Buyers Swarmed These 3 Stocks Post-Earnings

Earnings season continues to fade, with the vast majority of S&P 500 companies already delivering quarterly results. Overall, the Q2 cycle was primarily positive, with the market eluding the earnings meltdown many had feared.

As usual, many stocks soared following better-than-expected results, including heavyweights Amazon AMZN, Alphabet GOOGL, and Caterpillar CAT. Amazon and Alphabet shares have been big-time outperformers in 2023, whereas Caterpillar shares have modestly lagged.

Given the strong market reactions post-earnings, what was there to like? Let’s take a closer look at each.

Amazon

Amazon’s quarterly results came in nicely above expectations, exceeding the Zacks Consensus EPS Estimate by more than 80% and reporting revenue 2% ahead of expectations. Earnings jumped from the year-ago period, whereas revenue climbed 11% year-over-year.

Image Source: Zacks Investment Research

In addition, Amazon Web Services (AWS) sales climbed 12% from the year-ago period to $22.1 billion, exceeding the Zacks Consensus Estimate by roughly 3%. AWS growth has undoubtedly cooled, but the segment's significance can’t be understated, as it represented 70% of the company’s operating income throughout the period.

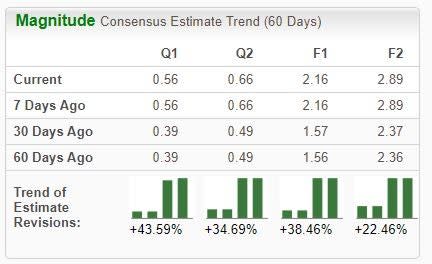

And to top it off, the e-commerce titan had its biggest Prime Day event ever in mid-July, selling more than 375 million items and reflecting a resilient consumer. Following the release, analysts have taken their expectations higher across all timeframes, landing Amazon into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Alphabet

Alphabet’s 2023 Q2 results were aided by continued resilience in Search and a recent acceleration in YouTube revenue growth, with the tech titan exceeding the Zacks Consensus EPS Estimate by 9%. Revenue throughout the period totaled $62.1 billion, 8% higher year-over-year.

Google Cloud revenues totaled $8.0 billion, improving by a solid 28% from the year-ago period. In addition, advertising revenue reached $58.1 billion, reflecting a 3% improvement. And the company remains a cash-generating machine; operating cash flow totaled $28.7 billion, whereas free cash flow reached $21.8 billion.

Like AMZN, analysts have taken their earnings expectations higher after the release.

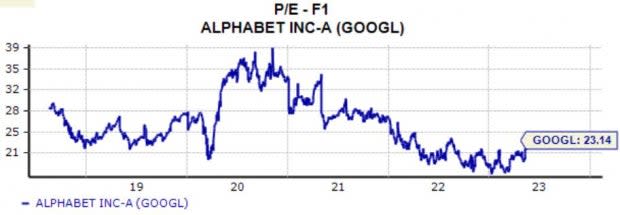

Image Source: Zacks Investment Research

It’s worth mentioning that GOOGL shares aren’t expensive given the company’s growth trajectory, with the current 23.1X forward earnings multiple (F1) sitting beneath the 24.6X five-year median and highs of 26.8X in 2022. Earnings are forecasted to climb 25% on 9% higher sales in its current year.

Image Source: Zacks Investment Research

Caterpillar

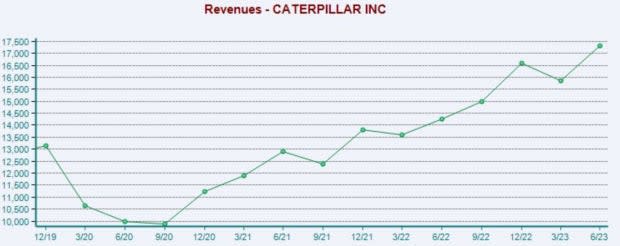

Caterpillar shares also saw momentum following its recent print, with the company exceeding the Zacks Consensus EPS Estimate by 23% and reporting sales 5% ahead of expectations thanks to higher sales volume and positive price realization. Earnings saw 75% growth year-over-year, whereas revenue climbed 20%.

The company’s sales have recovered nicely from pandemic lows, as we can see illustrated in the chart below.

Image Source: Zacks Investment Research

Caterpillar’s profitability improved in a big way, with an operating profit margin of 21.1% well above the 13.6% reported in the comparable period last year. The company also purchased $1.4 billion of CAT stock and paid $600 million in dividends throughout the period, reflecting the company’s shareholder-friendly nature.

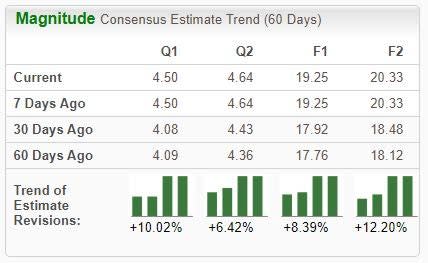

To little surprise, analysts took their earnings expectations higher post-earnings, pushing CAT into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Bottom Line

Earnings season always delivers surprises, and it was no different during the 2023 Q2 cycle.

All three companies above – Amazon AMZN, Alphabet GOOGL, and Caterpillar CAT – positively surprised investors, with shares of each seeing buying pressure post-earnings thanks to favorable results.

And to little surprise, all have enjoyed positive earnings estimate revisions following the better-than-expected results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance