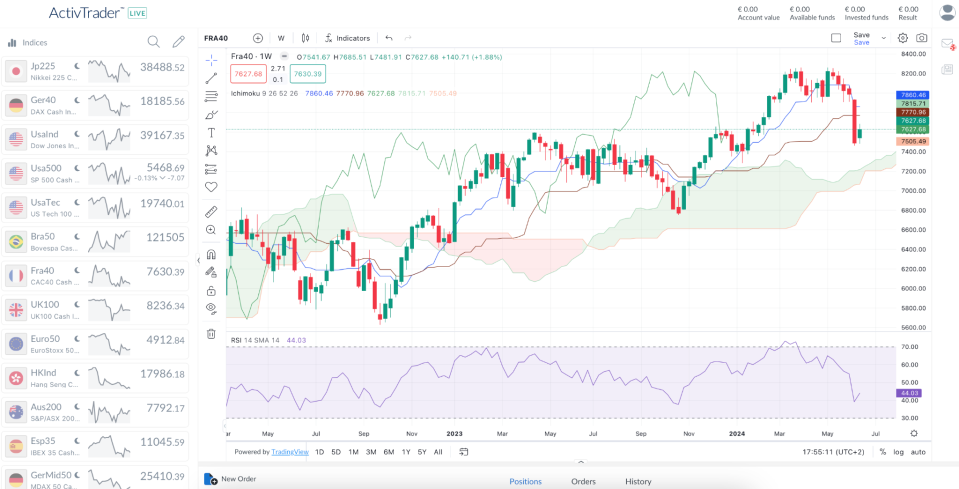

CAC 40 Still Faces Headwinds After Brief Rebound

The last drop resulted in the index falling by more than 6%, marking its most significant decrease since March 2022.

The little increase observed last week may be attributed mostly to the return of some investors to industry sectors that have been heavily impacted by market downturns, like banking, energy, media, and real estate.

The recent plunge in the French stock market hasn’t been contained within its borders. The ripple effects are being felt in popular exchange-traded funds (ETFs) that offer exposure to developed markets, mostly in Europe.

Two such examples are the iShares Core MSCI Europe ETF and the iShares MSCI EAFE ETF. Both have experienced losses in recent weeks, with the iShares Core MSCI Europe ETF dropping over 4% in the past month, with the iShares MSCI EAFE ETF shedding nearly 4% in June alone.

The market’s volatility might be directly linked to the current political turmoil in France. The decision made by President Macron to dissolve the National Assembly and announce hasty legislative elections in late June and early July has caused a surge of concern among investors. The ambiguity surrounding the political environment had a negative impact on French stocks, causing several investors to withdraw from the market.

The Fall Doesn’t Only Concern the French Stock Market

In addition to the decline in stock prices, there was an increase in tensions in the bond market. France saw a rise in borrowing expenses, leading to a large increase in the difference between the yields of French and German 10-year government bonds. This measure is a crucial indicator of the level of political risk in France.

Investors are closely observing to evaluate the perceived ability of the French government to repay its debts. The increasing difference, as observed in recent times, indicates a greater level of concern among investors over the impending elections and possible alterations in economic policies.

Despite a slight narrowing from its peak above 84 basis points – its highest level since 2017, the spread between French and German yields remained elevated at 73 basis points by last Friday’s close. This suggests lingering market anxieties, with Goldman Sachs strategists anticipating the spread to stay wide in the near future.

In the future, there is a significant possibility of seeing further market volatility.

The impending elections raise uncertainty about the future of the administration, and the result might have a substantial impact on economic policies and corporate laws. The CAC 40 may continue to face volatility until a definitive winner emerges and political stability is restored.

Goldman Sachs Strategists Pinpoint French Banks To Be Most Likely Negatively Impacted By This Uncertainty

Goldman Sachs strategists anticipate the spread between French and German bond yields to remain elevated at least until the upcoming election results are known. Their worries might even extend beyond the immediate outcome. Depending on the election’s final composition, the political uncertainty might linger, potentially causing the spread to stay wide even after the votes are counted.

This extended period of political risk, according to Goldman Sachs, will add pressure to “French domestic stocks, especially banks”, as they are particularly sensitive to the sovereign spreads mentioned previously.

Why? Mostly because their profitability is closely tied to the overall health of the economy and the stability of the government. A wider spread signifies heightened risk for the government, which can translate into higher borrowing costs for banks and potentially a less favourable economic environment for them to operate in.

When economic uncertainty is high, economic actors (like consumers and businesses) tend to become more cautious in their decision-making. This means they might tighten their belts and spend less. Consumers might delay purchases on borrowing for discretionary items, focusing on essential goods and services. Businesses might postpone investments in new equipment or projects, waiting for a clearer picture of the future economic climate.

The difficulty of planning and making sound financial choices under uncertain conditions is a major factor contributing to the current situation with banks. Limited visibility on the future economic landscape creates a climate of risk aversion across all actors.

The French banking industry has seen significantly negatively impacted, with BNP Paribas, France’s biggest bank, Société Générale, and Crédit Agricole witnessing respective declines of around 10%, 14%, and 10% over the past two weeks. These underwhelming results are the worst since the financial collapse of March 2023.

What’s Next?

The dissolution of the French National Assembly occurred on June 9, with legislative elections set to take place on June 30 and July 7, a few weeks before the commencement of the Paris Olympics on July 26.

Following the election of MPs, there will likely be a postponement until July 18, 2024, for the selection of the President of the National Assembly, the establishment of political factions, and the arrangement of the eight standing committees.

The phase of political transition is naturally characterised by uncertainty. Investors are uncertain about the policies that the new administration will enact, which can have an influence on several aspects, such as taxation and regulations.

The presence of this uncertainty might result in heightened market volatility, characterised by more pronounced fluctuations in stock prices.

Nevertheless, this inherent instability offers significant advantages for seasoned traders who possess a strong capacity to withstand risk.

Through meticulous analysis of the evolving political landscape and its effects on certain industries, experienced traders can spot opportunities to buy or sell assets for short-term gains. However, this requires a deep understanding of the industry and the capacity to quickly respond to evolving conditions.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 66% and 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance