Citi initiates 'buy' on CapitaLand Ascott Trust, 'a lodging giant in the making'

Citi has initiated coverage with a $1.10 target price, lower than CLAS’s trading price before its Aug 3 equity fund raising.

Citi Research has initiated coverage on CapitaLand Ascott Trust Hmn (CLAS), calling it a “lodging giant in the making”, with tailwinds such as continued improvement in revenue per available unit (RevPAU), distribution-accretive acquisitions and an expected pivot in US Fed interest rates.

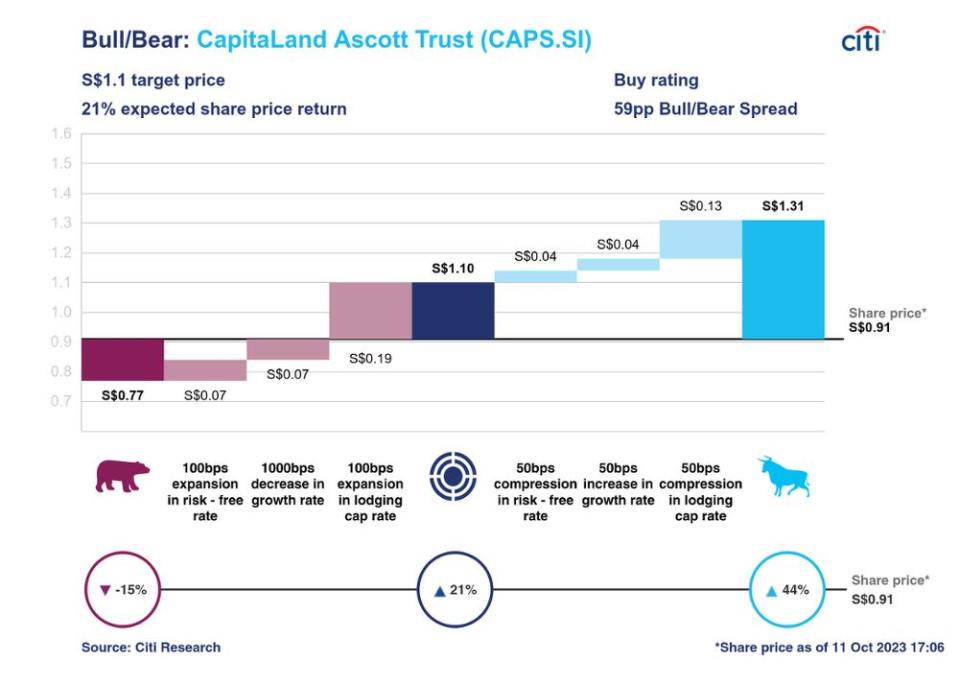

In an Oct 11 note, Citi analyst Brandon Lee starts CLAS at “buy” with a target price of $1.10. “We like CLAS for its proxy to the recovering hospitality sector, [with some] 80% of exposure, optimal mix of growth [and] stable earnings streams and proactive portfolio reconstitution, which should narrow its valuation gap compared to pre-Covid-19.”

The “mid-cap lodging S-REIT” boasts 107 properties in 16 countries worth some $8 billion across four segments: serviced residences, hotels, purpose-built student accommodation (PBSA) and rental housing; which make up 51%, 30%, 11% and 8% of assets under management respectively.

Singapore RevPAU at 127% of pre-pandemic levels

CLAS is a proxy to the ongoing hospitality recovery, writes Lee. “CLAS’s 2QFY2023 ended June RevPAU was 98% of pre-Covid-19, with five out of seven key markets at or above 2QFY2019.”

This was led by Singapore, at 127% of 2QFY2019 levels, UK (127%), Japan (109%) and Australia (105%).

Globally, the Americas, Europe and APAC revenue per available room (RevPAR) stood at 108%, 97% and 68% of pre-Covid-19. Lee expects the industry to reach pre-pandemic levels by end-1HFY2024, which also supports CLAS’s RevPAU recovery.

This includes geographies yet to hit 2QFY2019 levels, such as Vietnam (83%) and China (78%), says Lee, “especially given that visitor arrivals are still at 60%-90% of pre-Covid-19 in majority of CLAS’s operating geographies except Europe”.

Optimal earnings mix

Lee likes CLAS’s mix of income streams, with properties on master leases and Management Contracts with Minimum Guaranteed Income (MCMGI), as well as PBSA and rental housing, which together contribute 58% of gross profits.

This provides a countercyclical stability with partial indexed growth, while assets on management contracts (42% of gross profits) capture upside from RevPAU growth on travel recovery, adds Lee.

Proactive portfolio reconstitution

CLAS’s “proactive acquisition and divestment pursuits” resulted in five-year CAGR from FY2017 in AUM of some 7% and divestment gains of some $0.3 billion.

“We believe it can continue tapping on sponsor’s pipeline, including $0.5 billion on-balance sheet assets, at least $1.7 billion from two lodging private funds and $1.6 billion US multi-family portfolio, and network for inorganic growth, while divesting aged assets in China, Indonesia, the Philippines and France,” writes Lee.

He adds that CLAS’s sales proceeds can be redeployed to higher-yielding, newer or longer-stay assets, with gains mitigating income loss.

Undemanding valuations, risk of EFR

Finally, CLAS boasts undemanding valuations. “CLAS trades at 0.79x price-to-book (P/B) and FY2023/2024 yields of 6.4 and 7.0% are undemanding.”

For now, Lee thinks risks to CLAS’s performance include higher interest rates, with a 50 basis points (bps) rise leading to some 2% fall in distribution per unit (DPU).

Citi expects the US Fed Funds Rate to rise 125 bps in 2023 and fall 150 bps in 2024.

In addition, CLAS has done five private placements and two rights issues since FY2013. Lee thinks another round of equity fund raising (EFR) to partially fund acquisitions could be a risk, given CLAS’s 38.9% gearing.

CLAS’s stapled securities closed 9 cents lower, or 8% down, at $1.03 on Aug 3, a day after its managers announced EFR to raise $300 million via a $200 million private placement and a $100 million preferential offering.

Citi’s target price of $1.10 is lower than CLAS’s trading price before the Aug 3 EFR. CLAS’s stapled securities closed at $1.12 on Aug 2.

CLAS has called for an extraordinary general meeting (EGM) to seek the approval of its shareholders for the proposed acquisitions of The Cavendish London, Temple Bar Hotel in Dublin, and Ascott Kuningan Jakarta. The EGM is scheduled to take place at 3pm on Oct 24.

CLAS entered into purchase agreements on Oct 9 to acquire The Cavendish London, Temple Bar Hotel, and Ascott Kuningan Jakarta. CLAS has agreed to acquire 100.0% of the shares of the companies that own these properties.

As at 3.41pm, CLAS’s stapled securities are trading 1.5 cents higher, or 1.66% up, at 92 cents.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Brokers' Digest: OCBC, Delfi, CDL, Raffles Medical Group, UOL, Singtel, ESR-LOGOS REIT

MAS likely to keep policy parameters unchanged in upcoming October meeting: analysts

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance