Buy this Surging, Top-Ranked Dividend Aristocrat Stock?

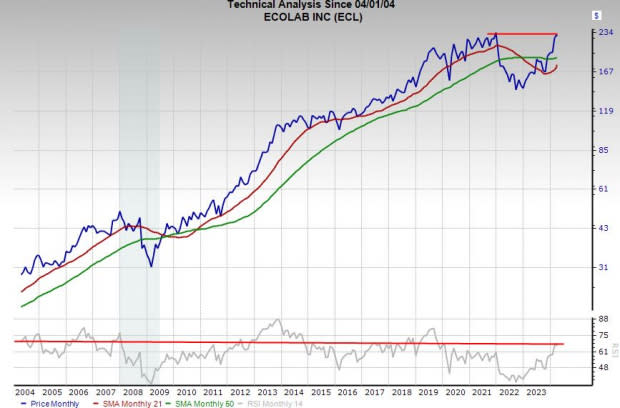

Ecolab (ECL) stock has jumped 35% in the last six months to crush the S&P 500, including a 15% YTD climb.

Ecolab lands a Zacks Rank #1 (Strong Buy) right now and it appears poised to possibly break out to new all-time highs. Ecolab is also an S&P 500 dividend aristocrat stock.

Ecolab’s Bull Case

Ecolab is a sustainability firm focused on advancing food safety, maintaining clean and safe environments, and optimizing water and energy use. Ecolab’s solutions improve operational efficiencies and sustainability for customers in the food, healthcare, life sciences, hospitality, and industrial markets in more than 170 countries.

Image Source: Zacks Investment Research

Ecolab’s cleaning and sanitizing offerings, and pest elimination services support customers across foodservice, hospitality, healthcare, and far beyond. The company’s products and technologies are used in water treatment, pollution control, energy conservation, refining, primary metals manufacturing, papermaking, mining, and other industrial processes.

Ecolab is coming off a solid stretch of growth and it won a significant amount of new business in 2023. Ecolab is projected to post 5% sales growth in FY24 and FY25 to reach nearly $17 billion. Ecolab’s adjusted EPS are projected to soar 23% and 13%, respectively.

Image Source: Zacks Investment Research

Ecolab’s upbeat EPS revisions help it earn a Zacks Rank #1 (Strong Buy) right now. The firm is also boosting its operating margin and remains on course to deliver on its 20% margin objective over the next few years.

Ecolab has crushed the S&P 500 over the last 20 years, up 665% vs. 386%. ECL has also destroyed the Zacks Basics Materials sector during the last two decades and the past 12 months. Despite that run, Ecolab trades at a 20% discount to its highs at 34.5X forward 12-month earnings.

Image Source: Zacks Investment Research

Bottom Line

Ecolab stock has jumped 35% in the last six months to crush the S&P 500, including a 15% YTD climb. Ecolab could be overheated right now and some investors might want to wait for a pullback to a longer-term moving average.

But ECL retook its 50-month moving average in Q4 and it is trying to find support at its 21-day following a recent cooldown. Ecolab is also trading slightly below its late 2021 records and it might be ready to break out to fresh highs.

Ecolab is a proven company with a diverse portfolio that investors might want to consider as a long-term buy and hold candidate. Plus, it is one of roughly 70 S&P 500 dividend aristocrats, which are firms that have both paid and raised dividends for at least 25 straight years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance