Coastal flooding the biggest potential climate-related threat to CapitaLand Investment’s properties: report

Released on April 1, the report features a climate scenario analysis of CLI’s portfolio of more than 480 propertie worldwide.

Coastal flooding could potentially pose the biggest threat to CapitaLand Investment’s (CLI) properties worldwide. This is according to CLI’s first standalone climate resilience report, based on the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD).

Released on April 1, the report features a climate scenario analysis of CLI’s portfolio of more than 480 properties in 20 countries across different asset classes.

Since 2017, CapitaLand has been aligning its climate-related disclosures in the four key areas of governance, strategy, risk management and metrics and targets, as recommended by the TCFD.

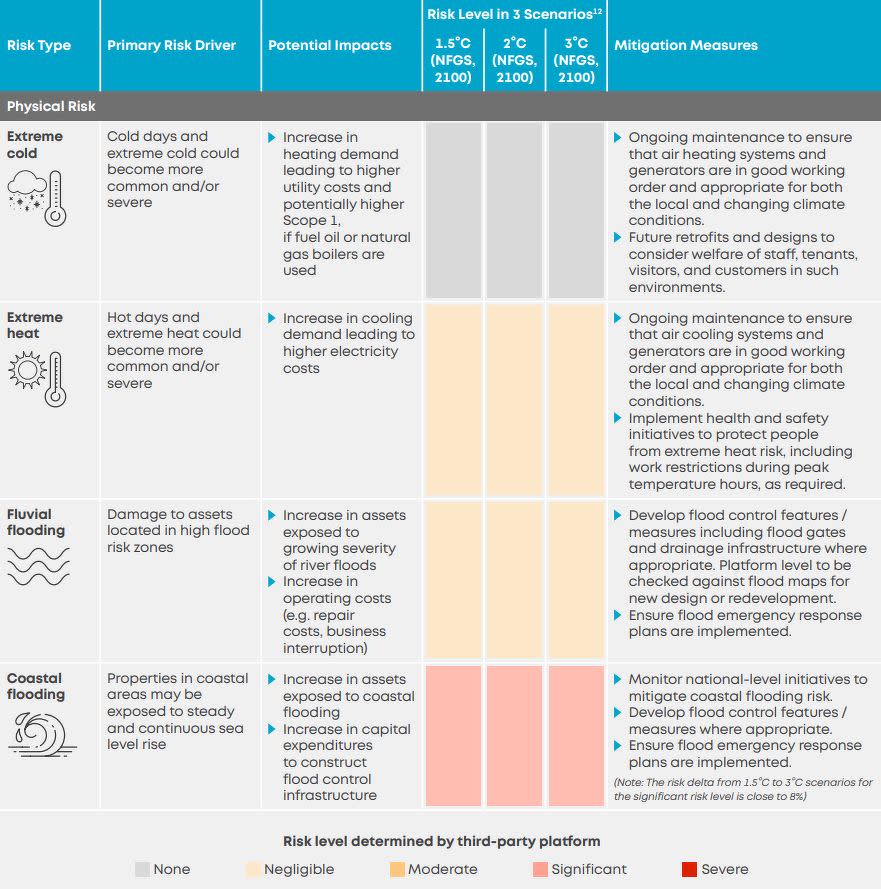

This is CLI’s third climate scenario analysis and the first time it has analysed its properties on a global portfolio level under three scenarios, where global temperatures rise by up to 1.5°C, 2°C and 3°C by 2100.

Coastal flooding was identified to potentially pose the most significant risk to CLI across all three scenarios. This is compared to other physical risks such as fluvial flooding, tropical cyclones, extreme cold, extreme heat and wildfire.

CLI says “most of its properties” already have flood control measures in place, such as flood barriers, sensors and water level pumps.

Floods are highlighted in due diligence reports for new investments and CLI says plans are in place to integrate climate change resilience into the design, development and management of properties. “CLI will continue to regularly update its flood emergency response plans to strengthen its resilience against flood risk.”

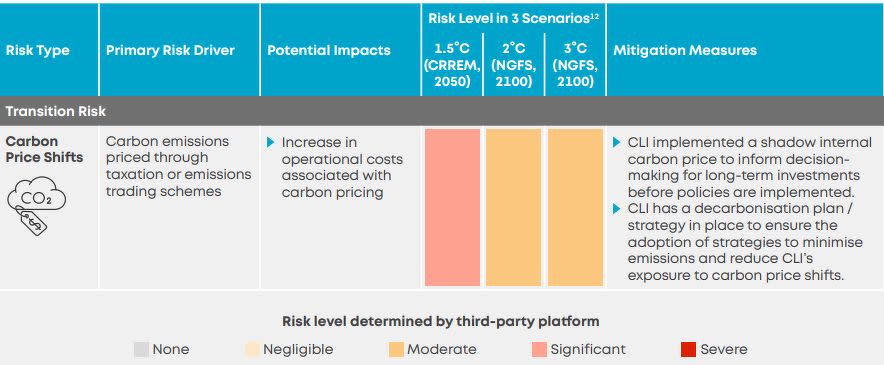

Meanwhile, transition risks analysed include potentially more stringent regulations, changes in electricity prices and increased expectations from stakeholders.

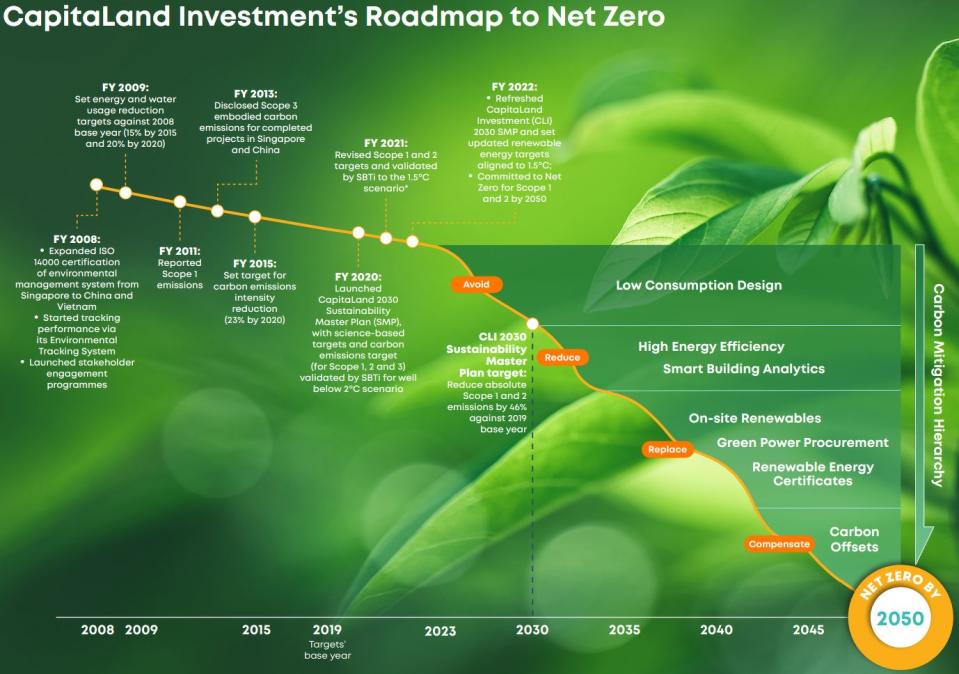

Carbon price shifts are one of the more significant transition risks that may impact the global portfolio, says CLI. The group has outlined a decarbonisation strategy in its 2030 Sustainability Master Plan (SMP) to ensure the adoption of measures to minimise carbon emissions and reduce CLI’s exposure to future carbon price shifts.

Vinamra Srivastava, CLI’s chief sustainability and sustainable investments officer, says the third climate scenario analysis is CLI’s “widest in coverage and deepest in impact assessment thus far”.

“It allows us to gain critical insights on the extent of impact of the various physical and transition risks through a top-down approach, from a global portfolio level, across each of our REITs and business trusts as well as countries, down to the property level,” he adds. “This further guides us in making more informed decisions on directing our green capital expenditure towards parts of the business with significant risk exposure, building resilience and reducing vulnerability of identified properties.”

CLI’s climate transition plan and metrics

CLI’s climate transition plan was updated in 2023 as part of the CLI 2030 SMP. The plan also sets sustainability and climate-related performance metrics and targets that are linked to the remuneration policies for senior management and staff.

At CLI, all new investments in operational assets and development projects undergo the Environmental, Health and Safety Impact Assessment (EHSIA) during due diligence to identify any environmental risks and opportunities related to the asset or project site and its surroundings.

The EHSIA uses an internal carbon price to quantify climate-related risks and opportunities. This assessment ensures that the required capital expenditure has been set aside for investments to meet CLI’s 2030 SMP targets.

CLI’s climate transition plan also includes a carbon mitigation hierarchy, initiatives to expand the capabilities of the Board, management and staff on ESG-related areas, and measures for stakeholder engagement among others.

Reducing Scope 3

Moving forward, CLI says the group will focus on reducing Scope 3 carbon emissions. It will enhance tracking and disclosure of material Scope 3 categories, especially supply chain-related emissions.

CLI has rolled out a green lease programme at its properties in Singapore and China, and plans to extend the programme to other markets globally as it works with tenants to enhance their sustainability performance.

CLI says it will strengthen ESG screening of its suppliers and enhance the awareness of ESG and safety standards among CLI’s supply chain partners through targeted briefings and training. The goup is also exploring sustainable financing tools to incentivise suppliers to strengthen their ESG credentials.

Beyond emissions, CLI says it will also assess the applicability of new nature-related disclosure guidelines under the Taskforce on Nature-related Financial Disclosures (TNFD), which is becoming a focus area for global sustainability reporting requirements and investors.

Concurrently, CLI is evaluating its readiness for reporting against the new standards launched by the International Sustainability Standards Board (ISSB). The Singapore Exchange S68 (SGX) requires all listed companies in Singapore to make climate-related disclosures that are aligned with the ISSB Standards starting 2025 and for large non-listed firms to do so from 2027.

As at 4.06pm, shares in CapitaLand Investment are trading 1 cent higher, or 0.37% up, at $2.69.

Photo: Albert Chua/The Edge Singapore

Infographics: CLI

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Ascott sees potential in Japan market, plans footprint expansion

CapitaLand Investment raises RMB1 bil from first sustainability-linked panda bond

OCBC initiates coverage on CapitaLand India Trust with $1.18 fair value target

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance