Charlie Munger believed investing got ‘much harder’ over his lifetime, as even pros face nearly zero chance of beating the S&P 500 now — but you may still have a shot if you follow his tips

The phrase “practice makes perfect” makes sense in many aspects of life, but when it comes to investing — with its twists, turns and constant changes — perfection is more of a pipe dream, according to late billionaire investor Charlie Munger.

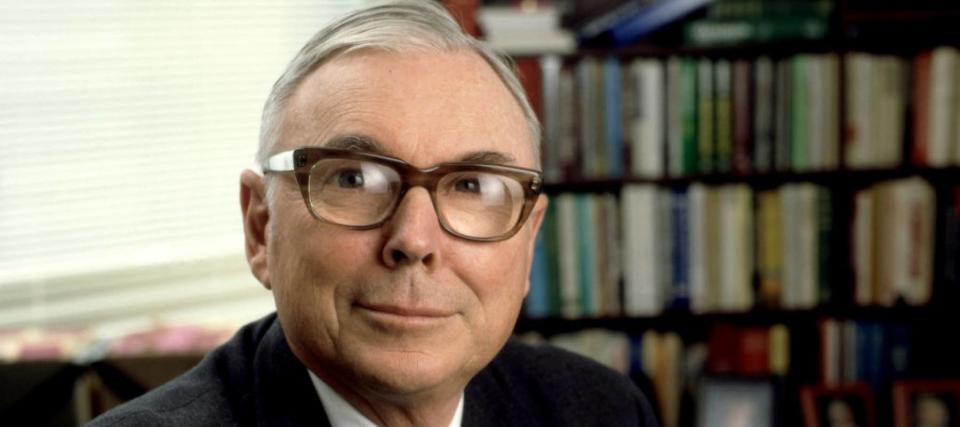

Munger, who died in November just a few months short of his 100th birthday, was best known for his role as the vice chairman of Berkshire Hathaway and Warren Buffett’s right-hand man. And with decades of experience under his belt, Munger recently made the observation that investing grew “much harder” over his lifetime.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Save big on your holiday shopping with an app that’s already saved users $800 million

Speaking with Stripe publishing company’s CEO John Collison ahead of the launch of the latest edition of his book “Poor Charlie’s Almanack,” Munger said investing has “gotten so hard that most of the people who are in wealth management have almost zero chance of outperforming an unmanaged index like the S&P.”

He says the stock market and wider investing playing field have grown “brutally competitive,” such that there are “manias where things are hot and start running, and the behavior gets crazy.”

The 99-year-old reflected back on simpler days: “In my lifetime, a guy who just bought the best common stocks and sat on his a-- would have made about 10% per round before inflation, maybe 8% after inflation. That is not the standard return that someone can expect from an investment.

“That was a very unusual period of time in a very unusual place. I do not anticipate that the average result is going to be nearly that good over the next hundred years.”

But it doesn’t hurt to try to prove him — and all those wealth managers — wrong. Here’s two pieces of investment advice from Munger that may help you along the way.

Look for no-brainer decisions

Munger, like his business partner Buffett, was a well-known proponent of value investing: a strategy that involves buying quality stocks while they’re trading below their intrinsic value. Typically, the pair looked for companies with a long-lasting earning potential, good cash flow and a low amount of debt.

Where Munger differed from other value investors is that he was seemingly willing to pay more for truly high quality stocks — but he admited they’re not always easy to find.

“What makes investment hard is that it’s easy to see that some companies have better businesses than others,” he told Collison. “But the price of the stock goes up so high that all of a sudden, the question of which stock is the best to buy gets quite difficult. We’ve never eliminated the difficulty of that problem.”

Munger explained that the dynamic investing duo were keenly aware they didn't know everything, which led to them identifying as "agnostics."

“We have no system for having automatic good judgment on all investment decisions that can be made. Ours is a totally different system,” he said. “We just look for no-brainer decisions.

“As Buffett and I say over and over again, we don’t leap seven-foot fences. Instead, we look for one-foot fences with big rewards on the other side. So we’ve succeeded by making the world easy for ourselves, not by solving hard problems.”

So, what are some “easy” investment decisions the two billionaires have made? They both appear to like big bank stocks due to their relatively low volatility, sound earnings and regular dividend payments.

The majority of holdings, or 84% of Munger’s portfolio when he died, were bank stocks — with Wells Fargo at around 41%, Bank of America at around 40% and U.S. Bancorp at around 3%, according to his latest 13F filing.

The S&P 500 bank index is down approximately 11% this year, and is at an all-time low when compared with the rest of the S&P 500. But with the Federal Reserve potentially holding off on further interest rate hikes, making it a potentially attractive time to get investing.

Reuter's points out that analysts at Bank of America Global Research indicated now is a good time for investors to "selectively" add bank stocks in their portfolio, as high interest rates are often the source of many bank stock investment risks.

Read more: Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Learn to quit

You would be extremely lucky to get through your entire investing life without making a mistake. Even Munger and Buffett have copped to making their fair share of flubs.

Munger once said “one of the stupidest mistakes I ever made” was around Belridge Oil. He'd bought 200 shares of the energy company in 1977, but decided not to pick up another 1,500 shares, according to Markets Insider — which meant he missed out on a potential $6.6 million sale after Shell acquired Belridge at almost 30 times the price he’d paid.

As for Buffett, when the COVID-19 pandemic brought the aviation industry to a standstill in 2020, he sold Berkshire Hathaway’s holdings in American, Delta, United and Southwest Airlines at a considerable loss. The company had invested $7 or $8 billion in the airlines and “did not take out anything like [that],” which Buffett said was his “mistake.”

“Part of what you must learn is how to handle mistakes and new facts that change the odds,” said Munger, who famously described life as being “like a poker game” in that “you have to learn to quit sometimes when holding a much-loved hand.”

“While there is no way of learning or behaving so you won’t make a lot of mistakes, you can learn to make fewer mistakes than other people — and how to fix your mistakes faster when you do make them.”

What to read next

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Here's how much the typical baby boomer has saved for retirement — how do you stack up right now?

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance