Capital Southwest And 2 Undervalued Small Caps With Insider Action In The United States

In recent sessions, the U.S. stock market has witnessed a notable rebound, led by significant movements in major tech stocks like Nvidia, which have influenced broader indices including the S&P 500 and Nasdaq. Amidst these fluctuations, small-cap stocks continue to present unique opportunities for investors looking for potential growth in a dynamic economic environment shaped by ongoing inflation concerns and monetary policy adjustments. In this context, understanding what constitutes an undervalued small-cap stock becomes crucial, especially considering insider actions that might signal unrecognized value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ramaco Resources | 11.3x | 0.9x | 27.95% | ★★★★★★ |

Columbus McKinnon | 21.4x | 1.0x | 42.13% | ★★★★★☆ |

PCB Bancorp | 8.6x | 2.3x | 46.54% | ★★★★★☆ |

AtriCure | NA | 2.7x | 41.90% | ★★★★★☆ |

Hanover Bancorp | 8.5x | 1.9x | 49.09% | ★★★★☆☆ |

Franklin Financial Services | 9.1x | 1.8x | 37.13% | ★★★★☆☆ |

Papa John's International | 20.7x | 0.7x | 31.02% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Titan Machinery | 3.8x | 0.1x | -7.01% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -147.10% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Capital Southwest

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capital Southwest is a financial services company that primarily operates in the investment segment, managing assets worth approximately $178.14 million.

Operations: Investment generates revenue of $178.14 million, with a net income margin of 46.81%, reflecting the company's financial outcomes from its operational activities and non-operating expenses, which total $70.65 million for the most recent period reported.

PE: 14.2x

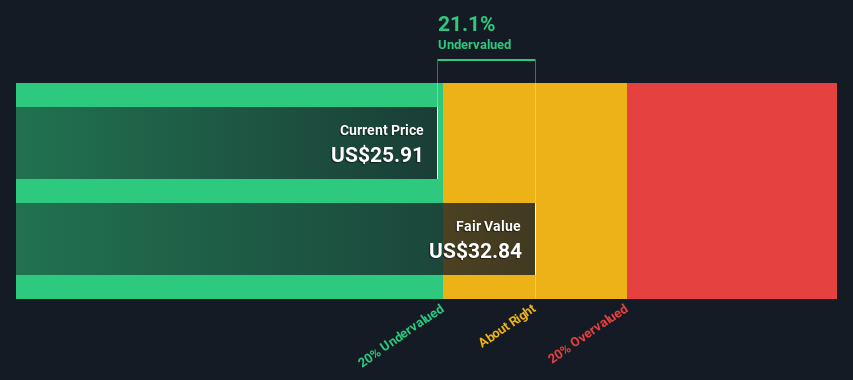

Capital Southwest, a lesser-known entity in the investment landscape, has demonstrated notable financial growth with its full-year revenue soaring to US$178.14 million from US$119.3 million previously, alongside a net income increase to US$83.39 million. This surge reflects in its earnings per share, which more than doubled to US$2.05 from US$1.1 last year, underpinning potential underpricing by the market. Recently purchased shares by insiders further underscore their confidence in the firm’s trajectory and stability despite its reliance on higher-risk external borrowing for funding—a testament to robust internal expectations and strategic foresight showcased at recent investor conferences and through consistent dividend affirmations.

Take a closer look at Capital Southwest's potential here in our valuation report.

Understand Capital Southwest's track record by examining our Past report.

Delek US Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings is a diversified energy company engaged in petroleum refining, the transportation of petroleum products, and convenience store retailing, with a market capitalization of approximately $1.07 billion.

Operations: The company's primary revenue is generated from its refining operations, which contributed $15.72 billion, complemented by retail and logistics segments bringing in $871.2 million and $1.029 billion respectively. The gross profit margin observed a notable figure of 6.12% as of the latest reporting period in December 2024.

PE: -20.6x

Despite a challenging quarter where Delek US Holdings reported a significant drop in sales to US$3.23 billion and swung to a net loss, the company's board demonstrated confidence by slightly increasing its quarterly dividend to US$0.25 per share. This action, coupled with recent insider purchases, signals strong belief in the company’s resilience and future prospects. These factors make Delek an intriguing consideration for those looking at potentially overlooked entities within the market.

Unlock comprehensive insights into our analysis of Delek US Holdings stock in this valuation report.

Evaluate Delek US Holdings' historical performance by accessing our past performance report.

Enviri

Simply Wall St Value Rating: ★★★★★☆

Overview: Enviri is a diversified environmental services company with operations in sectors including Clean Earth and Harsco Environmental, boasting a market capitalization of approximately $1.10 billion.

Operations: Clean Earth and Harsco Environmental contribute significantly to the revenue, totaling approximately $2.1 billion. The company's gross profit margin has shown variability over recent periods, with a recent figure of 21.29%.

PE: -12.8x

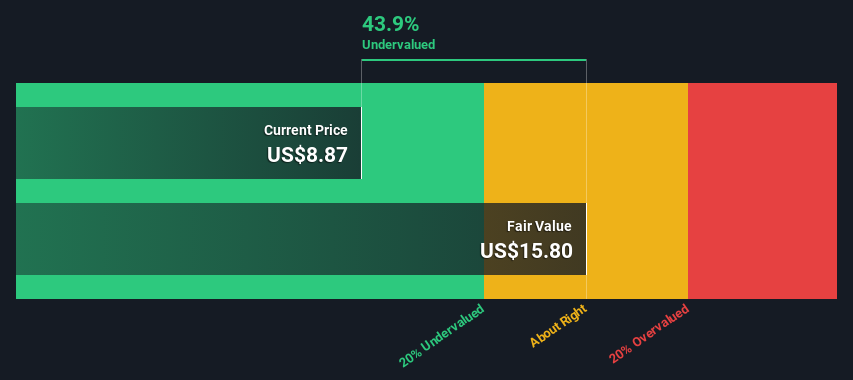

Enviri's recent upward revision in annual earnings guidance, projecting operating income between US$136 million and US$153 million, signals a robust financial trajectory despite a net loss reported for Q1 2024. This adjustment suggests resilience and potential underappreciated by the market. Notably, insider confidence is reflected through recent share purchases, underscoring belief in the company’s future prospects amidst its participation in high-profile industry conferences. These elements collectively paint Enviri as an intriguing entity within its sector with promising growth avenues ahead.

Click here to discover the nuances of Enviri with our detailed analytical valuation report.

Gain insights into Enviri's past trends and performance with our Past report.

Seize The Opportunity

Investigate our full lineup of 58 Undervalued Small Caps With Insider Buying right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CSWC NYSE:DK and NYSE:NVRI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance