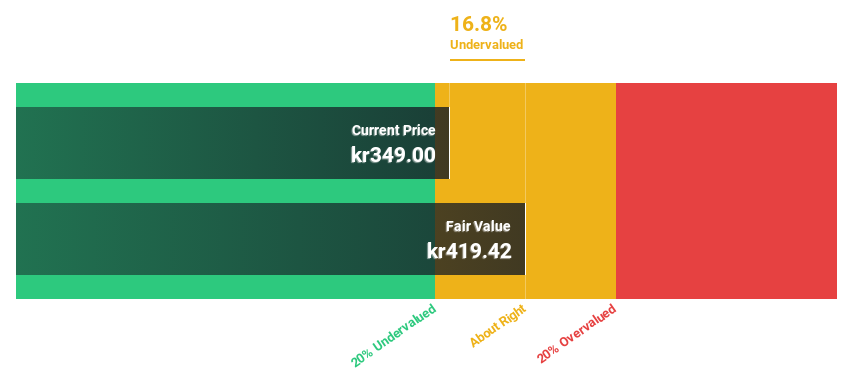

Estimated Discount To Fair Value: 16.8%

CTT Systems, a Swedish company specializing in aircraft cabin humidification systems, appears undervalued based on cash flow analysis. Currently trading at SEK 349, it is below the estimated fair value of SEK 419.42. The company's revenue and earnings are expected to grow significantly, with forecasts suggesting a 20.3% annual increase in revenue and a 21.58% rise in earnings per year. Recent successes include securing deals for their humidifiers with several airlines for new A350s and Boeing 777Xs, indicating potential future revenue streams starting from 2025 onwards. However, its dividend track record remains unstable despite recent increases.

NIBE Industrier

Overview: NIBE Industrier AB specializes in developing, manufacturing, marketing, and selling energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and globally. The company has a market capitalization of approximately SEK 98.26 billion.

Operations: The company's revenue is derived from three primary segments: Stoves (SEK 5.62 billion), Element (SEK 13.62 billion), and Climate Solutions (SEK 36.83 billion).

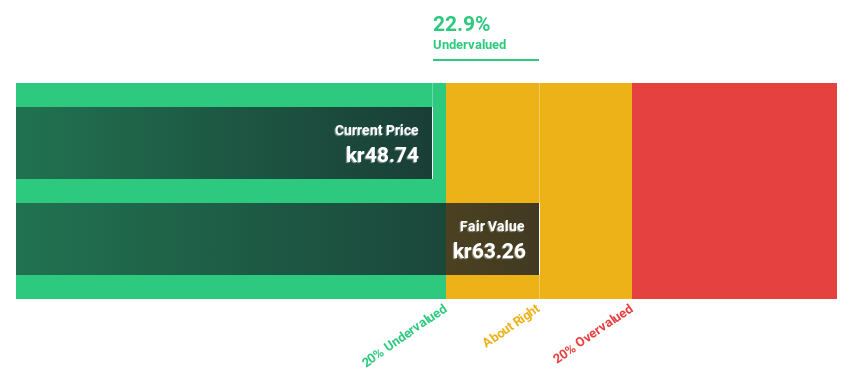

Estimated Discount To Fair Value: 22.9%

NIBE Industrier, priced at SEK 48.74, is considered undervalued with a fair value of SEK 63.26, reflecting a significant discount of 22.9%. The company's earnings are projected to grow by 27.57% annually, outpacing the Swedish market's average. Despite robust profit growth forecasts and favorable revenue comparisons to the market, NIBE faces challenges with lower profit margins year-over-year and debt that isn't well covered by operating cash flow. Recent leadership changes could influence future strategic directions and financial health.

Sweco

Overview: Sweco AB (publ) offers architecture and engineering consultancy services globally, with a market capitalization of approximately SEK 53.86 billion.

Operations: Sweco's revenue is generated from various regional segments, including SEK 8.52 billion from Sweden, SEK 3.94 billion from Belgium, SEK 3.67 billion from Finland, SEK 3.39 billion from Norway, SEK 2.98 billion from Denmark, SEk 2.89 billion from the Netherlands, and SEK 2.62 billion from Germany & Central Europe; other regions contribute smaller amounts.

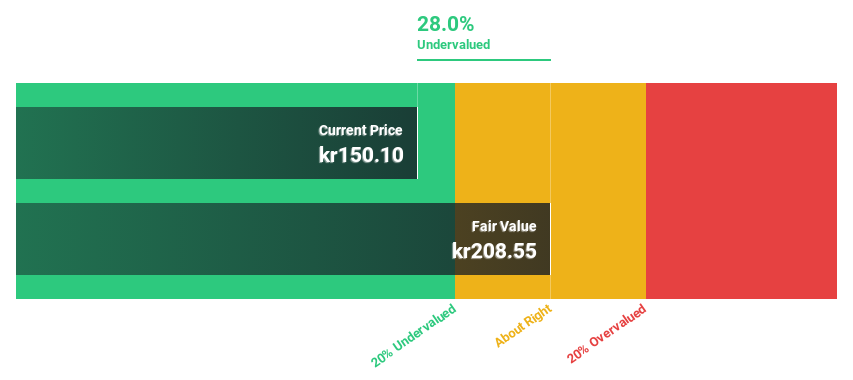

Estimated Discount To Fair Value: 28.0%

Sweco, priced at SEK 150.1, trades below its estimated fair value of SEK 208.55, indicating a substantial undervaluation based on cash flows. Expected to grow earnings by 16.4% annually and revenue by 5.3%, it outpaces the Swedish market forecasts significantly in both areas. However, Sweco has an unstable dividend track record and recent earnings have declined from last year's figures despite robust sales growth in Q1 2024 to SEK 7,720 million from SEK 7,140 million previously. Additionally, Sweco is expanding its role in sustainable energy projects across Europe which may bolster future performance.

Insights from our recent growth report point to a promising forecast for Sweco's business outlook.

Dive into the specifics of Sweco here with our thorough financial health report.

Taking Advantage

Discover the full array of 48 Undervalued Swedish Stocks Based On Cash Flows right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:CTT OM:NIBE B and OM:SWEC B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance