Cognizant (CTSH), TDECU Team Up for AI-Driven Transformation

Cognizant Technology Solutions CTSH recently announced a new agreement with Texas Dow Employees Credit Union (TDECU), the largest credit union in Houston and the fourth largest in Texas, to accelerate its ‘Run the Business’ transformation journey.

As part of the collaboration, Cognizant will deploy its Neuro IT Operations platform, an AI-driven automation solution, to transform TDECU’s enterprise infrastructure and technology, boosting operational efficiency and resilience while generating substantial cost savings over the next five years.

The partnership will also enhance TDECU’s data and testing capabilities, supporting the credit union’s roadmap to deliver innovative products and services more swiftly to its members, ultimately reducing time-to-market and improving customer experience.

Cognizant’s global expertise in modern technologies and AI tools such as Neuro AI and Flowsource will help the collaboration aims to drive innovation, improve productivity and enhance the member experience.

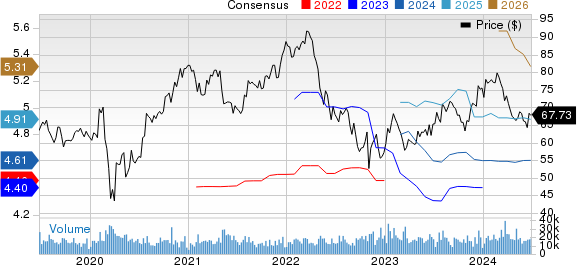

Cognizant Technology Solutions Corporation Price and Consensus

Cognizant Technology Solutions Corporation price-consensus-chart | Cognizant Technology Solutions Corporation Quote

Cognizant’s Prospects Driven by Strong Partner Base

Cognizant’s robust partner base, which includes the likes of Cengage Group, Gentherm THRM, Shopify SHOP and Alphabet’s GOOGL cloud business, Google Cloud, has been a key catalyst. Its robust pipeline, which includes a favorable mix of new opportunities, is noteworthy.

In first-quarter 2024, CTSH demonstrated significant improvement in securing large deals, winning several contracts worth more than $100 million each.

Cognizant recently collaborated with Gentherm to provide engineering services, including systems engineering, validation, and model-based development, aiming to enhance agility and scalability in product development through cloud-native technologies and virtualization.

Its partnership with Shopify and Alphabet’s Google Cloud bolstered its presence within the retail industry to drive digital transformation and platform modernization for global retailers and brands, focusing on leveraging the power of Shopify’s commerce platform, Google Cloud’s infrastructure and Cognizant’s retail industry expertise.

Acquisitions have also strengthened Cognizant’s digital capabilities and clientele. In first-quarter 2024, acquisitions contributed 70 basis points (bps) to top-line growth.

CTSH recently announced the acquisition of Belcan, for approximately $1.3 billion in cash and stock, significantly expanding its Engineering Research & Development (ER&D) capabilities and establishing a leadership position in the aerospace & defense industry.

CTSH Q2 Performance Not So Rosy

Despite an expanding clientele and strong partner base, a challenging macroeconomic environment, along with weakness in the Financial Services segment, is a concern for CTSH’s prospects.

In first-quarter 2024, Financial Services revenues declined 6.2% year over year to $1.38 billion.

Cognizant’s shares have declined 10.3% against the Zacks Computer & Technology sector’s growth of 24.9% year to date.

This Zacks Rank #3 (Hold) company expects second-quarter 2024 revenues to be between $4.75 billion and $4.82 billion, indicating a decline of 2.9% to 1.4% (a decline of 2.5-1% at constant currency). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the second quarter is pegged at $4.81 billion, indicating a decline of 1.63% from year-ago levels.

The consensus mark for earnings is pegged at $1.12 per share, unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Gentherm Inc (THRM): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance