Crypto Crime Hit All-Time High of $20.6B in 2022: Chainalysis

Join the most important conversation in crypto and web3! Secure your seat today

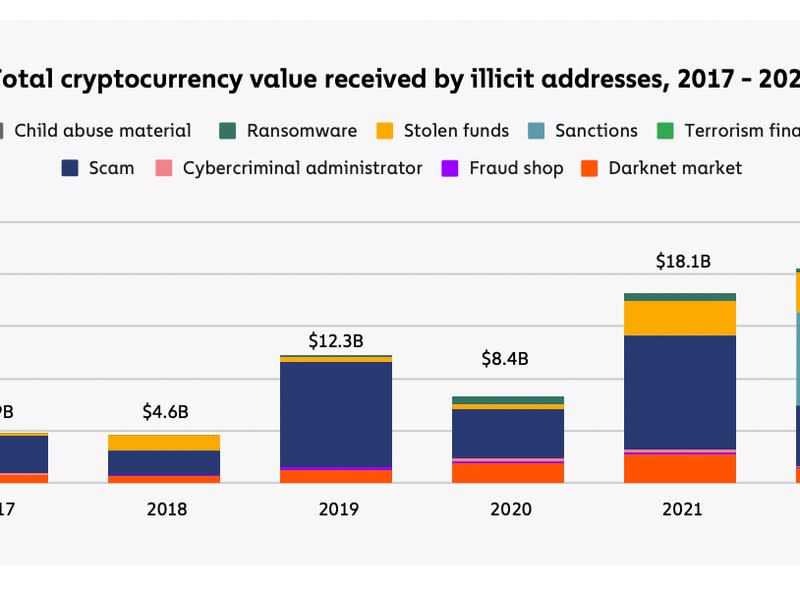

Crypto crime accounted for a record-setting $20.6 billion worth of blockchain transactions in 2022, according to a new report from blockchain research firm Chainalysis.

While other forms of illicit activity may have trended down, “there were two categories that really stood out in terms of their growth, and that’s sanctioned activity and hacking,” Kim Grauer, head of research at the firm, said Monday on CoinDesk TV’s “First Mover.”

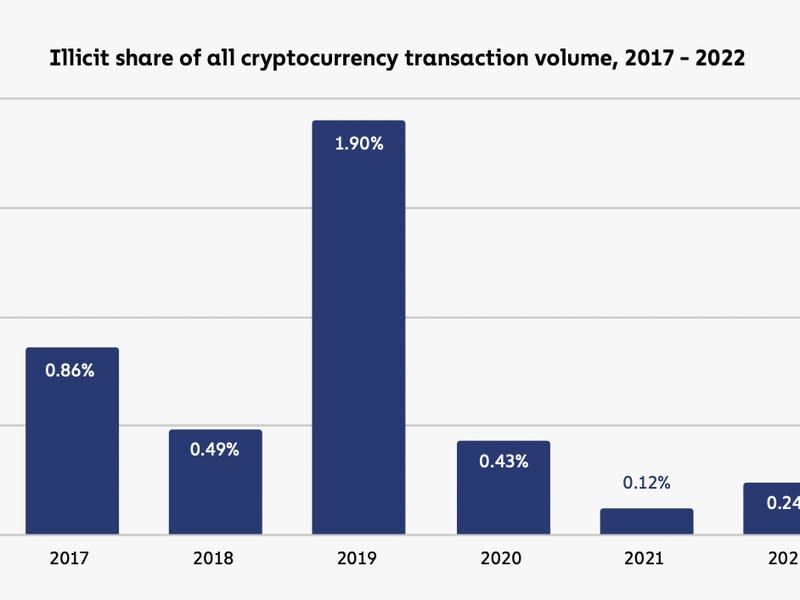

According to the Chainalysis report, criminal activity accounted for 0.24% of all blockchain transactions last year – an increase from the year before of 0.12%. However, crypto crime is “a small share of total volume at less than 1%,” the report found.

Grauer said that after the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) began to crack down on crypto platforms in 2021 rather than singling out crypto addresses of specific bad actors, all transactions done by the platforms that were said to facilitate crimes were counted. With this new categorization, Chainalysis found a majority of the sanctioned activity in 2022 came from funds “flowing to Garantex or other services like that after the designations occurred.”

Garantex is a Russian-based crypto exchange that continues to operate. The exchange had $1.3 billion in inflows through October, following its sanctioning in April, the report found.

When OFAC tried to limit illicit activity on other crypto-based platforms, such Hydra’s darknet market and decentralized mixing service Tornado Cash, the agency’s efforts varied, Grauer said. Its success often depends on the type of entity OFAC is sanctioning and whether users in that jurisdiction care about the sanctions imposed on the platform.

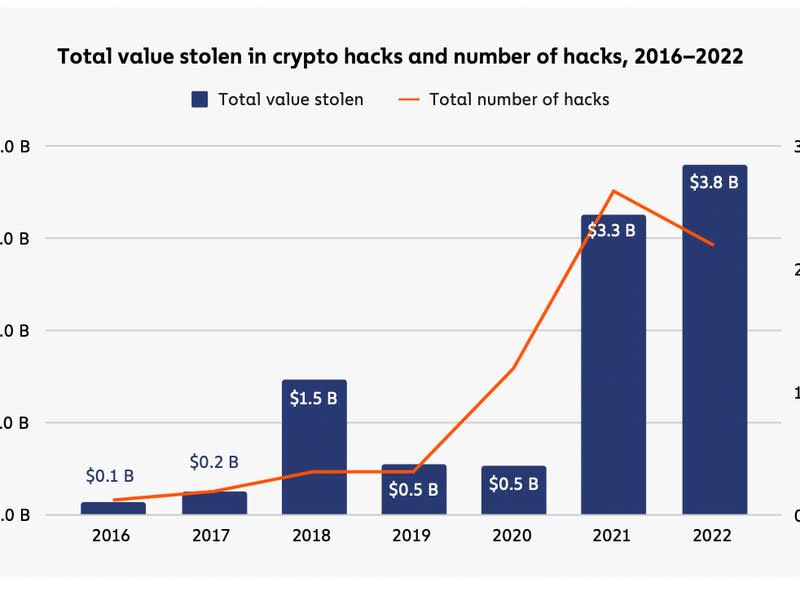

Chainalysis found a significant increase in the amount of funds hacked by North Korean organizations during 2022. North Korean-based cyber criminals hacked $1.6 billion worth of funds, beating their own record from the previous year, Grauer said.

She said it is likely bad actors exploited vulnerabilities of decentralized finance (DeFi) protocols. In 2022, $3.8 billion worth of crypto was stolen from DeFi protocols, an increase from $3.3 billion stolen the year prior.

“We can’t continue to have this rate of hacking,” Grauer said, “because it just really undermines trust in the ecosystem.”

Read more: Sanctioned Mixer Blender Re-Launched as Sinbad, Elliptic Says

Yahoo Finance

Yahoo Finance