CGS-CIMB keeps ‘add’ on Far East Hospitality Trust on the back of room for expansion

CGS-CIMB keeps ‘add’ on Far East Hospitality Trust with a lower target price of 77 cents.

CGS-CIMB Research analysts Natalie Ong and Lock Mun Yee have noted Far East Hospitality Trust (FEHT) Q5T reported a historical five-year P/B of 0.73x at a 20.9% discount to the P/B of its hospitality peers CapitaLand Ascott Trust (CLAS) of 0.91x, CDL Hospitality Trust (CDREIT) of 0.91x and 11.1% to Frasers Hospitality Trust (FHT) of 0.81x.

“We think that the discount relative to its peers could be due to FEHT’s comparatively smaller market capitalisation, lower free float, lack of diversification and comparatively fewer acquisitions,” says Ong and Lock.

The analysts also point to geographical diversification as another key reason to the re-rating of FEHT, citing the resulting room for expansion in investable markets and acceleration of inorganic growth.

As such, the analysts have recommended to keep “add” with a lower target price of 77 cents down from 79 cents previously.

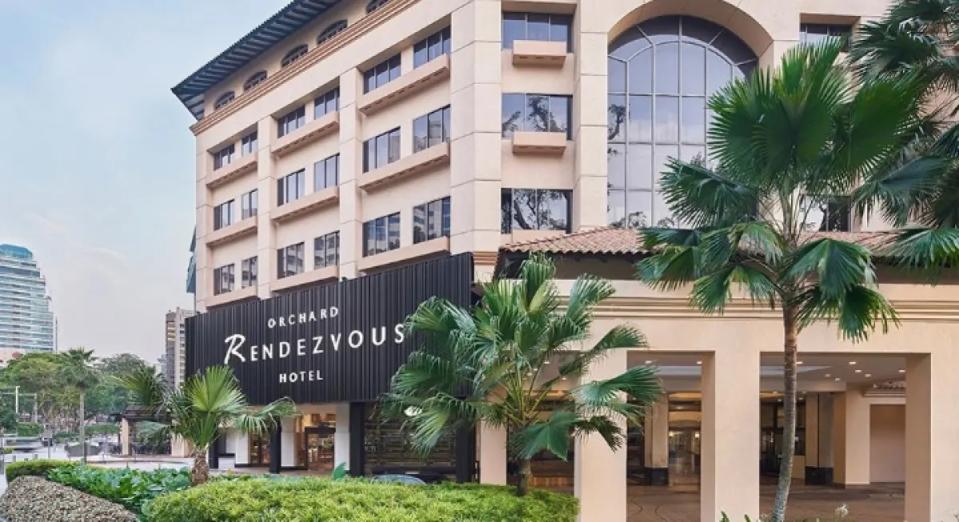

In the 21 July report, the analysts observe that since FEHT’s IPO in 2012, its portfolio has grown from 11 to 12 properties, as well as a 30% stake in a JV holding three hotels in Sentosa.

At 32%, FEHT’s gearing places it amongst the lowest of the SREITs, allowing a debt headroom of approximately $600 million to reach a gearing of 45%.

At this juncture, the trust has the right of first refusal pipeline of seven hotels and service residences in Singapore, but the analysts are concerned about the higher interest rate environment in Singapore and think that the acquisition of Singapore assets may not be adequately accretive in the near-term.

The analysts recall previous analyst briefings where the management of the trust have cited target acquisition markets, such as Japan, UK and Australia. In today’s high interest rate environment, the analysts are aware that the S-REITs are focusing on acquisitions in Japan, given the positive yield spread in that market.

“We think that this could be a similar strategy for FEHT. Given the lower quantum for Japan properties (about $30 million and above) compared to Singapore assets (about $100 million and above), we think that FEHT could fully debt-fund a Japanese acquisition whilst keeping gearing at a comfortable approximately 30% level,” say Ong and Lock.

The way the analysts see it, an overseas acquisition would help break the acquisition hiatus for FEHT, as well as re-rate FEHT as a geographically diversified REIT with more opportunities for inorganic growth.

Finally, the analysts have lowered their FY2023 to FY2025 DPU by 2.6% to 8% based on a few key reasons. Firstly, the trust’s four hotels saw lower margins as it ramps its occupancy after exiting the government contracts. Secondly, the rest of the portfolio experienced lower margins due to higher operating costs. Thirdly, lower revenue for retail and commercial space due to slower leasing. Lastly, higher interest cost assumptions.

Re-rating catalysts include accretive acquisitions, divestments and faster ramp-up period for its hotels that have exited government contracts, while downside risks include a slower-than-forecast leisure and corporate travel demand which would impact FEHT’s occupancy and room rates.

As at 11.58am, units in FEHT are trading at 65 cents.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

RHB keeps CDL Hospitality Trusts 'neutral' amidst a slow recovery

Nationalisation of SingPost's postal segment unlikely, UOBKH keeps 'hold' call

Broker’s Digest: OCBC, ComfortDelGro, LHN, UOL, Genting Singapore

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance