What CCC Intelligent Solutions Holdings Inc.'s (NASDAQ:CCCS) P/S Is Not Telling You

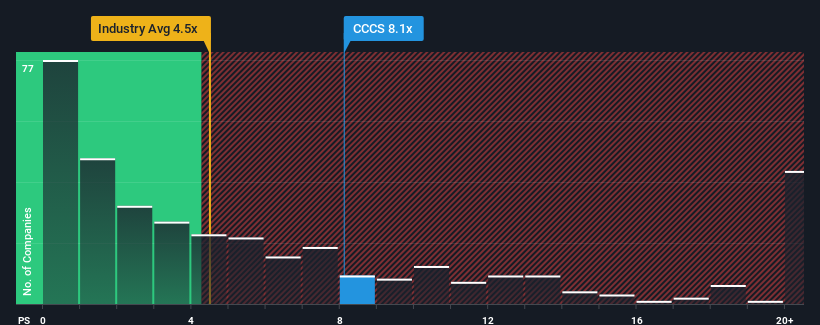

CCC Intelligent Solutions Holdings Inc.'s (NASDAQ:CCCS) price-to-sales (or "P/S") ratio of 8.1x might make it look like a strong sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.5x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for CCC Intelligent Solutions Holdings

What Does CCC Intelligent Solutions Holdings' Recent Performance Look Like?

Recent times haven't been great for CCC Intelligent Solutions Holdings as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CCC Intelligent Solutions Holdings.

How Is CCC Intelligent Solutions Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as CCC Intelligent Solutions Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 10.0% last year. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 8.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's alarming that CCC Intelligent Solutions Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does CCC Intelligent Solutions Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see CCC Intelligent Solutions Holdings trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with CCC Intelligent Solutions Holdings, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance