Can you buy a commercial property before you complete your HDB MOP? Apparently yes.

Most of us know that when we buy a BTO or HDB resale flat, we are required to stay a minimum of 5 years as part of the Minimum Occupation Period (MOP), before we can invest in a 2nd residential property.

However, did you know that even before you fully serve the MOP for your HDB flat, you are allowed to invest in commercial or industrial property without any penalties?

Better yet, because it is not a residential property, you do not pay Additional Buyer’s Stamp Duty (ABSD) for it even though it is your second property (after your HDB flat).

Besides completed commercial or industrial units, you are also allowed to purchase vacant land as long as it’s not zoned for residential development.

Here’s what HDB says:

In other words, if you’ve just moved into your new or resale HDB flat, and you’re thinking of investing in a 2nd property while still under MOP, you do have options – as long as the property in question is not classified as residential.

You can choose to invest in that 2nd property, become a landlord and lease it out to commercial tenants, or take over the premises yourself as an owner-occupier, renovate and start your own shop, office or cafe, as long as you apply and get the right operating licenses.

What’s more, the commercial or industrial property does not necessarily need to be in Singapore; it could be overseas as well.

Pros and Cons of Investing in a Commercial or Industrial Property while still under HDB MOP

There are, however, some pros and cons when you decide to invest in commercial or industrial property (while still being under HDB MOP). Here are a few:

Why invest in Commercial Property?

You have additional funds to invest in property, but because you have yet to complete the Minimum Occupation Period on your HDB flat, you are not able to sell your HDB flat or invest in a 2nd residential property.

You want to grow your own business and have a stake in its premises.

During the 5-year MOP, you can rent out your rooms, but you cannot rent out the entire flat until after. If you invest in commercial or industrial property, you can lease out the entire premises to earn additional rental income. Also, the rental yield from residential properties is usually 2-3%, but commercial properties can provide yields of about 5% (or even higher).

You believe that the commercial or industrial property you’re eyeing will appreciate and provide a significant capital gain or inheritance for you and your family in the future.

Most commercial properties (usually) have a lower price per square foot compared to residential properties.

Unlike residential rental tenancies, commercial tenancies, especially for large commercial spaces, have longer lease terms, like 5 to 6 years. This assures a steady stream of rental income for several years to come.

If you’re taking a bank loan to fund the commercial property, the maximum loan-to-value (LTV) that the bank can loan you is up to 80% of the property value. For residential property loans, the maximum is 75% (for banks).

Since this is a commercial property, you do not need to pay ABSD for it. As for Buyer’s Stamp Duty (BSD), the rate is lower than a residential property if the value of the property is above S$1m. For example, if you buy a S$1.5m commercial property, your BSD is S$39,600, but for an equivalent residential property, the BSD payable will be S$44,600.

Why a homeowner may not want to invest in Commercial Property?

Unlike residential properties, you cannot finance a commercial property with your CPF savings. You will need to pay out of pocket and/ or secure a bank loan. This includes paying for fees like stamp duty, legal, agent commission, valuation and so on. If you’re taking the loan as an individual investor, you will be subjected to prevailing regulations such as the Total Debt Servicing Ratio (TDSR), which is currently at 55%. So, if you’re someone with a lot of unsecured and secured debt to pay, you may want to hold back on investing first and pay off your debt.

The final quantum of the bank loan for your commercial or industrial property will depend on what you’re using the commercial property for. The bank will evaluate the anticipated returns, potential risk and market situation before deciding exactly how much it is able to loan you. This is unlike residential properties, where the loan quantum is based on the property value and your credit score. The interest rate for commercial property loans is also typically higher than for residential property loans (0.5-1% higher).

Loan tenures for commercial property are usually shorter, say 20 to 30 years. Residential property loans are usually longer (30 years for HDB flats and 35 years for non-HDB properties).

When you take a commercial property loan, you are usually locked in for 2 to 3 years. If you somehow decide to sell your property during this period, you may incur a penalty fee of around 1.5%. You will also be subject to Seller’s Stamp Duty (SSD) for industrial properties (eg. factories). The SSD rates are higher than that of residential properties. For industrial properties, the SSD rates are 15% of the property’s value for the 1st year, 10% for the second and 5% for the third. There is no SSD if it’s a commercial property.

Even after purchasing the commercial or industrial property, you may not be able to find a commercial tenant interested in renting the unit. With no incoming rent to tide through your investment, you still need to pay costs like maintenance and income tax (which is a flat 10% of the property’s annual value every year).

So whether you’re an investor or a business owner, investing in commercial or industrial property depends on your short-, mid-and long-term intentions, rental yield, appreciation, market conditions and timing.

When it comes to such properties, location and accessibility play important roles as they determine the property’s value, yield and demand over time.

Deciding What to Buy

Once you’ve decided that you want to go ahead and invest in a commercial or industrial property, here are some ways you can start:

Identify the Zone

99.co has commercial listings for Shophouses, Retail, Offices, Industrial and Warehouses, so that’s a good place to start.

Under each listing, there is a Property Segment that tells you whether the listing is Commercial, Industrial or mixed with Residential. So if you’re still under MOP, you should only view the ones listed as Commercial or Industrial.

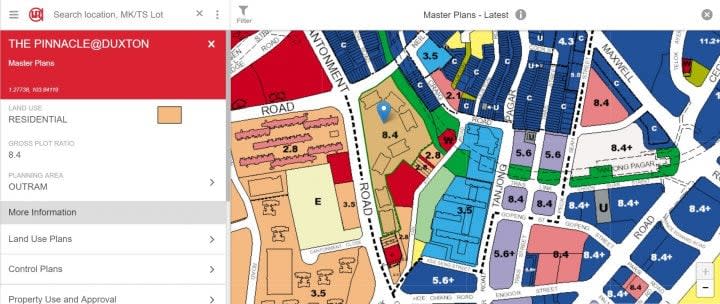

Another way to identify the zone the property is classified under is by referring to the URA Masterplan. We have an article on how to do this, but here’s a summary:

Residential-only sites: On the Masterplan, these are highlighted in light orange colour. These are your residential only zones, whether they are HDB flats, condos or landed houses.

Residential with commercial at 1st storey sites: These are in light pink and represent buildings with residential floors, but the 1st floor is meant for a shop or restaurant. Two- to three-storey shophouses with residential levels or sections are classified under this.

Commercial & residential sites: These are your mixed-residential developments and are in light blue. They are usually shopping malls, hotels or offices with residential blocks above them.

These three types of sites are off-limits to you if you’re still living under MOP in your HDB flat.

The ones available to you while under MOP are:

Commercial sites: These are your retail and office-only sites, denoted in dark blue. They cover Graded A, B and C offices, such as the ones at Suntec City and in the CBD, mom-and-pop shops, convenience stores and so on. They can be buildings with mixed uses like office space, shopping, and cinema, but not residential. They can be multi-storey shophouses purely for commercial use. As an investor, you can invest in a commercial unit and lease it out to tenants for rent. These tenants can run services from a tuition centre, grocery store, supermarket, gym, kopitiam, pet shop, massage parlour, recreation club, entertainment outlet and so on – you basically ensure you have the proper licenses and permits, upkeep the premises, make sure your tenants abide by the rules and collect rent.

Business sites: According to the Masterplan, there are three types of Business-zoned sites. The light purple ones (not to be confused with the dark purple ones, which denote hotels) are labelled as Business 1 sites. They are intended for clean and light industrial use, such as for public utilities, telecommunications and so on, with a maximum nuisance buffer (eg. noise) of 50 metres. The magenta-coloured ones are for Business 2 sites. These are usually catered for general industry, warehouses and manufacturing plants that may require larger nuisance buffers. Most Business 2 sites are in industrial estates as they handle heavy machinery, shipbuilding, repairs and so on. Finally, the third type is Business Parks, denoted by their teal-coloured zones. They could also be Science Parks, but in general, they are clusters of low-lying office buildings meant for various industries and research.

Anyway, as long as the property you’re interested in is non-residential and falls under commercial or industrial, you should be able to proceed.

2. Decide the type of commercial or industrial property to invest in

Next is to choose the commercial property type you’re interested in.

Shophouses

Shophouses are rare, especially the conservation ones in touristy neighbourhoods like Chinatown and Kampong Glam.

In Singapore, there are 6,760 shophouses gazetted for conservation, which puts them in the same rarity class as Good Class Bungalows.

This also explains why they command a premium in the market, like this 999-year leasehold Boat Quay shophouse which is selling with a guide price of S$18.8m.

This particular shophouse has three floors, and they’re all for commercial use – with a restaurant on the ground floor, an office on the second and a yoga gym on the third floor and attic.

In August 2022, a couple made a S$3.7m profit just five months after buying a Kitchener Road non-conservation shophouse. The couple bought the shophouse for S$4.3m last year and sold it for an 86% profit to a Hakka Association.

If you’re looking for something a little more affordable, there are shophouses for sale for less than S$1m. You just need to pick one that’s accessible and has a reasonable amount of foot traffic.

Shophouses for sale for less than S$1m

UB Point

UB Point

1,260 sqft

$580,000

The Splendour

The Splendour

1,970 sqft

$770,000

Midview City

Midview City

1,496 sqft

$899,999

Sunhaven

Sunhaven

560 sqft

$870,000

Synergy @ KB

Synergy @ KB

1,216 sqft

$460,000

Suites At Bukit Timah

Suites At Bukit Timah

97 sqft

$700,000

Crawford Court

Crawford Court

333 sqft

$600,000

Crawford Lane

Crawford Lane

312 sqft

$700,000

Le Regal

Le Regal

108 sqft

$368,000

Oxley Bizhub

Oxley Bizhub

2,023 sqft

$850,000

Office Buildings

While most offices are located within the Central Business District (CBD), you can find offices in the Outside of Central Region (OCR), such as in Jurong East, Paya Lebar, Woodlands, Tampines and so on.

Of course, choosing a higher grade-level office would also mean paying higher prices for it.

Grade A offices are your high-end offices with the latest technologies, installations and accessibility. They are usually tenanted or owned by MNCs, reputable businesses and large corporations.

Grade B offices are still fairly good offices with sufficient facilities. Some of them are renovated from older Grade A properties.

Grade C offices are bare minimum buildings with near-zero facilities. They are usually older buildings (30+ years old), found in far-flung locations and lack amenities. While considered riskier investments, some do offer the best potential cash-on-cash returns, if the timing’s just right.

Offices for sale for less than S$1m

Icon @ Changi

Icon @ Changi

366 sqft

$680,000

Tradehub 21

Tradehub 21

1,432 sqft

$799,000

Wcega Tower

Wcega Tower

958 sqft

$550,000

Hexacube

Hexacube

484 sqft

$860,000

Parklane Shopping Mall

Parklane Shopping Mall

452 sqft

$788,000

Wcega Tower

Wcega Tower

969 sqft

$510,000

The Crescent @ Kallang

The Crescent @ Kallang

947 sqft

$668,000

Icon @ Changi

Icon @ Changi

334 sqft

$648,000

High Street Centre

High Street Centre

445 sqft

$778,750

Havelock2

Havelock2

420 sqft

$894,300

Retail

If you’re someone who’s always wanted your own storefront in a retail mall, it’s possible to own one.

For example, one retail shop at Orchard Plaza is up for sale for S$568k, which is not too bad considering it’s in a prime shopping district. You may, however, want to check up on the immediate neighbourhood and what the adjacent stores are selling though.

If you prefer owning and running a shop near where you live (so you can save on transport), search the mall or retail neighbourhood near your home and see if something draws your attention.

Retail shops for sale for less than S$1m

The Plaza

The Plaza

151 sqft

$339,000

Grandlink Square

Grandlink Square

194 sqft

$680,000

Tai Seng Point

Tai Seng Point

215 sqft

$850,000

Singapore Shopping Centre

Singapore Shopping Centre

409 sqft

$715,750

The Commerze @ Irving

The Commerze @ Irving

387 sqft

$554,500

The Commerze @ Irving

The Commerze @ Irving

527 sqft

$688,000

Oxley Tower

Oxley Tower

194 sqft

$850,000

The Plaza

The Plaza

151 sqft

$339,000

Icon @ Changi

Icon @ Changi

183 sqft

$550,000

Viva Vista

Viva Vista

172 sqft

$488,888

Industrial Offices and Warehouses

If you plan on going into specific industries (like setting up a furniture workshop), or just want to lease out industrial or warehouse space to potential tenants, you can.

To save money, you can go for strata-titled industrial units instead of looking at whole floors.

A check on commercial listings on 99.co shows a 947-sqft flatted factory at Pioneer Junction selling for S$300k with an existing tenant.

Once again, investing in these types of properties requires a much longer-term view, as there are Seller Stamp Duty penalties if you sell them within 3 years.

Industrial properties for sale for less than S$1m

Pioneer Junction

Pioneer Junction

947 sqft

$300,000

Pioneer Junction

Pioneer Junction

947 sqft

$315,000

Pioneer Junction

Pioneer Junction

1,238 sqft

$320,000

Pioneer Point

Pioneer Point

1,066 sqft

$320,000

The Alexcier

The Alexcier

710 sqft

$320,000

Pioneer Point

Pioneer Point

968 sqft

$330,000

Pioneer Junction

Pioneer Junction

947 sqft

$330,000

Pioneer Point

Pioneer Point

958 sqft

$335,000

Pioneer Point

Pioneer Point

969 sqft

$340,000

Pioneer Junction

Pioneer Junction

1,238 sqft

$348,000

Warehouses for sale for less than S$1m

Eco-Tech @ Sunview

Eco-Tech @ Sunview

2,497 sqft

$530,000

The Westcom

The Westcom

3,079 sqft

$760,000

The Westcom

The Westcom

3,079 sqft

$760,000

Westlink Two

Westlink Two

2,390 sqft

$690,000

Midview Building

Midview Building

1,582 sqft

$638,000

B Central

B Central

2,995 sqft

$388,888

Pioneer Point

Pioneer Point

969 sqft

$340,000

Midview City

Midview City

1,496 sqft

$850,000

Pantech Business Hub

Pantech Business Hub

1,173 sqft

$760,000

City Warehouse

City Warehouse

1,604 sqft

$480,000

–

Are you actively looking to invest in commercial or industrial property? Let us know in the comments section below.

If you found this article helpful, 99.co recommends 7 reasons why shophouses are the most underrated properties in SG and Tanjong Pagar shophouse up for sale at S$12m.

The post Can you buy a commercial property before you complete your HDB MOP? Apparently yes. appeared first on .

Yahoo Finance

Yahoo Finance