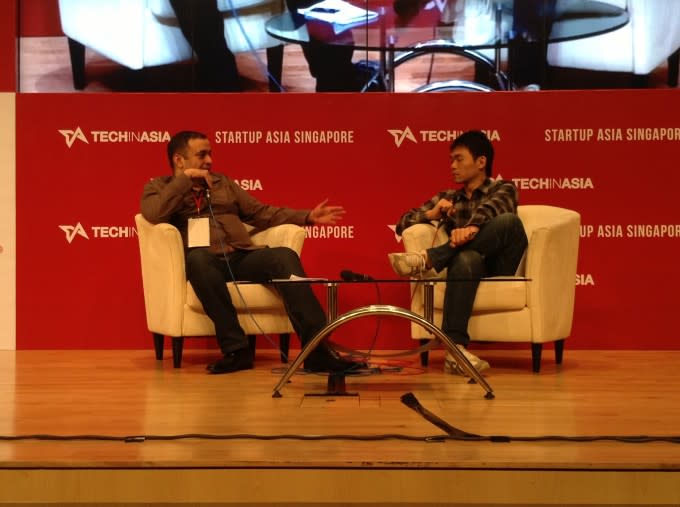

Coffee Chat: The MOL Startup Story

As one of the biggest payment companies in Southeast Asia, it is going to be interesting to hear what MOL founder Ganesh Kumar Bangah has to share about how he started his company. And most importantly, what his company plans to do in the future. Interviewed by Willis Wee, this is what Ganesh has to say:

#15:21: MOL's annual revenue is US$300 million, with 60 million transactions in a year.

#15:22: Ganesh raised funding of two million Ringgit from Berjaya Group in its early days. Out of Berjaya Group's 30 investments, he was one of the two to survive. About MOL's biggest investment made by Malaysian billionaire Vincent Tan, now Vincent owns over 80 percent of MOL. "When you raise a lot of money in the beginning, you increase your overhead, and after you do that, it's difficult to turn it down." So it is good to be conservative in spending, explained Ganesh.

#15:23: Ganesh gives advice to fellow entrepreneurs: persevere, don't lose focus. A lot of people give up early on. Back in the days, internet connection was not as big as now, if Ganesh gave up in the first eight, 12 months, he wouldn't be here now.

#15:24: Focus on games is important, and the social aspect inside it too. Before Zynga arrived, Ganesh suggested Friendster to put in social games, but it was ignored.

#15:25: "We bought Friendster not to beat Facebook, but to buy its assets, its brand." The moment after Ganesh bought Friendster, everyone recognizes his company as the one who bought Friendster. Before the Friendster acquisition, MOL had around 200,000 registered users with a few of them spending $60 a month. After the acquisition, MOL gathered 2.7 million registered members in three years, in which six percent of them spend $60 a month. Friendster patents had some value as well. It was sold to a big social network... maybe Facebook, but Willis was the one who said that, not Ganesh.

#15:27: Tons of developers out there need marketing, and now Friendster is a channeling arena for developers to launch games.

#15:28: Talking about MOL's acquisition to Indonesian payment gateway AyoPay, he explained that AyoPay is similar to MOL, but in Indonesia. MOL has had presence in Indonesia for one to two years, and AyoPay was distributing MOL points during that time. Ganesh sees that they can broaden the relationship to the next level.

#15:29: The next five to eight years, Ganesh will change Indonesia's game play to mostly physical card games compared to online gaming.

#15:30: "At this time and age, we need to have Southeast Asian focus which has 600 million people. Its demographic is similar to China and the US." Ganesh said that if you're not considering tp go global, at least eye Southeast Asia. Malaysia is small.

#15:31: MOL was once a listed company, but not anymore. Coping with its shareholders became problematic. They gave back shareholders good return, and cut some losses. Maybe next year MOL will go public again.

#15:32: On MOL's future plans, there's something about Vietnam which is associated with payment. The press release will come soon. Willis couldn't break Ganesh to reveal anything more.

#15:34: About things Ganesh would do differently if he could do it all over again, he said that he went for easy money too fast, like going to new region, selling his company [share] too fast, or even listing his company. This can decrease your company value, explained Ganesh. You need to aim medium to longer timeline.

#15:35: "I do angel investment, but in areas I'm good at." Ganesh doesn't invest in advertising, because he doesn't do that.

This is a part of our coverage of Startup Asia Singapore 2013, our event running on April 4 and 5. For all our newest Startup Arena pitches, see here. You can follow along on Twitter at @startupasia, and on our Facebook page.

The post Coffee Chat: The MOL Startup Story appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance