Codan And Two More Undervalued Small Caps With Insider Action In Australia

In the past year, the Australian market has demonstrated resilience with a 6.5% increase, despite a recent 1.4% dip over the last seven days. In such an environment, undervalued small-cap stocks like Codan that exhibit insider buying activity can present intriguing opportunities for investors looking to capitalize on potential growth prospects forecasted at 13% annually.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.6x | 2.7x | 47.32% | ★★★★★★ |

Nick Scali | 13.7x | 2.5x | 45.68% | ★★★★★★ |

RAM Essential Services Property Fund | NA | 5.6x | 41.70% | ★★★★★☆ |

Healius | NA | 0.6x | 43.68% | ★★★★★☆ |

Dicker Data | 20.7x | 0.8x | 3.94% | ★★★★☆☆ |

Eagers Automotive | 9.5x | 0.3x | 34.15% | ★★★★☆☆ |

Codan | 28.7x | 4.2x | 27.05% | ★★★★☆☆ |

Elders | 20.3x | 0.4x | 49.88% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.6x | 21.65% | ★★★★☆☆ |

Coventry Group | 283.1x | 0.4x | -17.24% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

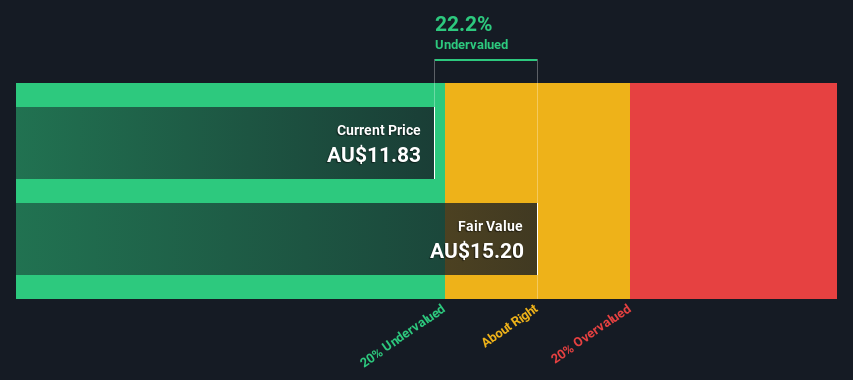

Codan

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a diversified technology company specializing in communications equipment and metal detection, with a market capitalization of approximately A$1.02 billion.

Operations: Communications and Metal Detection are the primary revenue contributors, generating A$291.50 million and A$212.20 million respectively. The company has experienced a gross profit margin of approximately 54.42% as of the latest reporting period in 2024.

PE: 28.7x

Recently, insiders at Codan have shown their belief in the company's potential through share purchases, signaling insider confidence. This action aligns with projections that forecast a 16% annual growth in earnings. Despite relying solely on external borrowing—a higher risk funding method—Codan remains a compelling prospect within the undervalued Australian market sector, suggesting both challenges and opportunities ahead. This blend of financial health and insider activity makes it an interesting consideration for those eyeing hidden gems in the market.

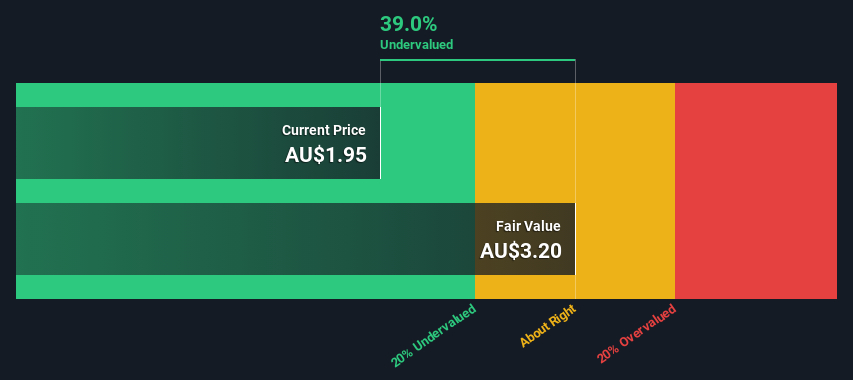

Lifestyle Communities

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lifestyle Communities is a company engaged in property development and management, with a market capitalization of approximately A$1.20 billion.

Operations: The company generates revenue primarily through property development and management, evidenced by a recent figure of A$239.11 million. Over the years, it has demonstrated a fluctuating gross profit margin, with the most recent being 21.02%.

PE: 19.7x

Lifestyle Communities, a lesser-known entity in the Australian market, recently showcased its potential at the Macquarie Australia Conference. Despite concerns about its debt not being well-covered by operating cash flow, insiders have shown their belief in the company's trajectory through recent share purchases. With earnings expected to grow by 22% annually, this reflects a promising outlook. This insider confidence coupled with strong non-cash earnings positions Lifestyle Communities intriguingly for those eyeing underappreciated assets.

Orora

Simply Wall St Value Rating: ★★★★☆☆

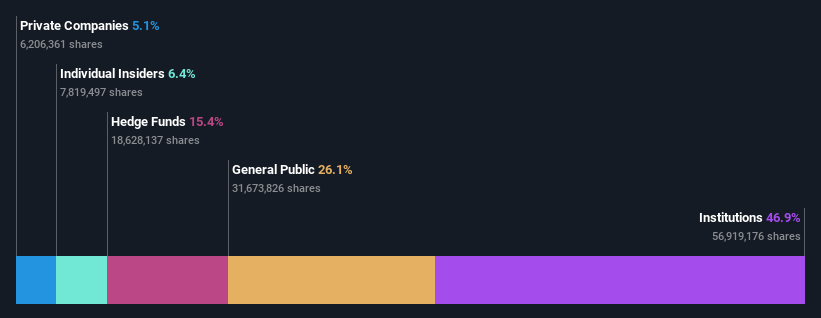

Overview: Orora is a company engaged in providing a variety of packaging solutions and displays, primarily operating across Australasia and North America, with a market capitalization of approximately A$3.17 billion.

Operations: Australasia and North America are significant markets, generating A$1.03 billion and A$3.02 billion respectively in revenue. The gross profit margin has seen a slight increase over the years, reaching approximately 18.95% by the end of 2024, reflecting modest improvements in operational efficiency.

PE: 18.2x

Orora, reflecting a promising trajectory with an expected earnings growth of 15% annually, recently showcased its potential at an Analyst/Investor Day on April 17, 2024. Despite challenges from substantial shareholder dilution over the past year and high-risk funding solely through external borrowing, insider confidence remains robust as evidenced by recent share purchases. This activity underscores a strong belief in the company’s prospects among those who know it best. With no reliance on customer deposits, Orora's financial agility could well position it for future opportunities in its market segment.

Unlock comprehensive insights into our analysis of Orora stock in this valuation report.

Explore historical data to track Orora's performance over time in our Past section.

Next Steps

Embark on your investment journey to our 28 Undervalued ASX Small Caps With Insider Buying selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:LIC and ASX:ORA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance