Companies need a new playbook for M&As in the energy transition: Bain & Co

Within energy and natural resources, divestitures activity totaled US$250 billion for the first nine months of 2022.

Acquisitions to advance an energy transition represented 27% of all deals in energy and natural resources (ENR) last year. This comes at a time when ENR companies are more flush with cash than any other industry, says Bain & Company.

Portfolio rebalancing in the ENR sector will accelerate in 2023 and the coming years, says the global consultancy in its fifth annual Global Mergers & Acquisitions (M&A) Report, published Jan 31.

The key, however, is in turning these acquisitions to profitability and fit with the acquiring company.

Global M&A value dropped dramatically in 2022, with a 36% loss in deal value. For this year’s analysis, Bain’s research reviewed the financial performance and M&A activity of 2,845 publicly-listed companies.

Within the ENR sector, divestitures activity totaled US$250 billion ($329.31 billion) for the first nine months of 2022.

“That is more than any other industry, as the race to divert away from carbon-heavy assets continues,” say Bain’s Whit Keuer and Arnaud Leroi.

Enel, a global energy company based in Italy, recently announced plans to sell assets valued at US$21.5 billion, representing 15% to 20% of the company’s enterprise value. The move was part of a strategy to streamline its business and push electrification across the full value chain in Europe, the US and Latin America, as well as to cut debt, says Bain.

In oil and gas, TotalEnergies is spinning off its Canadian oil sands operations and plans to list the new company on the Toronto Stock Exchange. “The assets simply don’t fit with the company’s new low-emissions strategy,” adds the consultancy.

Scale deals vs scope deals

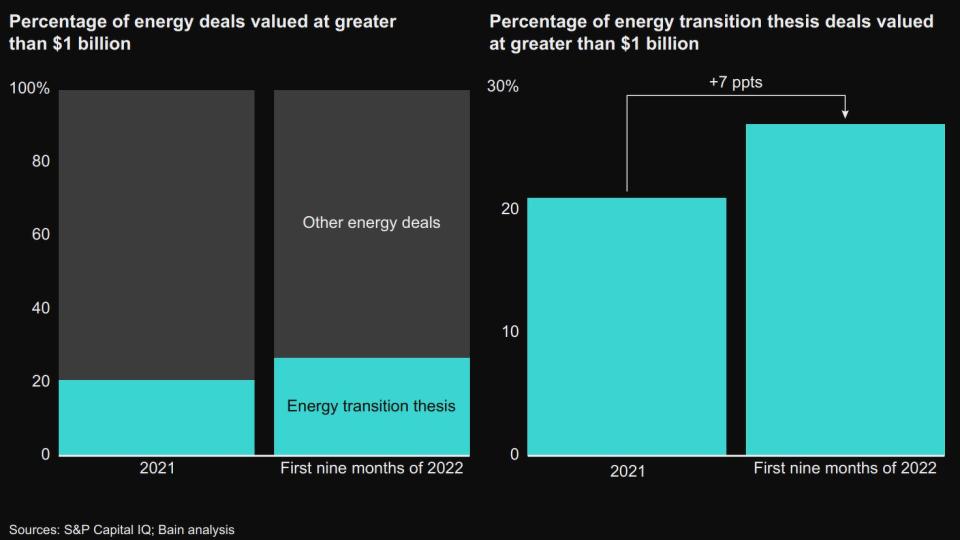

While these spin-offs are happening, acquisitions related to the energy transition as a percentage of ENR deal volume are steadily growing, from 21% in 2021 to 27% at 9M2022.

This comes at a time when ENR companies are flush with more cash than any other industry — totalling US$300 billion — and this will fuel their investments in the energy transition.

In the Bain M&A Practitioners’ 2023 Outlook Survey, 72% of energy and natural resources respondents said the most common investment thesis will be either expanding into new areas of business or building new engines of growth.

The new wave of M&A in ENR is becoming more competitive and has a different risk/return profile than previous deals, say Keuer and Leroi.

According to Bain, scale deals succeed based on rapid overall integration, capture of cost synergies and full cultural integration.

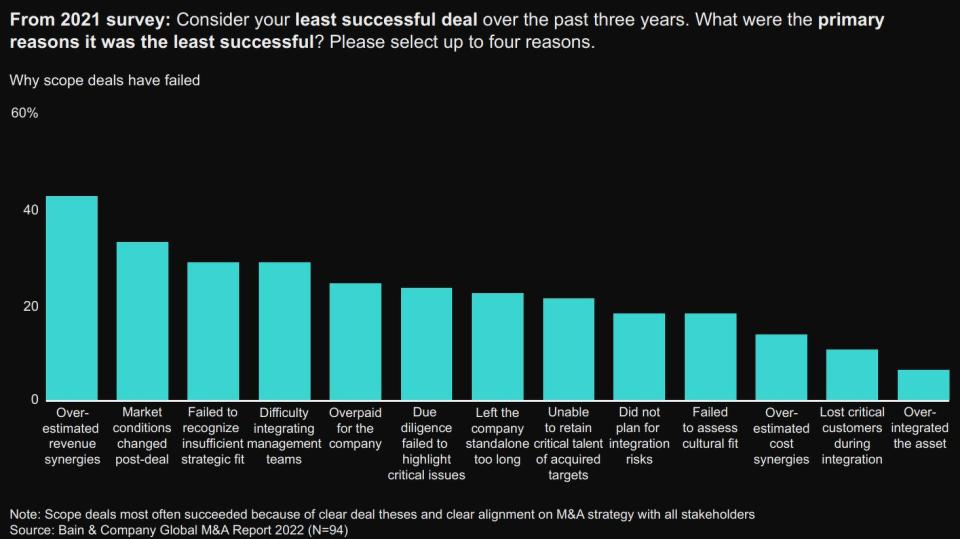

Scope deals, however, require a much more tailored approach when it comes to deciding what to preserve, what to integrate and how to evolve the business strategy to make the most of the acquirer’s core strengths.

‘A wider range of outcomes’

While returns from scope deals can be comparable to scale deals, there is a much wider range of outcomes, warns Bain.

Three features of scope deals make them more difficult, say Keuer and Leroi.

By definition, scope deals occur outside the acquirer’s core business, geographies or competencies. “The risk is that the acquirer stumbles as it learns to manage an unfamiliar business, they note.

Scope deals also often involve finding and knitting together new capabilities that serve as the source of competitive advantage, they add. “This requires the acquirer to think several steps ahead and identify other potential businesses and companies to bolt on to the one currently being acquired.”

More aggressive acquirers are even willing to incorporate anticipated synergies from future acquisitions into the purchase price of their initial deals, write Keuer and Leroi.

Finally, scope deals are typically aimed at generating revenue synergies, which inherently come with more risk and less control than cost synergies, they add. “In scale transactions, companies are selling into familiar territory, often global commodity markets with established supply and demand patterns; in scope deals, customer needs and market dynamics are not as well-known.”

The new M&A playbook

Energy companies are relatively less experienced in energy transition scope deals than scale deals. But ENR industry dealmakers can learn from what works in other industries, say Keuer and Leroi.

Firstly, reimagine your entire M&A process, say Bain’s experts. “Every element of the deal cycle, from M&A strategy to deal thesis to diligence and valuation to merger integration, must be managed differently. The starting point is a rigorous due diligence process.”

Secondly, build an integrated value chain to deliver energy transition products and services, they add. “Too many scope deals become one-off acquisitions as companies hope to gain access to new profit pools or high-growth markets but then fail to build out a complete portfolio.”

Bain raises the example of Shell, which is building out its footprint of electric vehicle (EV) charging stations globally.

Shell acquired Greenlots, which provides a software operating platform for EV charging companies that includes real-time charger health status, utilisation data, dynamic pricing capabilities and predictive analytics. Shell also bought a minority stake in microgrid developer GI Energy.

Shell has an integrated oil and gas value chain that extends from production, refineries, pipelines and ultimately through its retail gas stations, note Keuer and Leroi. “These recent EV-related acquisitions in combination show how Shell is following a similar integrated value chain approach, this time for renewable power generation all the way through delivery to the ultimate end user.”

Finally, start with a clear integration thesis, and integrate where it matters, says Bain. “Scope deals succeed when the acquirer preserves the unique attributes of the company it has just bought, integrating the two only where it matters — as well as when the two businesses begin to cross-pollinate, creating platforms for future growth.”

As the industry turns to M&A to speed the energy transition, companies that achieve the most success will be those that acknowledge how different these deals are from the traditional scale deals that proliferated in their industry for decades, write Keuer and Leroi. “They will master a new playbook, one that is thoughtfully revised for this time of historic possibilities.”

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Sats shareholders approve WFS acquisition, projected to be completed by April 2023

CGS-CIMB lowers target price on Sats after WFS funding plan revealed

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance