CACI's Bluestone Analytics Ties With Florida's Torchlight AI

CACI International Inc.’s CACI subsidiary Bluestone Analytics recently inked a strategic partnership with Florida-based Torchlight AI to offer its DarkPursuit tool within the Torchlight Catalyst platform. This will ensure that Special Operations Forces (SOF) customers get safe and secure access to browse the open, deep and dark web, which will accelerate the SOF customer’s pace of procuring critical information.

CACI’s DarkPursuit, part of its DarkBlue Intelligence Suite, enables users to pivot from analysis and targeting activity to secure virtual browsing on the open, deep and dark web.

Torchlight is a behavioral intelligence platform designed to predict emerging risk. It uses predictive analytics to detect leading indicators of risk at scale and globally for SOF clients. The latest move will enable Torchlight to advance its capabilities for real-time and enhanced decision-making across SOF challenges like irregular warfare.

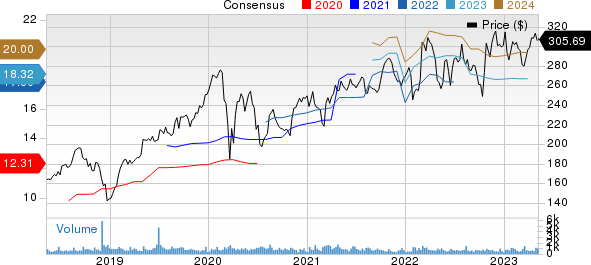

CACI International, Inc. Price and Consensus

CACI International, Inc. price-consensus-chart | CACI International, Inc. Quote

CACI has been winning a record number of deals for a while, reflecting its disciplined business development actions, consistent operational excellence and high customer satisfaction. The reliability provided by CACI’s services makes it a preferred choice among contractors.

In the third quarter of fiscal 2023, CACI won contracts worth $1.1 billion. Management secured several notable deals, including a $46 million single-award task order to provide mission expertise and analysis in science, technology, engineering and mathematics categories to support the Department of Defense and Intelligence Community.

The company also clinched a $100 million contract extension to continue mission software development support for the Air Force Distributed Common Ground System program. This will allow CACI to continue to enhance and modernize system capabilities with tools that enable warfighters to process and disseminate intelligence data.

Such back-to-back wins are the key catalysts for the company, which boasts a large pipeline of new projects and wins deals at regular intervals. As of Mar 31, 2023, its total backlog was $25.3 billion.

In March, Fortune magazine recognized CACI as one of the “world's most admired companies for 2023” for the sixth consecutive year. The company ranked eighth among Information Technology Services companies worldwide.

Zacks Rank & Other Stocks to Consider

CACI currently carries a Zacks Rank #2 (Buy). Shares of CACI have jumped 17% in the past year.

Some other top-ranked stocks from the broader Computer and Technology sector are Meta Platforms META, Momo MOMO and ServiceNow NOW. While Meta Platforms and Momo sport a Zacks Rank #1 (Strong Buy), ServiceNow carries a Zacks Rank #2 at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta Platforms' second-quarter 2023 earnings has been revised 14% upward to $2.79 per share over the past 30 days. For 2023, earnings estimates have moved north by 12.1% to $11.76 in the past 30 days.

META’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 15.5%. Shares of the company have gained 18.6% in the past year.

The Zacks Consensus Estimate for Momo’s first-quarter 2023 earnings has been revised southward from 36 cents to 32 cents per share over the past 30 days. For 2023, earnings estimates have moved down by 3 cents to $1.55 in the past 30 days.

MOMO's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 31.9%. Shares of the company have gained 73.9% in the past year.

The Zacks Consensus Estimate for ServiceNow’s second-quarter 2023 earnings has been revised northward by 11 cents to $2.04 per share over the past 30 days. For 2023, earnings estimates have moved up by 39 cents to $9.54 in the past 30 days.

NOW's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 10.4%. Shares of the company have inched up 2.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CACI International, Inc. (CACI) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Hello Group Inc. Sponsored ADR (MOMO) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance