CGS-CIMB maintains 'add' rating, TP of 88 cents for ThaiBev in anticipation of FY2023 volume recovery

Analysts say brown spirits and beer will lead the company’s volume recovery in FY2023 ending Sept 30.

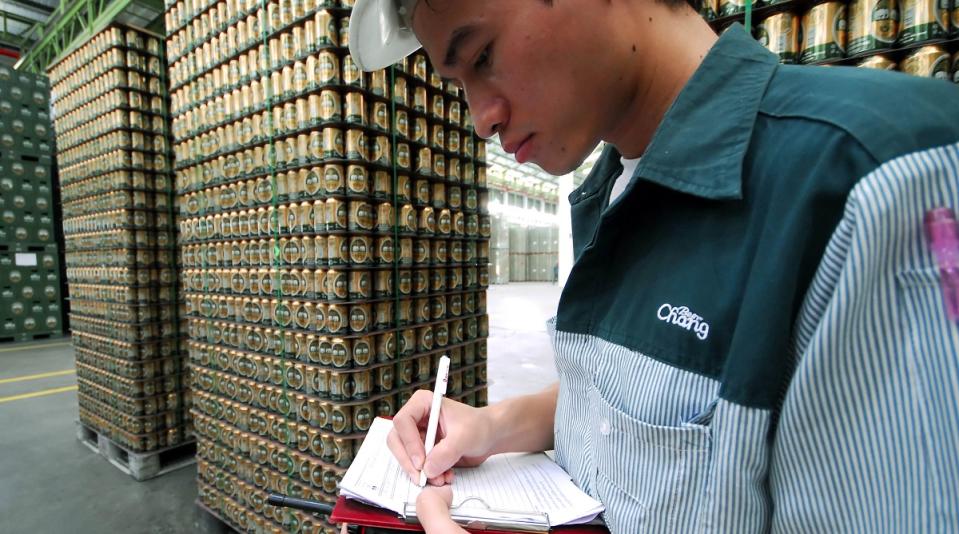

Analysts from CGS-CIMB Research have reiterated their “add” rating for Thai Beverage Y92 with an unchanged target price (TP) of 88 cents, as brown spirits and beer lead the company’s volume recovery in FY2023 ending Sept 30.

In their report dated March 31, analysts Ong Khang Chuen and Kenneth Tan say they remain positive on further volume recovery in Thailand in the coming quarters amidst improving consumer confidence, driven by strong tourism recovery — with China’s reopening a likely booster — and upcoming Thai general elections in May.

The analysts like ThaiBev as a proxy to Thailand’s economic recovery riding on tourism recovery and improving consumer sentiment. According to them, the stock trades at an undemanding valuation of 13.2x 2023 price-to-earnings ratio (P/E), some 1.4 standard deviations (s.d.) below its historical average.

Ong and Tan are forecasting ThaiBev to see 7.1% y-o-y revenue growth in FY2023 ending September, led by brown spirits and beer volume recovery as entertainment venues in Thailand only reopened in June last year. “That said, management cautioned that white spirits volumes could remain under pressure due to lower government cash handouts, and higher inflation biting into the lower income group’s disposable income,” add the analysts.

They add that the company is also actively pulling cost levers to offset higher raw material prices and selling, general and administrative (SG&A) expenses in FY2023 to manage inflationary pressures as it aims for profit growth, and expect ThaiBev’s ebitda margin to contract 0.4 percentage points y-o-y in FY2023. “With rolling hedging in place, the higher input cost prices from malt and molasses will start to be reflected in 1QFY2023 and 2HFY2023, respectively.”

Meanwhile, ThaiBev also plans to spend more on SG&A expenses to resume brand building activities post-reopening, especially in Vietnam to better penetrate the mid-premium segment. Nevertheless, management said it will be actively controlling SG&A expenses as a percentage of sales by focusing on high return on investment (ROI) projects and driving operational efficiencies as it targets to achieve profit growth in FY2023, add the analysts.

This is part of the company’s focus on organic growth and using its strong cash flow generation to deleverage its balance balance sheet, while remaining open to strategic partnerships to improve its brand offerings in Vietnam.

According to the CGS-CIMB analysts who recently hosted ThaiBev’s management in Singapore, the company says that it will continuously review its BeerCo IPO plans to help unlock shareholder value when market conditions improve. However, Ong and Tan say they sense “mixed feedback” from clients given concerns over the potential widening of conglomerate discounts offsetting potential positives from the spin-off.

Meanwhile, the company is also carrying out “smaller restructuring exercises”, including the privatisation of subsidiary Oishi and a potential stake increase in its 54%-owned Vietnam subsidiary SABECO’s associate brewers to improve operational efficiencies. ThaiBev expects to see continued topline growth for SABECO in FY2023, despite near-term macroeconomic constraints from weaker exports.

Their potential rerating catalysts include a stronger-than-expected volume recovery, while downside risks include the competitive landscape heating up, resulting in higher SG&A spend for ThaiBev.

As at 2.45pm, shares in ThaiBev were trading 0.5 cents or 0.78% up at 65 cents.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

CGS-CIMB maintains 'add' call, raises TP to $1.88 after MLT’s property acquisition announcement

Analysts positive on Sembcorp Marine after 'landmark' EUR6 bil renewables contract win

Slew of new contracts seen to lift ST Engineering's order book to new peak

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance