Choice Hotels (CHH) Rapidly Integrates Radisson Americas Hotels

Choice Hotels International, Inc. CHH is set to integrate almost 600 Radisson Americas hotels onto its reservation delivery engine and the Choice Privileges loyalty program by the end of summer. This rapid progress is facilitated by the company's integration expertise and substantial investments in advanced technology.

The acquisition of Radisson Americas has been instrumental in driving Choice Hotels' success. This enabled the company to achieve a remarkable turnaround, surpassing revenue and cost-saving expectations. The integration has brought about enhanced member benefits through status matching and point transfers between Radisson Rewards Americas and Choice Privileges.

The expanded corporate customer base fueled group bookings, while the addition of seven Radisson Americas branded properties, including the Radisson Blu Plaza El Bosque Santiago in Chile and the Radisson Blu Vancouver Airport Hotel & Marina in Canada, solidifies Choice Hotels' growth. Also, awarded contracts for eight additional Radisson Americas branded hotels and renewed contracts with 27 Radisson Americas branded hotels have positioned the company for continued success in the hospitality industry.

Radisson Hotels Major Growth Drivers

The company’s definitive agreement to acquire Radisson Hospitality for a purchase price of approximately $675 million and the integration of over 67,000 Radisson Hotels Americas rooms to the company’s portfolio helped it expand its presence in the Canadian, Mexican, Caribbean and other key Americas markets. This paves the path for 12% growth in global rooms number.

During the first quarter of 2023, Radisson Americas brands experienced a significant boost in business travel bookings, up 9% year over year. The portfolio-wide RevPAR saw a robust growth of 11.2% compared with the previous year’s levels. The integration of Radisson Americas hotels into Choice Hotels systems is progressing well, with plans to merge loyalty programs by the end of the third quarter. The company is ahead of schedule in delivering adjusted EBITDA of over $60 million in 2023 and expects it to exceed $80 million in 2024. The acquisition of Radisson Americas is seen as a strategic move to leverage the company's momentum in the Upscale segment. It is anticipated to accelerate growth of the Cambria and Ascend brands while expanding the Radisson portfolio.

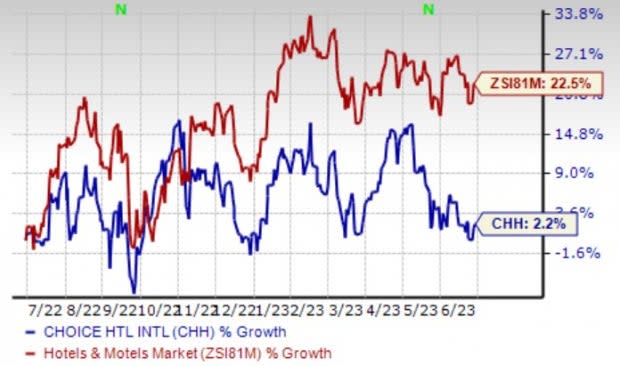

Image Source: Zacks Investment Research

In the past year, shares of Choice Hotels have increased 2.2% against the industry’s 22.5% rise.

Zacks Rank & Key Picks

Choice Hotels currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are:

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have gained 195.4 in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 48.7% and 163%, respectively, from the year-ago period’s levels.

Trip.com Group Limited TCOM sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 148%, on average. Shares of TCOM have increased 27.2% in the past year.

The Zacks Consensus Estimate for TCOM’s 2023 sales and EPS indicates a rise of 101.6% and 531%, respectively, from the year-ago period’s levels.

Bluegreen Vacations Holding Corporation BVH sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 24.7%, on average. Shares of BVH have increased 35.3% in the past year.

The Zacks Consensus Estimate for BVH’s 2023 sales and EPS indicates a rise of 3.6% and 17.6%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance