Concurrent Technologies Plc's (LON:CNC) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Concurrent Technologies' (LON:CNC) stock is up by a considerable 22% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Concurrent Technologies' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Concurrent Technologies

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Concurrent Technologies is:

11% = UK£3.9m ÷ UK£35m (Based on the trailing twelve months to December 2023).

The 'return' is the yearly profit. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Concurrent Technologies' Earnings Growth And 11% ROE

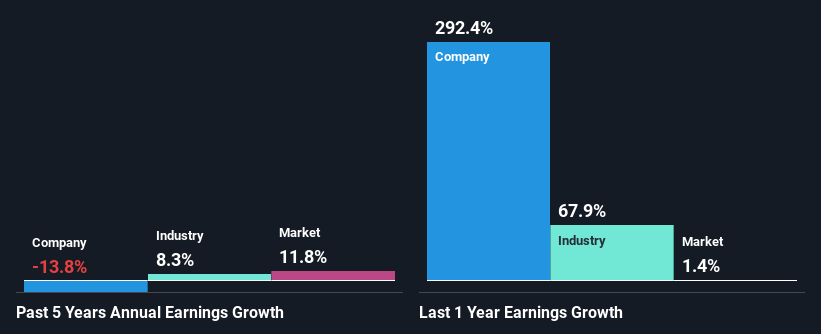

To start with, Concurrent Technologies' ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 9.5%. However, while Concurrent Technologies has a pretty respectable ROE, its five year net income decline rate was 14% . We reckon that there could be some other factors at play here that are preventing the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

However, when we compared Concurrent Technologies' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 8.3% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Concurrent Technologies is trading on a high P/E or a low P/E, relative to its industry.

Is Concurrent Technologies Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 62% (implying that 38% of the profits are retained), most of Concurrent Technologies' profits are being paid to shareholders, which explains the company's shrinking earnings. With only very little left to reinvest into the business, growth in earnings is far from likely. To know the 2 risks we have identified for Concurrent Technologies visit our risks dashboard for free.

In addition, Concurrent Technologies has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 21% over the next three years.

Summary

In total, it does look like Concurrent Technologies has some positive aspects to its business. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Concurrent Technologies' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance