Caesars (CZR) Acquires WynnBET's Michigan iGaming Operations

Caesars Entertainment, Inc. CZR has successfully finalized the acquisition of WynnBET's Michigan iGaming operations. This strategic move aligns with Caesars' ongoing expansion efforts and enhances its presence in the rapidly growing iGaming sector.

The acquisition also includes a long-term extension of iGaming market access rights with the Sault Ste. Marie Tribe of Chippewa Indians. This partnership ensures continued operations on the existing WynnBET platform with Caesars seamlessly assuming control. Customers can expect a smooth transition with no disruptions to their gaming experience, reflecting Caesars' commitment to maintaining high service standards.

Financially, this acquisition is set to boost Caesars' iCasino net revenue growth in an EBITDA-accretive manner. The integration of WynnBET's operations into Caesars' portfolio is expected to deliver significant financial benefits, further solidifying its position in the competitive iGaming market.

Looking ahead, Caesars plans to announce a new online casino brand and transition WynnBET's operations to its Michigan iGaming Platform in the latter half of 2024. This transition is contingent upon regulatory approvals, showcasing Caesars' proactive approach to compliance and operational excellence.

The acquisition represents a strategic milestone for Caesars, enabling the company to tap into the lucrative Michigan iGaming market more effectively. By leveraging WynnBET's established operations and Caesars' expansive expertise, the company is well-positioned to capture a larger share of the market and enhance its overall growth trajectory.

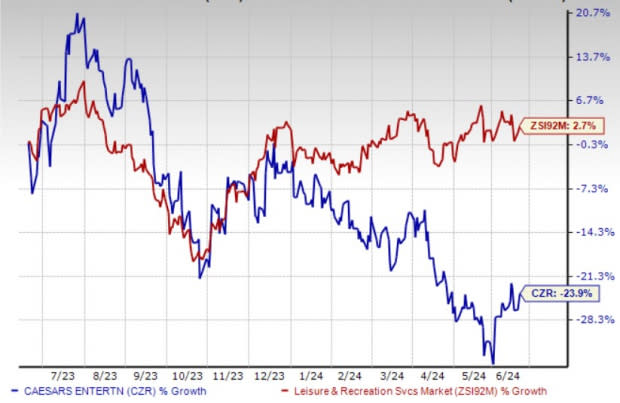

CZR currently has a Zacks Rank #3 (Hold). Shares of the company have lost 23.9% in the past year, against the industry’s growth of 2.7%.

Image Source: Zacks Investment Research

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has gained 48.4% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC presently carries a Zacks Rank of 2 (Buy). AMC has a trailing four-quarter earnings surprise of 38%, on average.

The consensus estimate for AMC’s 2024 EPS implies a rise of 73.8% from the year-ago levels. The stock has risen 14.4% in the past three months.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has surged 56.8% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 16.8% and 63.8%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Caesars Entertainment, Inc. (CZR) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance