Chegg (CHGG) Advances Learning Platform, Unveils CheggMate

Chegg, Inc. CHGG launched an AI-enhanced learning service, CheggMate. It is built with OpenAI’s latest model, GPT-4. Leveraging Chegg’s leading personalized learning platform, proprietary data set and advanced problem-solving capabilities of GPT-4, CheggMate will create an AI conversational learning companion. This will increase the efficiency and accuracy of instantaneous learning for students.

Using CheggMate, students will have access to personalized learning pathways that will enhance the learning process. The interactive AI learning companion will deliver instant conversational AI-guided support, quizzes and recommendations to assist in bridging knowledge gaps.

Pertaining to the launch, the CEO and president of Chegg said, “We believe the combination of Chegg’s proven ability to improve student outcomes, with the breakthrough technology of OpenAI and Chat GPT, will create the most powerful study companion for students around the world. CheggMate combines the best of AI and Chegg’s student-focused expertise and will be exclusively available on Chegg’s platform.”

More on Chegg

Chegg is a leading direct-to-student learning platform. In 2022, 8.2 million customers subscribed to its Subscription Services, up 5% year over year. Revenues from subscription services increased 8.9% to $672 million in 2022 from 2021. The growth was partly attributable to increased global brand awareness and penetration.

Gross margin increased 710 basis points (bps) in 2022 from 2021. In 2022, the adjusted EBITDA margin of Chegg increased 33% year over year. This growth was attributed to the company’s profitable growth outlook, which includes its strategic investments in its business model to support operating efficiency.

Price Performance

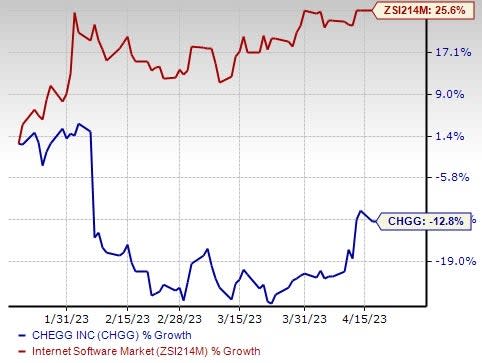

Shares of CHGG declined 1.86% during the trading session on Apr 17. The stock has declined 12.8% in the past three months against the Zacks Internet - Software industry’s growth of 25.6%.

Image Source: Zacks Investment Research

The downtrend is most likely due to the company’s weak 2023 outlook.

The company expects total net revenues in 2023 to range between $745 million and $760 million, down from 2022 reported value of $766.9 million. Also, adjusted EBITDA is expected to range between $240 million and $250 million, down from the 2022 reported value of $254.5 million.

Zacks Rank & Other Key Picks

CHGG currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some other top-ranked stocks that investors may consider from the Zacks Computer and Technology sector.

Meta Platforms, Inc. META currently sports a Zacks Rank #1. META has a trailing four-quarter earnings surprise of 8.6%, on average. Shares of the company have gained 64.2% in the past six months.

The Zacks Consensus Estimate for META’s 2023 sales and EPS indicates growth of 4.6% and 4.4%, respectively, from the previous year’s reported levels.

Salesforce, Inc. CRM currently sports a Zacks Rank #1. CRM has a trailing four-quarter earnings surprise of 15.6%, on average. Shares of the company have gained 28.3% in the past six months.

The Zacks Consensus Estimate for CRM’s fiscal 2024 sales and EPS indicates growth of 10.4% and 35.7%, respectively, from the previous year’s reported levels.

Splunk Inc. SPLK currently has a Zacks Rank #1. SPLK has a trailing four-quarter earnings surprise of 131.1%, on average. Shares of the company have gained 20.9% in the past six months.

The Zacks Consensus Estimate for SPLK’s fiscal 2024 sales and EPS indicates growth of 6.1% and 2.2%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Chegg, Inc. (CHGG) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance