Cadence (CDNS) Teams Up With Antiviral Discovery Consortium

Cadence Design Systems, Inc CDNS is teaming up with the Antiviral Platform (“ASAP”) Discovery Consortium to develop antivirals to prevent pandemics in the future. CDNS will offer its OpenEye molecular design software to drive the artificial intelligence (AI)-driven structure-enabled ASAP platform.

The goal of the AI-driven ASAP Discovery Consortium is to fast-track structure-based open-science antiviral drug discovery and deliver oral antivirals for pandemics equitably and affordably across the globe.

The ASAP Discovery Consortium is an Antiviral Drug Discovery U19 Center for Pathogens of Pandemic Concern. It is funded by the National Institute of Allergy and Infectious Diseases, which is a part of the National Institutes of Health, through a $68 million funding as part of the Antiviral Program for Pandemics.

The ASAP Discovery Consortium boasts partners like the Stanford University School of Medicine, Diamond Light Source, the Weizmann Institute of Science, Medchemica, Mount Sinai and the Fred Hutchinson Cancer Center. It also has a worldwide network of scientists and industry collaborators.

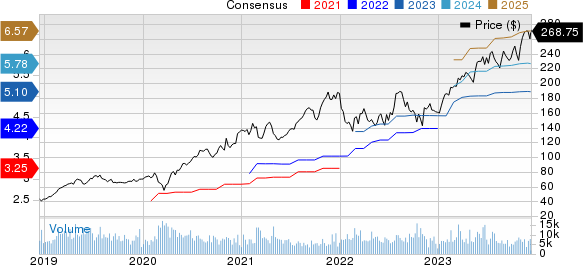

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

OpenEye’s software will help scientists develop therapeutics for less-researched infectious diseases. OpenEye’s various applications, toolkits and Orion platform will assist computational chemists in creating a strong antiviral drug discovery pipeline by leveraging structural biology, AI, machine learning (“ML”) technology and computational chemistry.

Cadence acquired OpenEye Scientific Software for about $500 million in cash in September 2022. With OpenEye’s acquisition, pharmaceutical and biotechnology companies will be able to work on robust drug discovery solutions by combining OpenEye’s molecular modeling and simulation software solutions with Cadence’s algorithmic and solver expertise, data management infrastructure, as well as innovative AI/ML and cloud solutions.

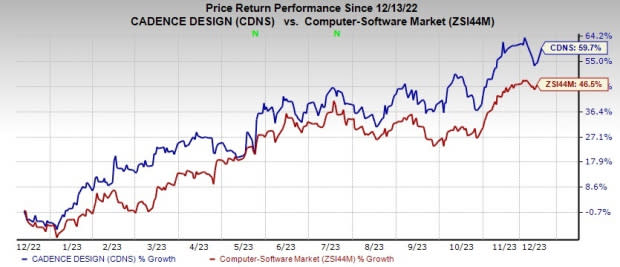

CDNS currently carries a Zacks Rank #3 (Hold). In the past year, the stock has gained 59.7% compared with the Zacks sub-industry’s growth of 46.5%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Blackbaud BLKB, BlackBerry BB and Woodward WWD, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Blackbaud’s 2023 EPS improved 1.8% in the past 60 days to $3.86. BLKB’s long-term earnings growth rate is 23.4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 10.6%. Shares of BLKB have surged 49.3% in the past year.

The Zacks Consensus Estimate for BlackBerry’s fiscal 2024 EPS has remained unchanged in the past 30 days at 4 cents. BB’s earnings outpaced the Zacks Consensus Estimate in three of the last four quarters, the average surprise being 55%. Shares of BB have lost 7.4% in the past year.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 EPS has improved 6.9% in the past 60 days to $4.92.

WWD’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 14.7%. Shares of WWD have jumped 39.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance