This Combination of 3 Stocks Provides Monthly Income

Receiving steady dividend payouts is always a great feeling, as paydays are always the best. Of course, most dividends are paid quarterly.

However, by targeting companies that pay out dividends in different months, investors can construct a portfolio that allows them to get paid monthly.

For example –

The first stock pays dividends in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

As we can see, this type of portfolio would undoubtedly be attractive to income-focused investors.

Interestingly enough, three stocks – Cardinal Health CAH, AbbVie ABBV, and Archer Daniels Midland ADM – would allow investors to reap a monthly income. Let’s take a closer look at each one.

Cardinal Health

Cardinal Health is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. The company’s dividends are paid in January, April, July, and October.

The stock is currently a Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year particularly notable, up 15% over the last year and suggesting year-over-year growth of 20%.

Image Source: Zacks Investment Research

CAH shares presently yield a solid 1.9% annually paired with a sustainable payout ratio sitting at 32% of its earnings. The company has long displayed a shareholder-friendly nature, further reflected by its inclusion into the elite Dividend Aristocrats group.

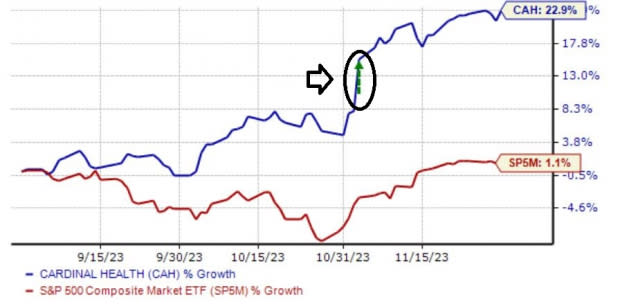

In addition, it’s worth noting that CAH shares have been big-time outperformers as of late, up nearly 23% over the last three months and seeing notable buying pressure following its latest quarterly release.

Image Source: Zacks Investment Research

Concerning the release, Cardinal Health exceeded the Zacks Consensus EPS Estimate by 23% and posted a modest revenue surprise, with both items showing notable growth relative to the year-ago figures. And to top off the results, the company raised its FY24 guidance, now expecting diluted EPS in a band of $6.75 - $7.00 (previously $6.50 - $6.75).

AbbVie

AbbVie enjoys leadership positions in key therapeutic areas, including immunology, hematologic oncology, neuroscience, aesthetics, eye care, and women’s health. The company currently holds the rank of a Dividend King, showing an unparalleled commitment to shareholders.

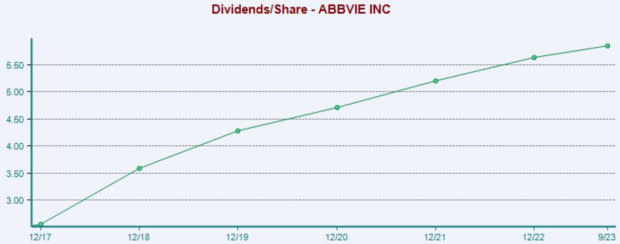

ABBV shares yield a sizable 4.3% annually, well above its respective Zacks – Large Cap Pharmaceutical industry average of 2.2%. The company has increased its payout six times over the last five years, translating to a solid 9.1% five-year annualized dividend growth rate.

Please note that the chart below is on an annual basis. ABBV pays dividends in February, May, August, and November.

Image Source: Zacks Investment Research

The company jumped into the news recently following the announcement of an acquisition of ImmunoGen and its flagship cancer therapy, ELAHERE. The acquisition is expected to accelerate AbbVie’s entry into the commercial market for ovarian cancer, anticipated to close in the middle of 2024 and valued at roughly $10.1 billion.

Archer Daniels Midland

Archer Daniels Midland is one of the leading producers of food and beverage ingredients and goods made from various agricultural products. The company’s dividends are paid in March, June, September, and December.

Like CAH, analysts have been notably bullish surrounding its current year outlook, with the $7.26 Zacks Consensus EPS Estimate up 14% over the last year.

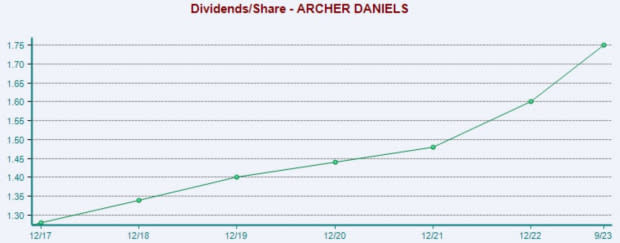

Image Source: Zacks Investment Research

ADM shares presently yield 2.5% annually, with the payout growing by 6% annualized over the last five years. The company is also a member of the Dividend Aristocrats club.

Image Source: Zacks Investment Research

Bottom Line

Dividends provide a nice boost, limiting the impact of drawdowns in other positions and providing passive income.

And if investors select their stocks in a structured manner, they can create a portfolio that pays them monthly.

When combined, all three stocks above – Cardinal Health CAH, AbbVie ABBV, and Archer Daniels Midland ADM – construct a portfolio that allows monthly income.

In addition, all three have consistently boosted their payouts over the years, providing investors with strong reliability.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance