ConocoPhillips (COP) Signs Agreement to Deliver LNG to Germany

ConocoPhillips COP signed two agreements to purchase liquefied natural gas (LNG) from QatarEnergy and supply it to Germany for at least 15 years.

This represents the first-ever long-term supply deal to deliver LNG to Germany, contributing to the largest European gas-consuming nation’s energy security.

Per the deal, ConocoPhillips would purchase 2 million tons (Mt) of LNG per year for 15 years, starting in 2026. COP will deliver it to an onshore receiving terminal, which is currently under construction in Brunsbuttel, northern Germany.

The LNG volumes will be obtained from Qatar’s North Field East (“NFE”) and North Field South (“NFS”) projects. Once online, the projects are expected to boost Qatar’s LNG export capacity to 126 Mt from the current 77 Mt. ConocoPhillips holds 3.125% and 6.25% interests in the NFE and NFS projects, respectively.

The agreements came as Europe looks to replace Russia gas supplies after sanctions were imposed against Russia. Germany, which is Europe’s biggest importer of Russia gas, has not received any LNG since August. LNG demand has become robust since Russia gas constitutes 40% of the continent’s imports.

As European countries supported Ukraine after Russia’s aggressive invasion, Moscow reduced natural gas supplies used for heating homes, generating electricity and powering industry. This led to an energy crisis, fueling inflation and increasing pressure on companies.

Germany is manufacturing five LNG terminals as part of plans to replace Russia supplies, with the first expected to become operational shortly. Most of Germany’s current gas supply comes from or through Norway, the Netherlands and Belgium.

The latest agreements will provide an attractive LNG offtake solution and reliable sources of LNG supplies into Europe.

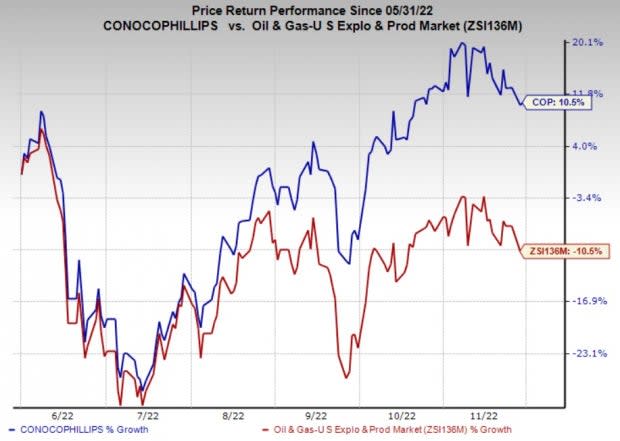

Price Performance

Shares of COP have outperformed the industry in the past six months. The stock has gained 10.5% against the industry’s 10.5% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ConocoPhillips currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following stocks that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Petrobras PBR is one of the largest publicly-traded Latin American oil companies, which dominates Brazil’s oil and gas sector. PBR’s third-quarter 2022 earnings per ADS of $1.35 beat the Zacks Consensus Estimate of $1.32.

Petrobras is expected to see an earnings surge of 135.3% in 2022. In further good news for investors, Petrobras plans to pay RMB 43.7 billion or $8.5 billion in total dividends in 2022.

Equinor ASA EQNR is one of the premier integrated energy companies in the world. EQNR’s third-quarter 2022 adjusted earnings per share of $2.12 beat the Zacks Consensus Estimate of $1.78.

Equinor is expected to see an earnings surge of 133.8% in 2022. For the third of 2022, Equinor’s board increased its extraordinary cash dividend to 70 cents per share from 50 cents per share for the previous quarter. This reflects the firm’s strong commitment to returning capital to shareholders.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX is expected to see an earnings rise of 29.7% in 2022. MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents. The distribution will be paid out on Nov 22, 2022, to common unitholders of record as of Nov 15, 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance