'A concerning trajectory': Texas got slammed for acting ‘like California' and micromanaging private business — is the Lone Star State going down a 'disastrous' path?

A public policy expert has slammed Texas lawmakers for taking a leaf “right out of the California playbook.”

“The fight over environmental and social governance (ESG) policy has gotten so out of control that Texas is seemingly trying to emulate California,” according to Brandon Arnold, EVP of the National Taxpayers Union, a fiscally conservative taxpayer advocacy organization.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Take control of your finances in 2024: 5 money moves to start the new year off strong

“The Lone Star State — a great economic success story — is now trying to engage in the concerning practice of micromanaging private businesses,” he wrote in an opinion piece, published by Fox News.

Is he right that America’s two most populous states — and polar opposites in politics — actually have more in common that their lawmakers would like to admit?

California’s ‘expansive regulations’

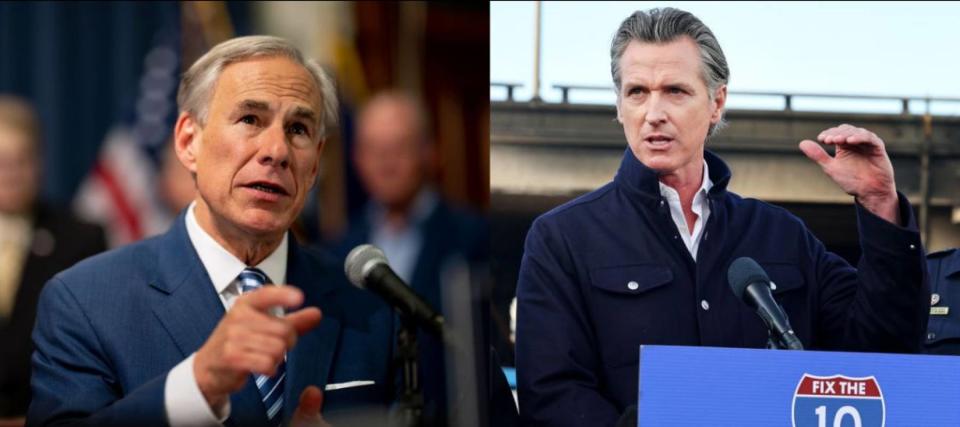

California and the state’s democratic governor, Gavin Newsom, have been loud and clear on where they stand in the ESG culture war.

In Oct. 2023, California gov. Newsom signed two watershed climate bills into law, which will require large corporations operating in the Golden State to disclose their carbon footprints and their climate-related financial risks, starting in 2026.

He has also been a public supporter of ESG investing and has taken legal action against energy giants — including California-based Chevron — for allegedly misleading the public and downplaying how fossil fuels are contributing to climate change.

Newsom’s climate policies have come under fire on several fronts for reportedly making the nation’s most populous state a tricky place to do business and a risky state to invest in — both things that impact local taxpayers.

While Texas’ politics is on the opposite side of the spectrum, is the Lone Star State edging down the same “dangerous path,” as Arnold put it, of “exceedingly high taxes and expansive regulations?”

Read more: Retire richer — why people who work with a financial advisor retire with an extra $1.3 million

Texas’s war on ESG

Texas currently has no state income tax and is therefore unlikely to match California’s sky-high tax rates any time soon — but Arnold believes Texas Republicans are guilty of “implementing California-style … restrictions on businesses in the next culture war front.”

One example he refers to is the Lone Star State’s “blocking” of certain financial corporations from participating in a huge municipal bond deal — all because of their ESG policies.

In Oct. 2022, the state dropped UBS Group AG from its biggest-ever municipal bond transaction because of its alleged attempts to “boycott” the fossil-fuel industry. Four months later, Citigroup was dropped from the same $3.4 billion deal after Texas attorney general, Ken Paxton, found the firm “discriminates” against the firearms industry.

Texas has also voted to enact Senate Bill 833 in June 2023, which aims to stop insurance companies in the state from using ESG models, scores, factors or standards to set rates. And back in 2021, it passed Senate Bill 13, an anti-ESG investing bill that challenges the boycott of fossil fuels by global financial companies.

While Texas and California have very different stances on the matter of ESG guidelines, what Arnold takes issue with is states forcing businesses to take political positions one way or another.

“No matter what you think about ESG, this will cost taxpayers millions of dollars, as it will reduce competition and raise the interest costs that taxpayers must shoulder,” Arnold wrote. “Stuck in the middle, as usual, are taxpayers who have to foot the bill for this back-and-forth battle.”

What to read next

This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

The US dollar has lost 87% of its purchasing power since 1971: Learn how to diversify your portfolio by investing in the world’s most popular precious metal

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance