Cognizant (CTSH) Rides on Expanding Clientele, Partner Base

Cognizant Technology Solutions CTSH is benefiting from an expanding clientele and strong partner base. Its robust pipeline, which includes a favorable mix of business renewals and expansions of new opportunities, is noteworthy.

The upside is further bolstered by CTSH’s continued improvement of large deal momentum, evidenced by winning several deals exceeding $100 million each in first-quarter 2024. It expects the NextGen initiative to help expand margins in the long haul.

Building on this momentum, the company recently announced its collaboration with a leading provider of digital experience management solutions, Nexthink, to transform digital enterprise operations.

Through this partnership, Cognizant’s WorkNext platform will merge seamlessly with Nexthink’s flagship product, Nexthink Infinity, to introduce the new joint offering, Cognizant WorkNEXT Workplace Intelligence.

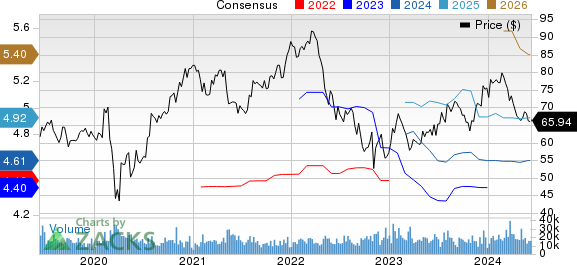

Cognizant Technology Solutions Corporation Price and Consensus

Cognizant Technology Solutions Corporation price-consensus-chart | Cognizant Technology Solutions Corporation Quote

Cognizant WorkNEXT Workplace Intelligence solution is poised to redefine the traditional approach to digital workplace support by delivering a comprehensive ‘Total Experience’ for clients across various industries.

With a focus on intelligence-driven IT support, the offering encompasses features such as experience observability, predictive intelligence, user engagement and automated self-heal capabilities.

Expanding Clientele Boosts Prospect

The latest move bodes well with Cognizant’s commitment to driving digital transformation and delivering value-added solutions tailored to the evolving needs of enterprise clients.

CTSH’s robust partner base, which includes the likes of Microsoft MSFT, Shopify SHOP and Google Cloud, and Fair Isaac FICO, has been a key catalyst.

Cognizant, in collaboration with Microsoft, announced an expanded partnership in April. It aims to leverage generative AI and Copilots to drive innovation across industries, focusing on transforming enterprise operations and enhancing employee experiences.

Collaborations with Shopify and Google Cloud have strengthened CTSH’s position in the retail sector, enhancing digital transformation and platform modernization for international retailers and brands. This partnership leverages Shopify's commerce platform, Google Cloud’s infrastructure and Cognizant’s retail industry expertise.

CTSH also announced a collaboration with FICO in April to launch a cloud-based real-time payment fraud prevention solution, boosting security in North America's digital payments landscape.

Conclusion

Despite an expanding clientele and strong partner base the challenging macroeconomic environment, along with weakness in the Financial Services segment, is a concern for CTSH’s prospects.

In the first quarter of 2024, Financial Services revenues decreased 6.2% year over year to $1.38 billion.

Cognizant’s shares have declined 12.7% against the Zacks Computer & Technology sector’s rise of 19% year to date.

This Zacks Rank #3 (Hold) company expects second-quarter 2024 revenues to be between $4.75 billion and $4.82 billion, indicating a decline of 2.9% to 1.4% (a decline of 2.5-1% on a cc basis). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the second quarter is pegged at $4.80 billion, indicating a year-over-year decline of 1.8%.

The consensus mark for earnings is pegged at $1.12 per share, unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

Fair Isaac Corporation (FICO) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance