Checking In on Meme Stocks

No matter which side you were on during the initial meme stock mania, we can all agree on one thing – the market felt like the wild west out there.

Out of the bunch, GameStop GME was among the most popular, shaking the market violently with a short-squeeze that was the magnitude of which is rarely seen.

Of course, other meme stocks, including AMC Entertainment AMC, BlackBerry BB, and Bed Bath & Beyond BBBY, also became a nightmare for short-sellers, causing violent price swings.

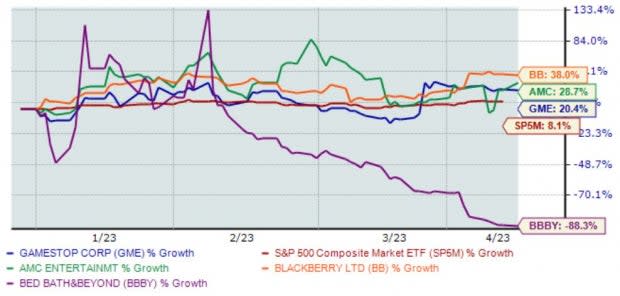

Surprisingly enough, several of the meme stocks have outperformed the general market so far in 2023, including AMC, GME, and BB. However, as we can also see in the chart below, BBBY shares have massively lagged, with fears of bankruptcy taking hold of sentiment.

Image Source: Zacks Investment Research

Let’s look at where a few mega-popular meme stocks presently stand.

GameStop

GME shares were valued at roughly $5 (split-adjusted) per share at the beginning of January 2021, and after the month was over, shares closed at approximately $120 per share (split-adjusted), etching in a +1500% gain.

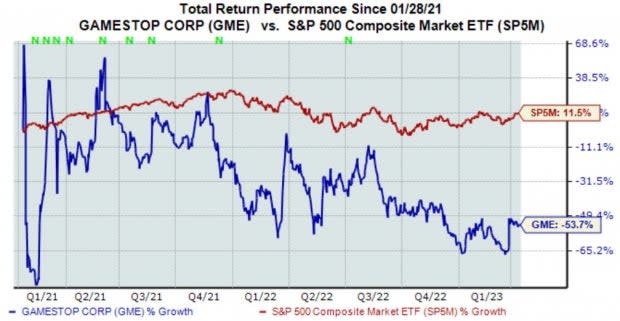

Needless to say, it was a rollercoaster that many market participants decided to take a ride on. However, since touching all-time highs on January 28th, 2021, GME shares have lost more than half their value, underperforming relative to the S&P 500.

Image Source: Zacks Investment Research

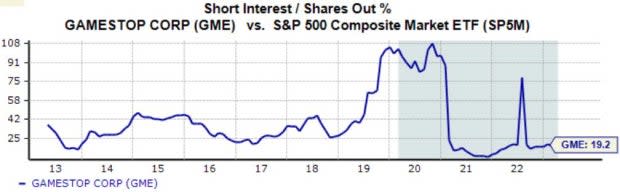

As we can see in the chart below, short interest as a percentage of outstanding shares peaked right before the melt-up, fueling the nearly unbelievable squeeze.

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #2 (Buy), with earnings estimates moving higher across several timeframes as of late.

Image Source: Zacks Investment Research

AMC Entertainment

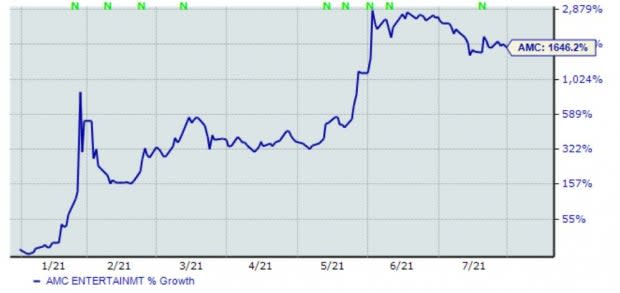

AMC shares also found extreme investor interest, etching in a +500% gain in January 2021. Shares moved much higher following the initial January squeeze, peaking at $44 per share in July 2021.

Unlike GME, AMC investors got to ride the surge for an extended period, as shown in the chart below.

Image Source: Zacks Investment Research

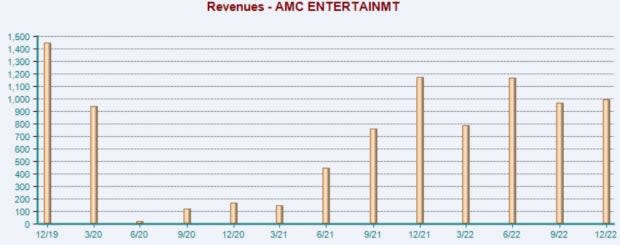

AMC posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 30% and delivering a marginal revenue surprise. The company’s top line was impacted heavily by the pandemic but has since begun its road to recovery, illustrated in the chart below.

Image Source: Zacks Investment Research

Analysts have primarily taken a bearish stance on the company’s earnings outlook, with negative earnings estimate revisions hitting the tape across all timeframes over the last 60 days.

Image Source: Zacks Investment Research

Bottom Line

Once heavily-shorted stocks begin rising, it kicks off a vicious cycle for shorts, who are forced to cover their positions and buy back the shares they borrowed. This leads to massive losses for shorts who are unable to cover their positions, while long investors can reap significant profits.

That’s precisely what happened in 2021 with meme stocks such as GameStop GME, AMC Entertainment AMC, BlackBerry BB, and Bed Bath and Beyond BBBY.

Needless to say, it’ll probably be some time before we see a short squeeze the size of GameStop again.

But it raises a valid question, who’s next?

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GameStop Corp. (GME) : Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance