Consolidated Edison, Inc.'s (NYSE:ED) Low P/E No Reason For Excitement

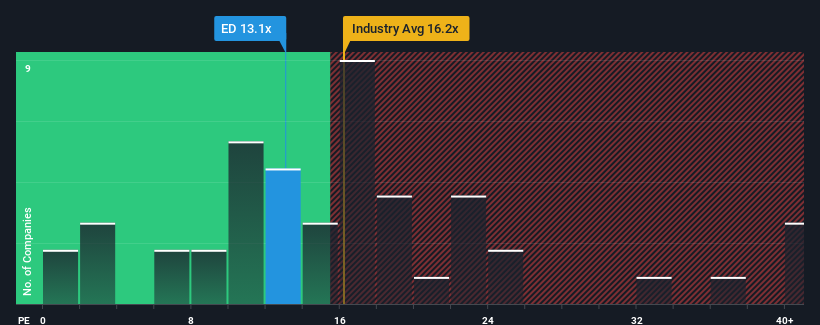

With a price-to-earnings (or "P/E") ratio of 13.1x Consolidated Edison, Inc. (NYSE:ED) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Consolidated Edison as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Consolidated Edison

Keen to find out how analysts think Consolidated Edison's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Consolidated Edison's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Consolidated Edison's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 42% last year. The strong recent performance means it was also able to grow EPS by 70% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings growth is heading into negative territory, declining 4.7% each year over the next three years. That's not great when the rest of the market is expected to grow by 12% per year.

With this information, we are not surprised that Consolidated Edison is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Consolidated Edison maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Consolidated Edison (2 are potentially serious!) that you should be aware of.

Of course, you might also be able to find a better stock than Consolidated Edison. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance