Candel (CADL) Stock Skyrockets 431% Year to Date: Here's Why

Candel Therapeutics CADL, a clinical-stage oncology company, is focused on developing two novel therapeutics, CAN-2409 and CAN-3110, to treat a variety of cancer indications.

The company’s most advanced product candidate, CAN-2409, is an investigational adenovirus immunotherapy candidate that is being developed in separate mid to late-stage studies across three different types of cancer, including, prostate cancer, non-small cell lung cancer (NSCLC) and pancreatic cancer.

On the other hand, CAN-3110, Candel’s HSV-1-based immunotherapy candidate, is currently being evaluated in an ongoing investigator-sponsored early-stage study to treat recurrent high-grade glioma (HGG).

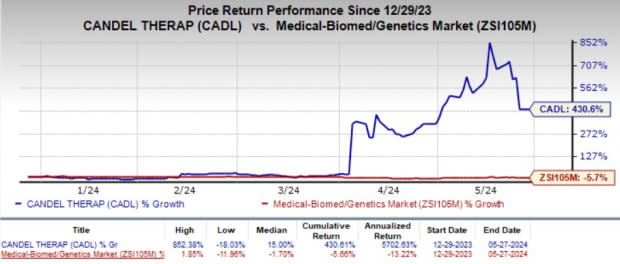

Year to date, shares of CADL have skyrocketed 430.6% against the industry’s 5.7% decline. Developmental and regulatory updates from the clinical program for CAN-2409 fueled the colossal stock price rally.

Image Source: Zacks Investment Research

In April, Candel reported positive interim data from the phase II study evaluating CAN-2409 plus valacyclovir (prodrug), together with standard of care (SoC) chemoradiation, followed by resection for treating borderline resectable pancreatic ductal adenocarcinoma (PDAC).

The updated interim data from the ongoing phase II study showed that experimental treatment with CAN-2409 led to notable improvements in estimated median overall survival of 28.8 months compared with only 12.5 months in the control group in borderline resectable PDAC.

Patients treated with CAN-2409 had a survival rate of 71.4% compared with only 16.7% in the control group after chemoradiation at 24 months of treatment. Moreover, the survival rate was 47.6% for patients treated with CAN-2409 compared with a mere 16.7% in the control group at 36 months.

If successfully developed, CAN-2409 could present a significant commercial opportunity for Candel. There is a high unmet medical need for effective new treatments, given the frequent recurrence and short survival with SoC chemotherapy for non-metastatic PDAC.

Last week, Candel announced positive overall survival data from a phase II study evaluating CAN-2409 plusvalacyclovir, together with SoC in patients with stage III/IV NSCLCwho are non-responsive to immune checkpoint inhibitor therapy over a prolonged period.

Data from the study showed that treatment with two administrations of CAN-2409 plus valacyclovir led to a median overall survival of 20.6 months in NSCLC patients whose disease had progressed despite receiving prior anti-PD-(L)1 treatment. The median overall survival observed upon treatment with SoC docetaxel-based chemotherapy in a similar patient population was 11.6 months.

In April, the FDA granted orphan drug designation to CAN-2409 for the treatment of PDAC, which further boosted stock price.

Per management, the orphan designation grant reaffirms the potential of Candel’s CAN-2409 to treat rare and difficult-to-treat forms of cancer and will ensure market exclusivity upon potential approval. Please note that the FDA also granted the Fast Track designation to CAN-2409 last year for the same indication.

We remind the investors that CADL’s other pipeline candidate, CAN-3110, also enjoys the FDA’s Fast Track designation in the United States for treating HGG patients to improve overall survival.

The Fast Track designation is credited with facilitating and thereby expediting the developmental timeline of drug candidates that are being developed to treat serious conditions for which there is an unmet medical need.

Candel is also evaluating CAN-2409 to treat patients with newly diagnosed, localized prostate cancer who have an intermediate or high risk for progression, as well as patients with low-to-intermediate risk, localized prostate cancer in phase III and phase II studies, respectively.

Looking forward, the company expects to report top-line data from both these studies in the fourth quarter of 2024, which should be an important catalyst for the stock.

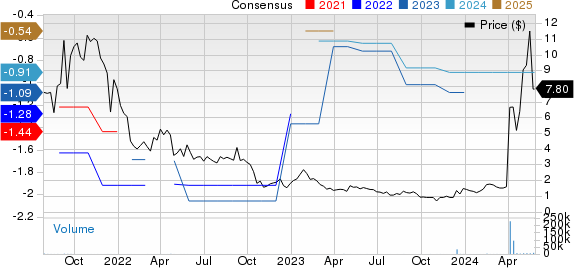

Candel Therapeutics, Inc. Price and Consensus

Candel Therapeutics, Inc. price-consensus-chart | Candel Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Candel currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Entera Bio Ltd. ENTX, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have lost 11.6%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.82 to $1.95. Year to date, shares of ANVS have plunged 61%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, the Zacks Consensus Estimate for Entera Bio’s 2024 loss per share has remained constant at 25 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 54 cents. Year to date, shares of ENTX have skyrocketed 286.7%.

ENTX’s earnings beat estimates in three of the trailing four quarters and missed once, delivering an average surprise of 6.50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Candel Therapeutics, Inc. (CADL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance