China Pacific Insurance (Group) And 2 More Premier Dividend Stocks

As global markets navigate through various economic challenges, China's market has shown resilience despite facing deflationary pressures and a cautious consumer environment. In such a landscape, dividend stocks like China Pacific Insurance (Group) can offer investors potential stability and steady income streams amidst broader market volatility.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.35% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.69% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.63% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 7.08% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.56% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.64% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.14% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.44% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.59% | ★★★★★★ |

Click here to see the full list of 218 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Pacific Insurance (Group)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Pacific Insurance (Group) Co., Ltd. offers a range of insurance products to both individual and institutional clients across the People's Republic of China, with a market capitalization of approximately CN¥248.20 billion.

Operations: China Pacific Insurance (Group) Co., Ltd. generates its revenue primarily from providing a variety of insurance products across the People's Republic of China.

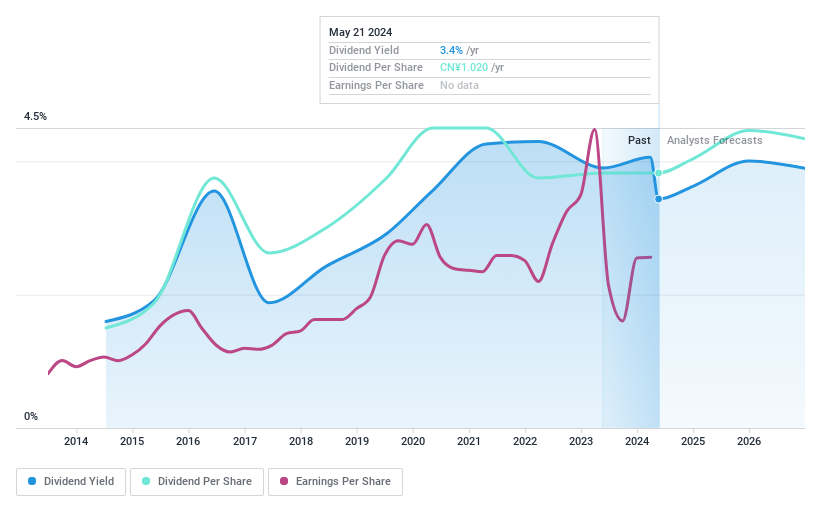

Dividend Yield: 3.6%

China Pacific Insurance (Group) Co., Ltd. recently affirmed a dividend of RMB 1.02 per share for 2023, maintaining its record of dividend distributions despite an unstable history over the last decade. The company's dividends are well supported by earnings with a payout ratio of 35.9% and a cash payout ratio at just 7.3%, indicating strong coverage by both profits and cash flow. However, the dividend track record shows volatility, reflecting past financial fluctuations which might concern conservative investors seeking steady income streams from dividends.

China Design Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Design Group Co., Ltd. specializes in engineering survey and design services across China, with a market capitalization of approximately CN¥6.35 billion.

Operations: China Design Group Co., Ltd. generates its revenues primarily through engineering survey and design services across China.

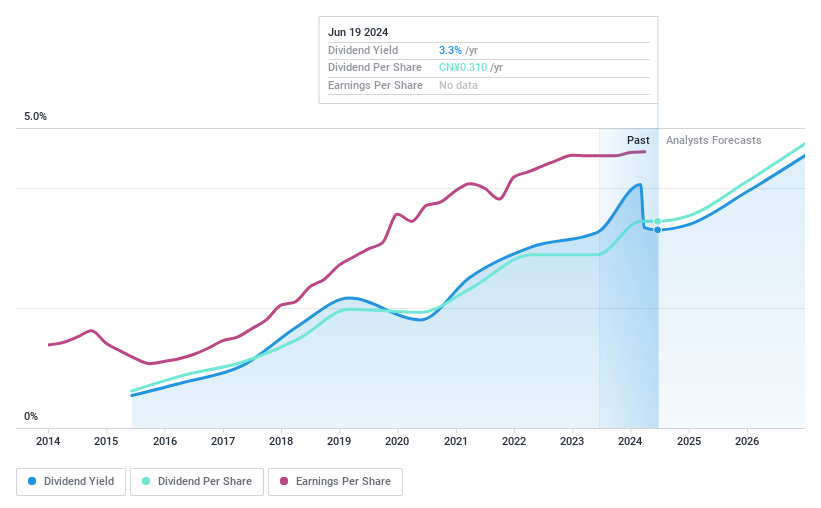

Dividend Yield: 3.3%

China Design Group Co., Ltd. has a relatively short dividend history, having initiated payments just 9 years ago. Despite this, dividends have shown growth and are well-supported by both earnings and cash flows, with a payout ratio of 30.6% and a cash payout ratio of 50.6%. The dividend yield stands at 3.3%, ranking in the top quartile for its market. Financially, the company is trading at a P/E of 9.1x, which is favorable compared to the broader Chinese market average of 30.2x. However, recent earnings have slightly declined with Q1 sales dropping from CNY 872.72 million to CNY 790.02 million year-over-year and net income also decreasing marginally.

Unlock comprehensive insights into our analysis of China Design Group stock in this dividend report.

Zhejiang Changsheng Sliding Bearings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Changsheng Sliding Bearings Co., Ltd. is a company specializing in the manufacture of sliding bearings, with a market capitalization of approximately CN¥4.46 billion.

Operations: Zhejiang Changsheng Sliding Bearings Co., Ltd. does not have detailed revenue segment data available in the provided text.

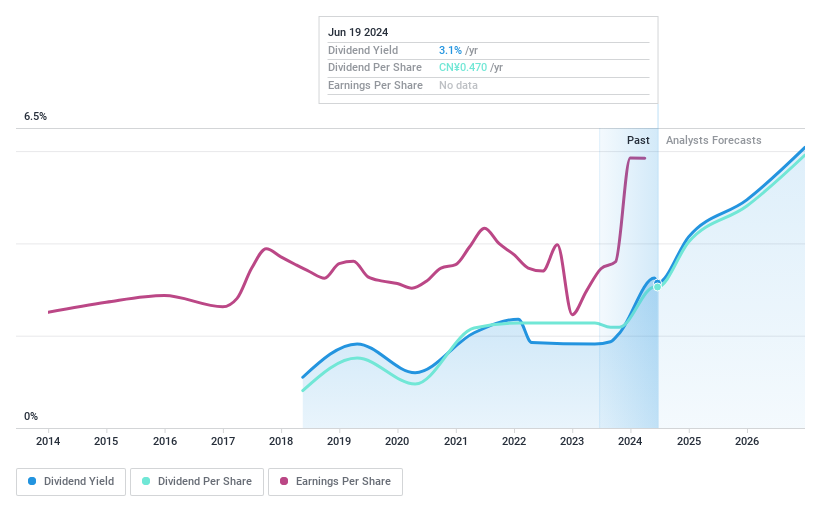

Dividend Yield: 3.1%

Zhejiang Changsheng Sliding Bearings Co., Ltd. recently affirmed a final cash dividend of CNY 2.35 per 10 shares for 2023, aligning with its modest but growing dividend history over six years. Despite an unstable track record, the dividend yield is competitive at 3.14%, placing it in the top quartile within its market sector. Financially, the company maintains a healthy coverage with a payout ratio of 49.8% and cash payout ratio of 70.7%, underpinned by earnings growth of nearly 97% last year and forecasted annual growth of 21.39%.

Seize The Opportunity

Click this link to deep-dive into the 218 companies within our Top Dividend Stocks screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601601 SHSE:603018 and SZSE:300718

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance