Choosing Beyond NP3 Fastigheter's Dividend For One Better Option

Large dividends can be alluring, offering the prospect of steady income from investments. However, it's crucial to examine whether these dividends are sustainable over the long term. Companies with excessively high payout ratios may struggle to maintain their dividend payments, which could indicate underlying financial issues. In this article, we will explore two Swedish stocks: one that presents a promising dividend opportunity and another that might pose risks due to its high payout ratio.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.33% | ★★★★★★ |

Betsson (OM:BETS B) | 5.61% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.57% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.38% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

Duni (OM:DUNI) | 4.99% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.10% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.39% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.33% | ★★★★★☆ |

AB Traction (OM:TRAC B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

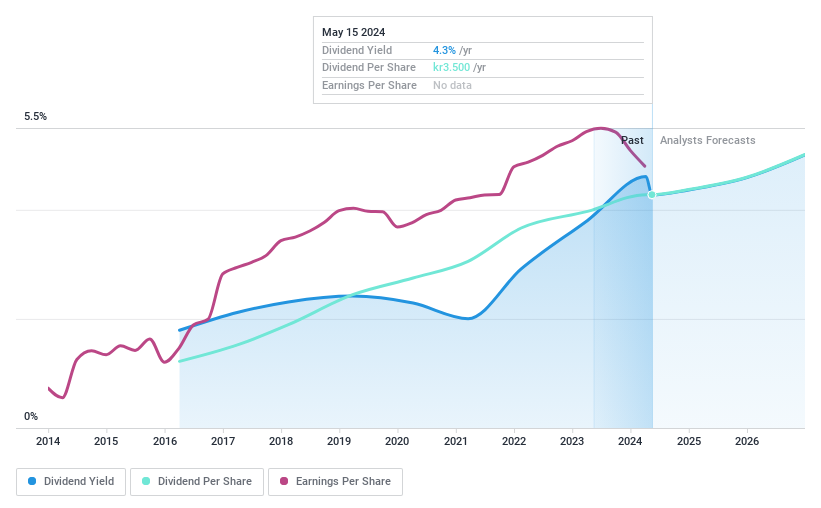

Bravida Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB operates in Sweden, Norway, Denmark, and Finland, providing technical services and installations for buildings and industrial facilities with a market capitalization of approximately SEK 16.71 billion.

Operations: The company generates its revenue through technical services and installations across Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.3%

Bravida Holding's recent dividend increase to SEK 3.50 per share, totaling SEK 714.29 million for FY 2023, highlights its commitment to shareholder returns amidst a reasonable payout ratio of 61.7%. This contrasts sharply with some peers struggling with unsustainable high payout ratios. Additionally, Bravida's dividends are well-supported by earnings and cash flows (Cash Payout Ratio: 43.5%), ensuring reliability even though it has a shorter dividend history of less than ten years. The firm's involvement in significant projects like the installation at Froso Strand Prison underscores operational robustness, despite recent challenges such as the overbilling incident at Region Skåne which has been addressed with executive changes and internal reviews.

One To Reconsider

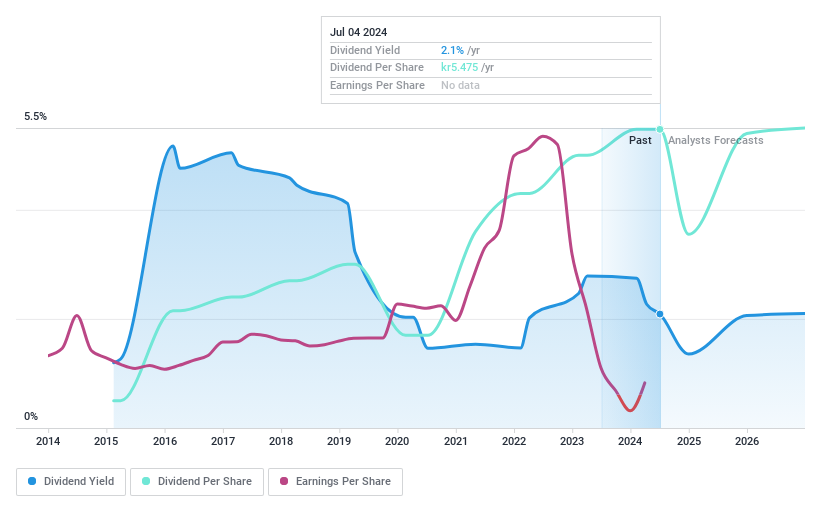

NP3 Fastigheter

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: NP3 Fastigheter AB is a Swedish real estate company specializing in the rental of commercial properties, with a market capitalization of approximately SEK 15.06 billion.

Operations: The company generates its revenue primarily through the rental of commercial properties, totaling SEK 1.81 billion.

Dividend Yield: 2.1%

NP3 Fastigheter's recent earnings show a significant improvement, with sales reaching SEK 492 million and net income at SEK 241 million. Despite these gains, the company's dividend strategy raises concerns. Its dividend yield of 2.13% is low compared to top Swedish payers, and with a high payout ratio of 310.3%, dividends are not adequately covered by earnings, indicating potential sustainability issues. Moreover, NP3 has experienced volatile dividend payments over its short nine-year history of distributions, further questioning the reliability for long-term investors seeking stable returns.

Where To Now?

Embark on your investment journey to our 25 Top Dividend Stocks selection here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BRAV and OM:NP3.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance