CI Select Canadian Equity Fund's Strategic Moves in Q1 2024: A Focus on Manulife Financial Corp

Insight into the Fund's Latest Portfolio Adjustments and Market Strategy

CI Select Canadian Equity Fund (Trades, Portfolio), managed by CI Investments Inc. and advised by Signature Global Advisors, has been a significant player in the investment landscape since 1998. Specializing in Canadian equities and convertible securities, the fund adheres to a rigorous investment process that includes comprehensive global analysis and continuous monitoring of investments. This approach ensures that the fund's investments are well-aligned with the evolving economic and market conditions.

New Additions to the Portfolio

In the first quarter of 2024, CI Select Canadian Equity Fund (Trades, Portfolio) expanded its portfolio by acquiring stakes in three new companies:

The most significant addition was The Goldman Sachs Group Inc (NYSE:GS), with 25,585 shares, accounting for 0.52% of the portfolio and a total value of $14.48 million.

DoubleVerify Holdings Inc (NYSE:DV) was another notable addition, with 254,734 shares representing approximately 0.44% of the portfolio, valued at $12.13 million.

Healthpeak Properties Inc (NYSE:DOC) was also included, with 57,687 shares, making up 0.05% of the portfolio and valued at $1.47 million.

Key Position Increases

The fund also increased its stakes in five stocks, with significant boosts in:

Agnico Eagle Mines Ltd (TSX:AEM), which saw an addition of 237,223 shares, bringing the total to 504,095 shares. This adjustment represents an 88.89% increase in share count, impacting the portfolio by 0.69%, with a total value of C$40.72 million.

Bank of Montreal (TSX:BMO) also saw a substantial increase, with an additional 98,561 shares bringing the total to 679,559. This adjustment represents a 16.96% increase in share count, with a total value of C$89.87 million.

Positions Sold Out Completely

During the first quarter of 2024, CI Select Canadian Equity Fund (Trades, Portfolio) exited its positions in nine stocks, including:

Emera Inc (TSX:EMA), where the fund sold all 403,333 shares, resulting in a -0.74% impact on the portfolio.

Humana Inc (NYSE:HUM), with all 27,955 shares liquidated, causing a -0.71% impact on the portfolio.

Significant Reductions in Holdings

The fund reduced its positions in 91 stocks, with the most notable reductions being:

Manulife Financial Corp (TSX:MFC), which saw a reduction of 1,247,529 shares, resulting in a -28.02% decrease in shares and a -1.19% impact on the portfolio. The stock traded at an average price of C$28.53 during the quarter and has returned 9.76% over the past three months and 26.87% year-to-date.

Fairfax Financial Holdings Ltd (TSX:FFH) was reduced by 18,901 shares, resulting in a -22.43% reduction in shares and a -0.81% impact on the portfolio. The stock traded at an average price of C$1,287.86 during the quarter and has returned 5.58% over the past three months and 28.83% year-to-date.

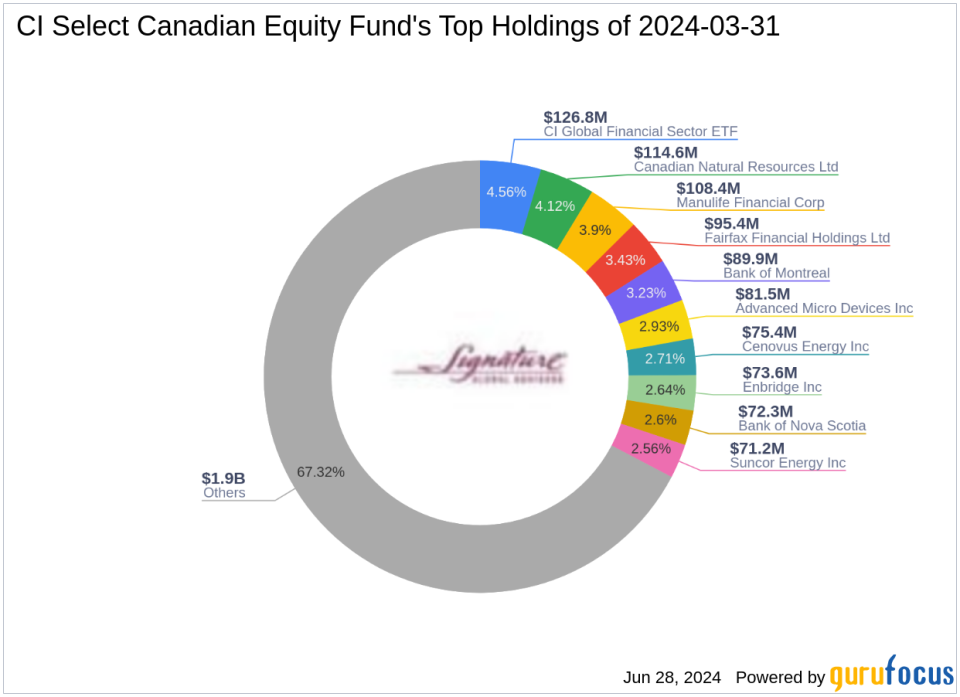

Portfolio Overview

As of the first quarter of 2024, CI Select Canadian Equity Fund (Trades, Portfolio)'s portfolio included 99 stocks. The top holdings were 4.56% in CI Global Financial Sector ETF (TSX:FSF.TO), 4.12% in Canadian Natural Resources Ltd (TSX:CNQ), 3.9% in Manulife Financial Corp (TSX:MFC), 3.43% in Fairfax Financial Holdings Ltd (TSX:FFH), and 3.23% in Bank of Montreal (TSX:BMO). The holdings are mainly concentrated across 11 industries, reflecting a diverse and strategic allocation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance