Clean Harbors Inc (CLH) Reports Solid Growth in Q4 and Full-Year 2023 Earnings

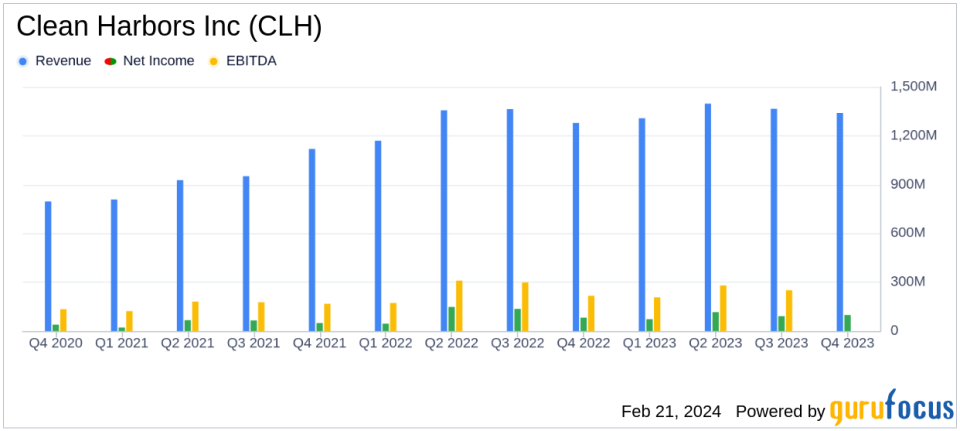

Revenue: Q4 revenue increased by 5% to $1.34 billion; Full-year revenue rose to $5.41 billion.

Net Income: Q4 net income reached $98.3 million, with EPS of $1.81; Full-year net income was $377.9 million, with EPS of $6.95.

Adjusted EBITDA: Q4 Adjusted EBITDA grew by 14% to $254.9 million; Full-year Adjusted EBITDA surpassed $1 billion.

Adjusted Free Cash Flow: Full-year adjusted free cash flow increased by 11% to $321.9 million.

Guidance: 2024 Adjusted EBITDA expected to be between $1.05 billion and $1.11 billion; Adjusted free cash flow projected between $340 million and $400 million.

On February 21, 2024, Clean Harbors Inc (NYSE:CLH), North America's leading provider of environmental and industrial services, released its 8-K filing, announcing financial results for the fourth quarter and the full year ended December 31, 2023. The company, which serves a diverse customer base including a majority of Fortune 500 companies, reported a year of record growth, particularly in its Environmental Services (ES) segment, which saw robust demand and favorable pricing.

Performance Highlights and Challenges

The ES segment concluded the year with significant growth, contributing to a 5% increase in Q4 revenue to $1.34 billion and a full-year revenue of $5.41 billion. The segment's Adjusted EBITDA rose by 16% in Q4, with a 190-basis point margin improvement year-over-year. However, the Safety-Kleen Sustainability Solutions (SKSS) segment did not meet expectations in Q4 due to deteriorating market conditions for base oil.

Despite these challenges, Clean Harbors achieved a Q4 net income of $98.3 million, or $1.81 per diluted share, and a full-year net income of $377.9 million, or $6.95 per diluted share. Adjusted EPS for Q4 was $1.82, and for the full year, it was $6.99. The company also reported a 14% growth in Q4 Adjusted EBITDA to $254.9 million and generated a full-year Adjusted EBITDA of over $1 billion.

Financial Achievements and Importance

The company's financial achievements are significant in the waste management industry, where efficient operations and strategic growth are crucial. Clean Harbors' ability to generate an 11% increase in adjusted free cash flow to $321.9 million in 2023, compared with $289.9 million in 2022, underscores its effective working capital management and operational efficiency.

From an operational standpoint, Clean Harbors made notable progress in 2023, including accelerating the construction of its Nebraska incinerator, acquiring Thompson Industrial, and improving its ESG ratings. The company's dedication to safety was evident as it achieved a TRIR of 0.63, marking the best annual safety performance in its history.

Outlook and Analysis

Looking ahead to 2024, Clean Harbors anticipates continued momentum, with Adjusted EBITDA expected to grow 2-3% in Q1 compared to the same period in 2023. The company projects full-year 2024 Adjusted EBITDA to be in the range of $1.05 billion to $1.11 billion and adjusted free cash flow between $340 million and $400 million. These projections reflect the company's confidence in its ES segment and its strategic initiatives, including the upcoming launch of its Group III program and the integration of HEPACO.

Clean Harbors' performance in 2023 and its positive outlook for 2024 demonstrate the company's resilience and strategic positioning in the environmental and industrial services industry. Investors and stakeholders can look forward to Clean Harbors' continued growth and operational excellence as it works towards realizing its Vision 2027 strategy.

For more detailed information on Clean Harbors Inc's financial results and future expectations, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Clean Harbors Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance