Canadian Imperial (CM) Stock Gains 7.5% as Q2 Earnings Rise Y/Y

Shares of Canadian Imperial Bank of Commerce CM gained 7.5% following the release of its second-quarter fiscal 2024 (ended Apr 30) results. Adjusted earnings per share of C$1.75 increased 3% from the prior-year quarter.

Results were primarily aided by an improvement in revenues. Also, the loan balance increased marginally in the quarter. However, higher expenses and provisions were the undermining factors.

After considering non-recurring items, net income was C$1.75 billion ($1.29 billion), reflecting a 4% year-over-year increase.

Revenues Improve, Costs Increase

Total revenues were C$6.16 billion ($4.5 billion), up 8% year over year. The improvement was driven by higher net interest income and non-interest income.

Net interest income came in at C$3.28 billion ($2.42 billion), up 3% year over year. Non-interest income increased 15% to C$2.88 billion ($2.1 billion).

Non-interest expenses totaled C$3.50 billion ($2.58 billion), rising 11% year over year.

The adjusted efficiency ratio was 56.4% at the end of the reported quarter, down from 56.6% in the prior-year quarter. A decline in the efficiency ratio indicates an improvement in profitability.

Provision for credit losses was C$514 million ($378.8 million), up 17% from the prior-year quarter.

Balance Sheet Strong

As of Apr 30, 2024, total assets were C$1 trillion ($728.9 billion), up 3% from the prior quarter. Net loans and acceptances increased marginally from the prior quarter to C$543.9 billion ($396.4 billion), while deposits grew 1% to C$732 billion ($533.5 billion).

Capital Ratios Improve, Profitability Ratio Deteriorates

As of Apr 30, 2024, the Common Equity Tier 1 ratio was 13.1% compared with 11.9% in the prior-year quarter. The Tier 1 capital ratio was 14.7% compared with 13.4% in the prior-year period. The total capital ratio was 17%, up from 15.5%.

Adjusted return on common shareholders’ equity was 13.4% at the end of the fiscal second quarter, down from the prior year’s 13.9%.

Our Take

Given high interest rates and decent loan demand, Canadian Imperial is likely to witness continued improvement in revenues. However, a challenging operating backdrop and steadily increasing provisions remain near-term concerns.

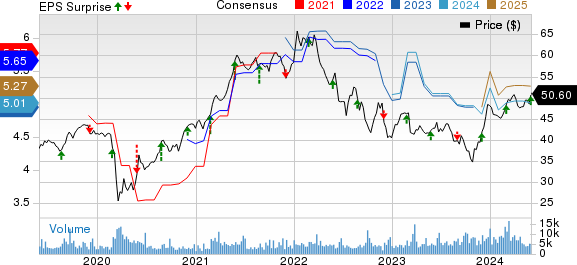

Canadian Imperial Bank of Commerce Price, Consensus and EPS Surprise

Canadian Imperial Bank of Commerce price-consensus-eps-surprise-chart | Canadian Imperial Bank of Commerce Quote

Currently, CM carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Canadian Banks

Toronto-Dominion Bank’s TD second-quarter fiscal 2024 (ended Apr 30) adjusted net income of C$3.79 billion ($2.79 billion) increased 2.2% from the prior-year quarter.

TD’s results benefited from higher non-interest income, and growth in loans and deposit balance. However, an increase in expenses and provision for credit losses were the undermining factors.

The Bank of Nova Scotia's BNS second-quarter fiscal 2024 (ended Apr 30) adjusted net income was C$2.11 billion ($1.55 billion), which declined 2.6% year over year.

A rise in expenses and a surge in provisions for credit losses hurt BNS’s results. However, higher revenues, an increase in loan balance and solid capital ratios were tailwinds.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report

Bank of Nova Scotia (The) (BNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance